Summary

Asia will play a leading role in the world’s green transition, especially in the clean energy sector, given its manufacturing sophistication, technological development, and vast natural resources. This will create investment opportunities in the solar and wind energy sectors, as well as within the Electric Vehicles (EV) supply chain.

In our whitepaper “Asia 2.0: Investing in an era of new opportunities ”, we highlighted that Asia’s transformation will create opportunities in the renewable energy and EV sectors. Asia is expected to account for 40% of the world’s GDP by 2030 and the region’s strong growth will be accompanied by rising energy demand. With coal currently accounting for most of the region’s power generation, the path to secure a more sustainable future makes Asia one of the world’s largest markets for renewable energy. China is currently the world’s biggest producer of solar and wind energy; South Korea is pioneering hydrogen technology, and India is making strides in manufacturing solar panels and equipment.

The electrification of transport will also be a critical aspect of Asia’s green transition. According to the International Environmental Agency (IEA), road transport accounts for 24% of direct CO2 emissions. Asia’s increasing technological capabilities can enable it to spearhead the electrification of the transport industry. Asia already has niche capabilities along the EV supply chain – from vast nickel reserves in Indonesia to hydrogen fuel cell and battery technology in South Korea.

Renewable Energy

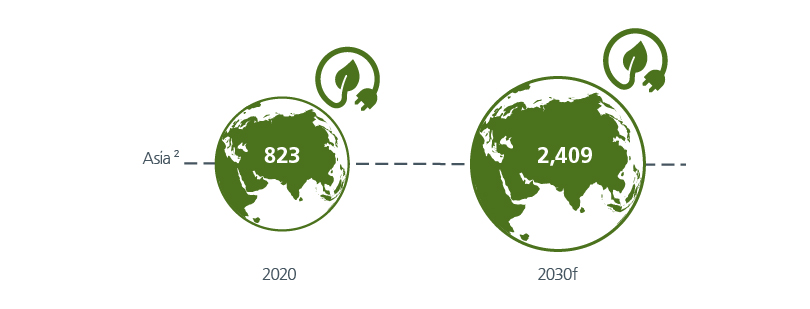

By 2030, Asia’s renewable energy (RE) capacity is expected to reach 2.4 Terawatts, accounting for 57.4% of global capacity, with China and India contributing the majority. Fig. 1.

Fig. 1. Asia’s Renewable Energy capacity1 (gigawatt)

Source: Fitch Solutions.

China is leading the RE transition in Asia, particularly in solar. Currently, China’s solar power capacity accounts for 39% of global solar power capacity and is expected to rise to 43% by 2030. Fig. 2. The country is a major producer of key components used in solar panel production - polysilicon, ingot and wafers. The IEA estimates that by 2025, China will have a 95% share of global polysilicon, ingot and wafer production.

Fig. 2. Solar power capacity by country (% of global solar capacity)

Source: Fitch Solutions.

India’s transition from coal-based power is also pushing it to develop stronger capabilities in solar cell and module manufacturing. By 2030, India is expected to add over 120GW of renewable energy from 2022, with solar accounting for more than two thirds of this capacity increase.

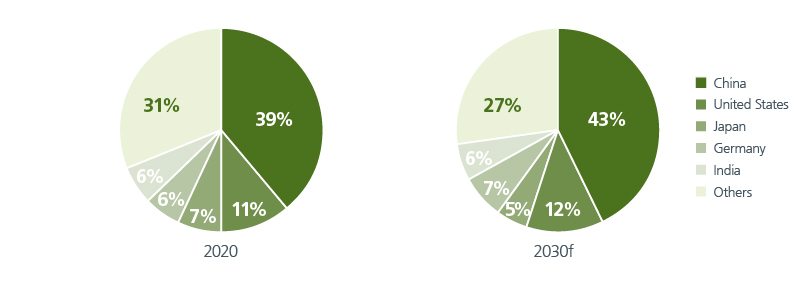

Besides solar, China is also a major wind power equipment manufacturer, and the largest market for both onshore and offshore wind. Its lower costs makes it an attractive alternative to Western wind-turbine makers. Between 2022 and 2030, China is expected to almost double its wind capacity to 747GW. Fig. 3.

Fig. 3. China wind capacity (gigawatt)

Source: Fitch Solutions.

Meanwhile, South Korea wants 22% of its energy to come from renewable sources by 2030 and has ambitions to be a leading offshore wind region. South Korea’s offshore wind capacity is forecasted to increase by more than sixfold to 858MW between 2022 and 2030. Fig. 4. While the country is building up its wind capacity, it is a leader in hydrogen energy, accounting for half of the world’s installed capacity for utility-scale stationary fuel cells. By 2030, South Korea’s hydrogen industry is expected to reach USD20 billion.

