Executive Summary

- Singapore’s AAA rating, and the breadth and maturity of the SGD bond market continue to attract investors seeking quality and stability.

- Even after recent gains, SGD bonds offer similar or better returns on a hedged basis when compared to their equivalents in developed markets.

- SGD bonds have delivered stable returns through major market shocks such as the Global Financial Crisis, COVID-19 and Fed rate hikes.

As Singapore marks six decades of nation-building, the Singapore dollar (SGD) bond market has evolved in step with the nation’s journey of growth and progress. The SGD bond market has grown into the fourth largest local currency bond market in Asia and stands among the most developed in the region. Singapore Government Securities and quasi-sovereign bonds comprise around 76% of the market size, and corporate bond issuances have increased over time.1

The increasing breadth and maturity of the SGD bond market has sparked greater issuer and investor interest. Global corporates are tapping the SGD bond market to fund their operations and to diversify their funding sources. In 2024, SGD-denominated non-sovereign bond issuance surged to a decade high, with 126 deals totaling S$31.2 billion — a 57% increase year-on-year2. At the same time, institutional demand remains robust, supported by ongoing capital inflows into Singapore.

The healthy credit profiles and lower default risk of Singapore companies and the country’s AAA sovereign credit rating have been drawing investors to this market. Singapore is one of the few economies in the world to enjoy and retain a AAA rating, underpinned by strong economic fundamentals and a stable political environment. The SGD bond market is increasingly appreciated by investors for its lower volatility vis-à-vis other bond markets, even developed market ones.

Count on me

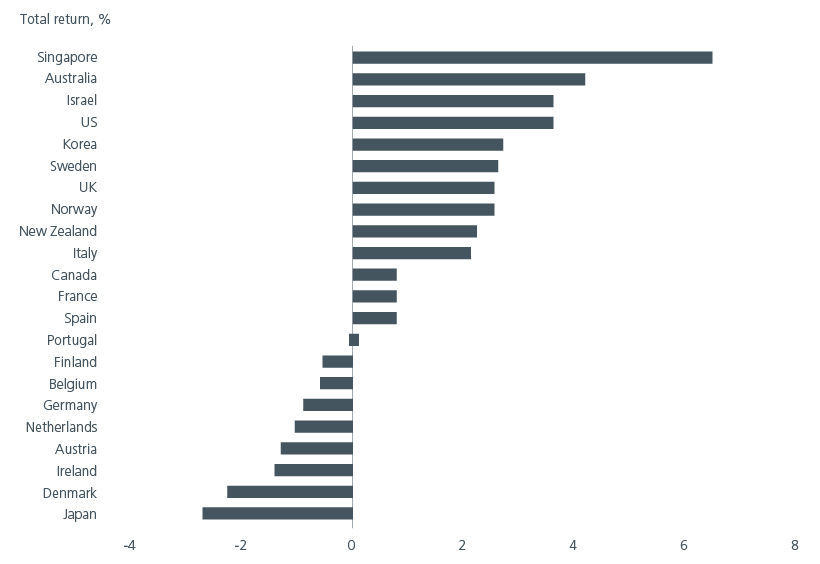

While yields have been declining across the various SGD bond maturities, reflecting broader market dynamics such as lower inflation expectations, central bank policy shift, and increased demand for safe assets, on a total return basis, SGD bonds have outperformed peers in developed markets in the first half of 2025.

Fig 1: SGD government bonds outperformed peers in 1H 25

Source: Bloomberg as of 27 June 2025

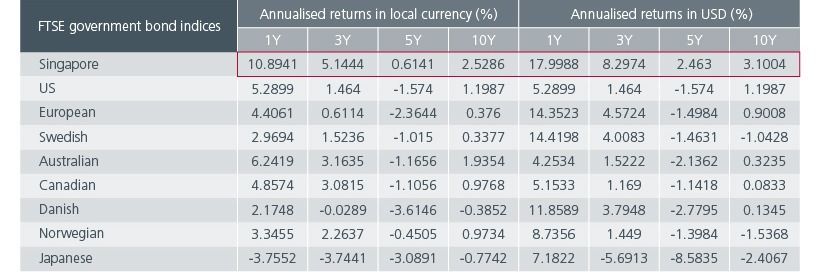

This outperformance is not a one-off as over the 1-, 3-, 5-, and 10-year horizons, the SGD government bond market has consistently outpaced other AAA-rated sovereign bond markets, both in local currency and USD terms.

