Executive Summary

- Companies in high-polluting industries are often undervalued due to the stigma associated with their environmental impact and/or possible emissions-related financial penalties. This creates a mispricing opportunity for investors who can identify firms that are committed to transitioning towards more sustainable practices.

- By choosing not to ignore “dirty” industries, investors enjoy an expanded investment universe and therefore increased alpha opportunities. This is particularly relevant for investors in Asia and the Emerging Markets (EMs) where brown industries are integral to the economy.

- As these companies reduce their carbon footprint while making their business models more climate-resilient, their market valuations are likely to increase. Tapping into companies at an early stage of their transition journey can potentially result in outsized returns in the future.

Sustainable investing faces greater skepticism and political controversy today than it did a decade ago. Greenwashing concerns, regulatory challenges and political backlash have accompanied an evolution in the way investors approach sustainable investing.

Investing in high-polluting or carbon-intensive industries, often referred to as "dirty" or “brown” industries, may seem at odds with sustainable investing. However, the very industries that are struggling to reduce their carbon emissions can offer investors very attractive opportunities.

The potential for market beating returns

Companies in high-polluting industries are often undervalued due to the stigma associated with their environmental impact and/or possible emissions-related financial penalties. This creates a mispricing opportunity for investors who can identify firms that are committed to transitioning towards more sustainable practices. As these companies implement changes to reduce their carbon footprint while realising opportunities to monetise climate adaptation and/or mitigation solutions, their market valuations are likely to increase, potentially delivering attractive returns to early investors. These companies may also be less researched, hence providing alpha opportunities.

These two directions are potentially value accretive in the following ways:

- Emission reductions: In the case of a Paris-aligned scenario, this will reduce the risk of the company having to pay increased emissions-related costs from carbon taxes or emission trading schemes.

- Realisation of climate transition opportunities: In a climate-changed world, Paris-aligned or otherwise, companies featuring climate-adapted or low carbon solutions in their strategy will likely be able to realise commercial opportunities.

Take for instance a Chinese company which we had identified in the Oil and Gas Drilling industry, a potentially taboo industry for some sustainable investors. While the company has a lower-than-average ESG score1, it has devised a low carbon development action plan overseen by its board, aligning with China’s Nationally Determined Contribution (NDC) targets. The company has also shown significant innovation in its transition efforts and improved energy efficiency.

Similarly, consider an Australian company within the Diversified Metals and Mining industry, another “dirty” industry. The company has an average ESG score2 but has developed a comprehensive climate transition plan and issued Sustainability-Linked Loans (SLL) to support its climate-action initiatives. It has also taken concrete steps to enhance energy efficiency and started increasingly diversifying its business into transition minerals.

These are the kind of opportunities which investors could potentially forego if the focus on ESG ratings leads them to exclude companies in brown industries. The chance to tap into companies at the early stages of their transition journey can result in outsized returns in the future. That said, this approach requires active engagement, robust screening processes and tracking to ensure that investments are directed at companies genuinely working to enhance their environmental, social, and governance (ESG) practices. We will share more of our proprietary framework in upcoming articles.

Do good instead of just feeling good

By choosing not to ignore “dirty” industries, investors enjoy an expanded investment universe and therefore increased alpha opportunities. This is particularly relevant for those investing in Asia and the Emerging Markets (EM) where brown industries form a significant part of the economy.

Although EMs (excluding China, India and Brazil) accounts for c.48% of global population and 33% of global GDP, they only account for only 10% of the investment in clean energy and transition solutions. See Fig. 1. With significant investments needed to support the process of converting inefficient, carbon-emitting assets into sustainable and energy-efficient assets (brown-to-green transition), this should potentially present more opportunities for investors.

Fig. 1. Proportion of energy transition related investments vs population and GDP (2023)

Source: International Energy Renewable Agency. 2024. A just and inclusive energy transition in emerging markets and developing economies. Energy planning, financing, sustainable fuels and social dimensions. Based on: (BNEF, 2024a; IMF, n.d.; World Bank, 2024). Notes: GDP = gross domestic product; EMDEs = emerging markets and developing economies; Data based on latest year available. Annual investment figures are from 2023, while GDP and population data are from 2022. Country classification is based on IMF’s World Economic Outlook.

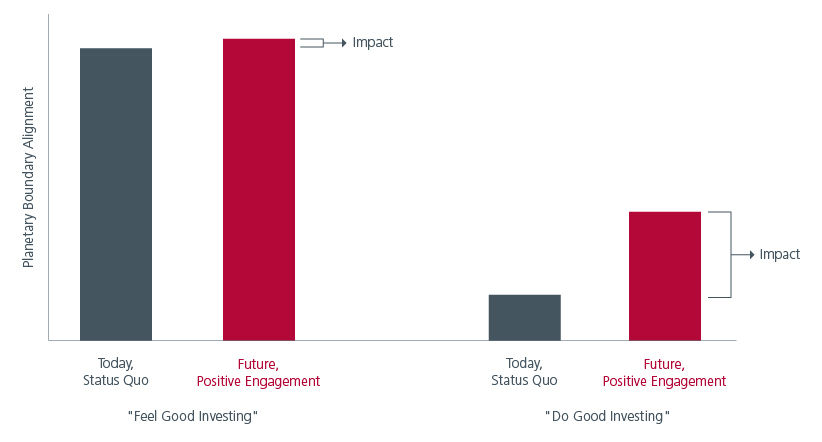

Facilitating companies’ transition from “bad” or “dirty” to “average” or “clean” (Do Good Investing) creates more real-life impact than buying companies that are already “clean” (Feel Good Investing). See Fig 2. With many countries in Asia Pacific and the EMs heavily dependent on high-polluting industries for their GDP, an abrupt divestment from these industries could lead to significant economic disruption and social inequality. By investing in and supporting the transition of these industries, investors can help balance the need for environmental sustainability with economic stability and social equity.

Fig. 2. True impact can’t be achieved by ignoring the difficult

Source: Eastspring Investments (Singapore) Limited. The information provided herein are subject to change at the discretion of the investment manager without prior notice. Any projection or forecast is not necessarily indicative of the future or likely performance. Planetary boundary alignment is the process of aligning actions with the limits of Earth's capacity to support human development. January 2025.

Maximising returns: A win-win proposition

Investing in "dirty" or high-polluting industries presents a unique opportunity for investors to not only enjoy attractive returns but also play a pivotal role in the transition towards sustainability. By tapping into mispriced opportunities and benefitting from a broader investment universe, early adopters of this strategy can also enjoy positive return tailwinds as more institutional investors shift their focus towards transition opportunities.

For those investing in Asia and the EMs, where high-polluting industries are integral to the economy, this approach offers a win-win proposition. By actively supporting the transformation of high-polluting industries, investors can maximise returns while contributing to a more sustainable and balanced future.

Sources:

1 Ratings from Sustainalytics and S&P Global.

2 Ratings from Sustainalytics and S&P Global.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.