Executive Summary

- Rising adoption, robust capex plans and emerging use cases strengthen the AI growth narrative where Asia is a key enabler and innovator.

- Frequent shifts in sentiment create significant volatility within AI-related stocks. Such dislocations are alpha opportunities for active investors.

- A value-centred approach can capture AI’s long-term growth upside while sidestepping frothy valuations, delivering consistent returns amid the noise.

Artificial intelligence (AI) is emerging as a foundational technology for the future. This can be seen from the robust capital spending by US and China hyperscalers. At the latest US earnings results season in May, selected US hyperscalers guided their capex forecasts higher. The CEO of the world’s largest hyperscaler also commented that their AI capacity is being used up as fast as it is put in, calling out supply bottlenecks in motherboards and components.

However, short-term ebbs and flows in market sentiment are common with structural themes. More recently, the AI narrative was affected by recession fears arising from the US tariffs, rumours of capex cuts by US hyperscalers, and poor manufacturing yields of advanced server racks. In addition, the apparent lack of monetisation of popular chatbots, concerns over the commoditisation of Large Language Models (LLMs) and falling Graphics Processing Unit (GPU) rental rates also contributed to significant volatility in AI-related stocks. Such market dislocations present opportunities for active investors to generate alpha.

Inferencing at scale

Given Asia’s role as an enabler and innovator, there are multiple opportunities across the region’s AI ecosystem. Strong capex growth by US hyperscalers should benefit Taiwanese and Korean AI chip supply chain players especially in the areas of foundry, High Bandwidth Memory (HBM), ABF substrate (Ajinomoto Build-Up Film), PCBs (Printed Circuit Boards), ASIC (Application Specific ICs) backend design, and server assembly.

Asia is home to almost 60% of the global population which represents a huge base of end users that generate data. As demand for AI-powered services rises in the region, the need for low-latency, high performance AI inferencing becomes critical. As such, US and China hyperscalers are expanding their cloud presence in the region to be closer to the end users.

Given the significant capital requirements and local presence needed to secure land and power in the region, third party data centre providers are well positioned to capitalise on the growing demand for AI inferencing through leasing arrangements with hyperscalers. Governments and multinationals are also driving demand for regional data centre capacity. Co-locating with other services saves costs and reduces latency. At the same time, many companies prefer to retain some of their own computing capacity rather than relying entirely on hyperscalers due to concerns over data sovereignty, security and control.

In Korea and Malaysia, leading data centre providers are planning to more than double their existing capacity. In Singapore, there is a capacity constraint due to a government-imposed moratorium on new data centres. However, as enterprises prefer to keep their regional data in Singapore due to a stable legal and political environment, third party data centre providers can enjoy premium rental rates that are 4x higher than the industry average.

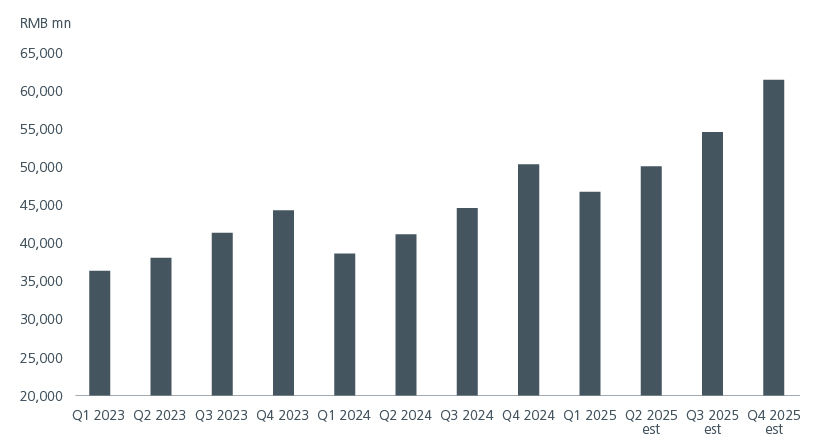

At the same time, Chinese hyperscalers are driving revenue growth by moving beyond low value GPU rental services and enabling enterprise-level AI transformation by offering Model as a Service (MaaS). Fig. 1. These services can be customised for specific industries, supporting applications ranging from front-end customer facing chatbots to back-end risk management tools like fraud detection. By offering MaaS alongside traditional cloud services such as compute, databases and storage, Chinese hyperscalers are creating sticky ecosystems.

Fig. 1. China hyperscalers cloud revenue growth

Source: Visible Alpha (subsidiary of S&P Global). May 2025.