Fig 2: SGD government bonds show consistent strength vs AAA peers

Source: FTSE world government bond indices as of 30 June 2025

Despite the outperformance of SGD bonds over the last year, SGD bonds still offer similar to better returns when compared to their equivalents in developed markets on a hedged basis. Singapore based investors hence have the potential to benefit from holding a core allocation to SGD bonds given similar to better returns without incurring high hedging costs.

Furthermore, the Singapore dollar is perceived to be a safe haven currency with lower volatility. Given the country’s stable macroeconomic fundamentals and the Monetary Authority of Singapore’s exchange rate policy, the currency has generally been on an appreciating path over the long term, making it an attractive option that investors can turn to during periods of uncertainty.

Stronger together

History too shows that SGD bonds have provided stable returns across periods of market volatility. During the Global Financial Crisis, SGD bonds stayed resilient and delivered a positive return. Similarly, they held up better than equities during the 2015 Chinese stock market correction, outperformed during the 2020 COVID-19 outbreak and fell less through the US Fed’s rate hiking cycle in 2022.

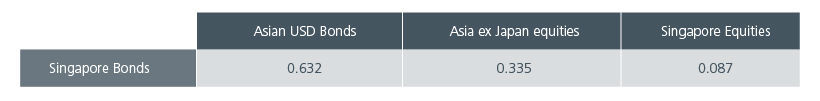

As such, SGD bonds serve as an effective tool for mitigating downside risk in investment portfolios. Their low correlation with Asian USD bonds and other asset classes, in particular Singapore equities, enhances portfolio stability over the medium to long term.

Fig 3: SGD bonds have low correlation with other asset classes

Source: Bloomberg as at 30 June 2025 based on 10-year monthly correlation data. Singapore Bonds represented by Markit iBoxx ALBI Singapore (SGD), Asian USD Bonds represented by the JP Morgan Asia Credit Index (USD), Singapore Equities represented by MSCI Singapore Index (SGD), Asian Equities represented by MSCI AC Asia ex Japan (USD)

The road ahead

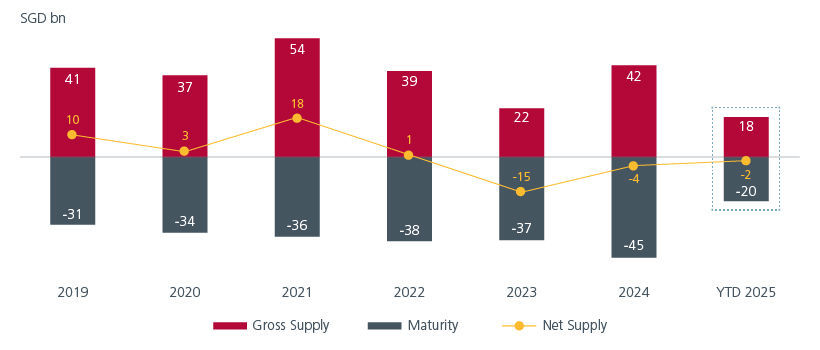

SGD bonds are poised to continue its strong outperformance in 2025 on the back of positive technicals. Demand has been robust as evidenced by the high bid-to-cover ratios in primary deals and strong performance in secondary markets. Net negative supply in 2023 and 2024 due to high all-in yields made it unattractive for many bond issuers to come to market and we expect this supply trend to persist into 2025, providing a strong tailwind for SGD bonds.

Fig 4: SGD bonds’ net supply expected to remain negative in 2025

Source: Eastspring Investments, Bloomberg as of 25 June 2025. Excludes T-bills and bonds that are smaller than SGD 100m. Only bonds that were issued or matured/called till 25 June 2025 is taken into account in the “YTD 2025” bar.

Despite the decline in SGD rates over the last 6 months, we remain constructive on duration given Singapore’s growth and inflation outlook, and we will look to extend duration on spikes in rates.

Whilst SGD credit spreads have tightened more than their equivalents in developed markets over the last 3 months, valuations are still compelling after taking into account hedging costs. Coupled with solid fundamentals and positive technicals, we believe that SGD bonds continue to deserve a core allocation in investors’ portfolios.

Sources:

1 Asiabondsonline, size of local currency market as at 1Q2025

2 https://www.straitstimes.com/business/invest/singapore-dollar-bonds-remain-a-core-income-allocation-as-markets-bounce-back

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.