Fig. 4. South Korea’s renewable energy ambition

Source: Fitch Solutions. Ministry of Trade, Industry and Energy.

EVs and EV-related supply chains

Against the backdrop of climate change, the future of transport will be electric. With fossil fuels being burnt to keep cars, trains, trucks, and ships moving and airplanes flying, electrification is key in the transition to greener vehicles.

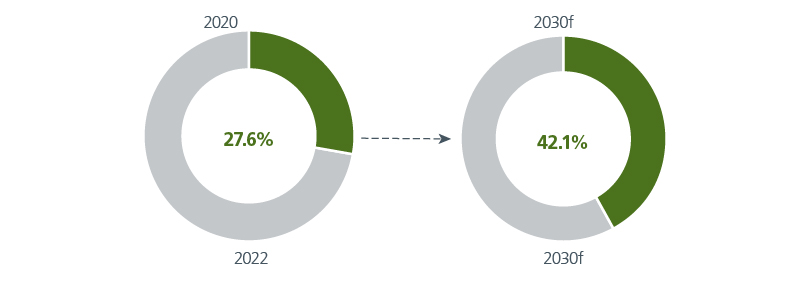

Globally, market penetration is low with passenger EVs accounting for only 15% of total vehicle sales. EV adoption across Asia has been uneven. In 2022, 27.6% of total vehicles sold in China were EVs (See Fig. 5) while passenger EVs accounted for less than 1% of total vehicles sales in Indonesia. Countries’ zero-carbon targets, better charging infrastructure as well as cheaper and more efficient batteries will increase EV adoption going forward. By 2030, Asia is expected to make up 52% of global passenger EV sales. For now, there is a vast, untapped market ripe for electrification in many Asian economies. As the world’s largest EV manufacturer, China is well positioned to benefit from growing global demand for EVs.

Fig. 5. EV sales as % of total vehicle sales in China

Source: Fitch Solutions.

While internal combustion engine vehicles (ICEVs) compete on engine and transmission, EVs compete on their batteries. Battery costs is the largest single factor in the price differential between EVs and ICEVs. The battery determines the EV’s range and safety, and the charging infrastructure, which can influence a potential EV buyer’s decision. Hence EV batteries and their supply chain play key roles in the electrification of transport. Asia is an important player within the EV battery supply chain. The world’s largest EV battery makers are China, South Korea and Japan.

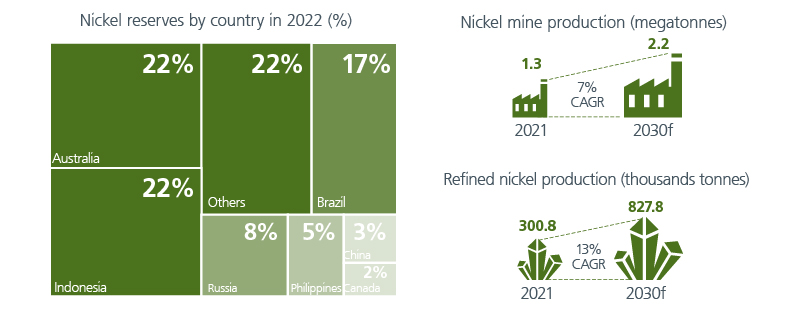

Indonesia has extensive reserves in nickel, a key component in EV batteries. Its vision to develop downstream mineral processing and to be a key player in the EV battery industry can transform the economy and support the next stage of economic growth. Refined nickel production in Indonesia is expected to increase by nearly threefold to 828kt between 2022 and 2030. Fig. 6.

Fig. 6. Indonesia’s nickel reserves and production

Source: United States Geological Survey.

Participating in Asia’s green growth

Asia’s renewable energy and EV companies as well as those operating within the EV-related supply chain present opportunities for both equity and bond investors. Sustainable debt issuance in Emerging Asia (ex-China) hit USD35 billion in 2021 and since 2013, utilities, financials and energy companies have accounted for nearly 70% of total issuance.

Active investing is still important when navigating these sectors, as hype may have pushed valuations up. Rising raw material costs and intense price competition may also temper the profitability of selected companies and sectors. In some sectors, government support and cheap financing may have led to overcapacity issues. Meanwhile, the technical know-how to adapt quickly to new regulatory requirements and consumer preferences will separate the leaders from the pack. It is often worthwhile to dig deeper beyond the obvious names for hidden investment opportunities.

Sources:

1 Refers to the maximum output that grid-connected non-hydro renewables (solar, wind, biomass, marine, geothermal) generating equipment can supply to system load, adjusted for ambient conditions.

2 Asia includes economies as per United Nations Statistics Division’s geographical classification of Asia, including Taiwan

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.