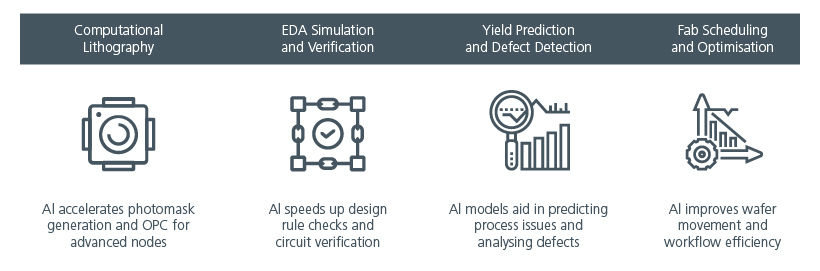

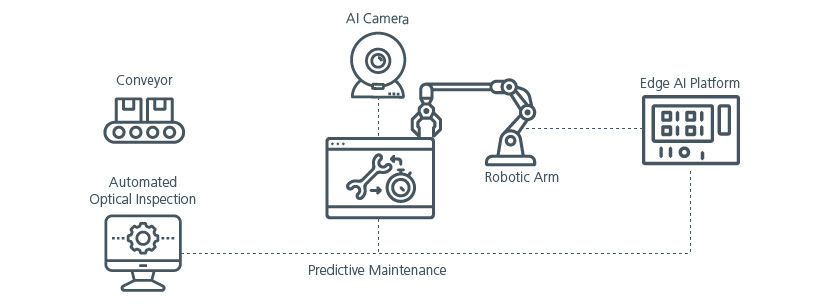

Solving real world problems

We are seeing more AI use cases emerge in Asia. This will drive broader AI adoption, in turn fuelling demand for AI infrastructure and compute resources. For example, a leading Taiwanese semiconductor chip manufacturer is leveraging a cutting-edge AI computational lithography platform to enhance its production of photomasks – critical tools used to imprint circuitry onto chips. The company notes that every 1% of productivity gain yields cost savings of NT$1 bn. Fig. 2. In another example, a major electronics contract manufacturer in Taiwan is utilising an advanced edge AI platform in its smart manufacturing process, applying it to tasks such as robotic arm control and optical inspection to boost precision and automation on the factory floor. Fig. 3.

Fig. 2. Applications of AI chips at a leading semiconductor chip manufacturer

Source: Eastspring Investments. May 2025. Original image is AI generated. OPC: Optical Proximity Correction. EDA: Electronic Design Automation.

Fig. 3. Leveraging edge AI platform in smart manufacturing

Source: Eastspring Investments. May 2025. Original image is AI generated.

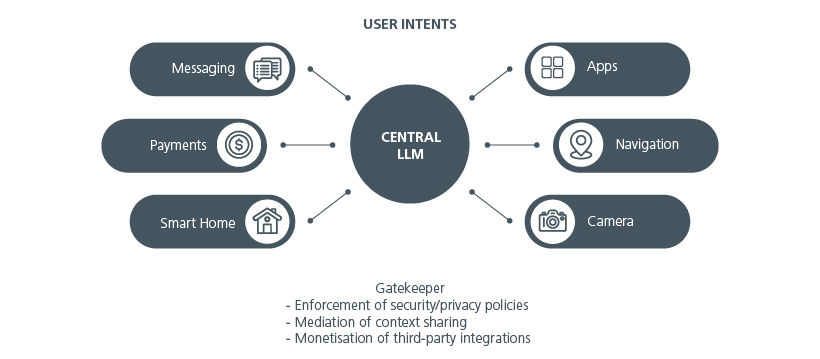

Consumer-facing AI has been slower to see breakthrough in major use cases, with chatbots currently being the primary use case. But some smartphone makers in China are rolling out their own AI-augmented operating systems with writing, editing and translation capabilities. These developments increasingly position smart phones in competition with existing dominant application ecosystems.

In a future where agentic AI becomes central to the smartphone experience, system-level AI agents—bundled directly into the operating system—could manage cross-app workflows by default. This shift may challenge the traditional role of app stores, as these system agents begin to control user interactions and data flows, potentially unlocking new gatekeeper economics for device makers. Fig. 4.

Fig. 4. Agentic AI becoming central to the smartphone experience

Source: Eastspring Investments. LLM: Language Learning Model. Original image is AI generated.

A value-centred approach

These dynamics across Asia—from the chip fabs in Taiwan and HBM in Korea, to China’s hyperscalers and the region’s third-party data centres and enterprise adopters—are not just a secular growth story. They are fertile ground for disciplined value investing when trying to identify beneficiaries of the structural AI theme. A margin of safety approach allows us to buy on scepticism and profit as fundamentals re-assert themselves. Focusing on companies with durable competitive advantages at attractive valuations enables us to capture AI’s long-term growth upside while sidestepping frothy valuations. In markets that oscillate between euphoria and skepticism, a patient, value-centric process can help deliver consistent returns amid the noise.

Sources:

1 Amrkit iBoxx ALBI (USD unhedged).

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.