Executive Summary

- Indonesia which has the largest nickel reserves in the world is carving a niche in the electric vehicle (EV) supply chain.

- Massive investment flows into nickel and battery materials have positively impacted the country’s trade balance.

- To capitalise the opportunities in electric vehicles, invest directly in Indonesia’s EV supply chain listed companies.

To commemorate Eastspring’s 30th anniversary, we have curated a series of articles that explore Asia's transformation over the last three decades and share insights from our investment teams, gained through years of investing in the region. These articles aim to help investors better appreciate Asia’s growth potential and the investment opportunities in the region. The first article in our series explores how Asia’s changing economic growth model impacts investors.

The Asian economy grew rapidly over the last three decades, with nominal GDP expanding by almost 16x from 1990 to 2022, versus 9x for the global economy1. During this period, demographic shifts, technological advancements, and geopolitical dynamics have shaped Asia’s approach to growth.

Trading places

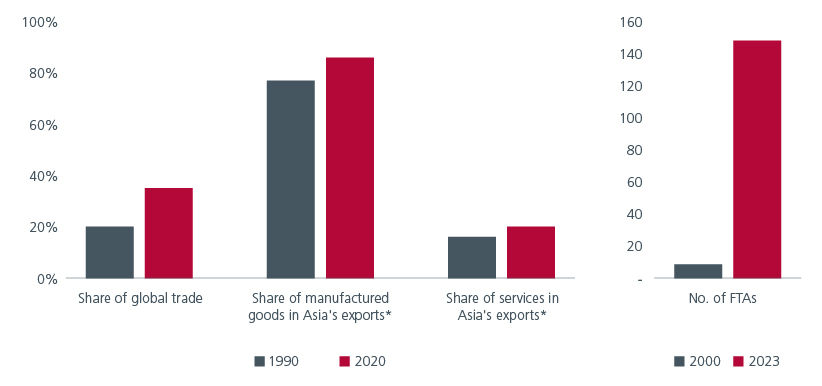

Asia’s share of the global economy rose from 21% in 1990 to 39% in 20232. Trade has historically been an important growth driver - Asia is the largest trading region in the world, accounting for 35% of world trade in 2020, up from about 20% in 19903. The region’s increasing number of free trade agreements (FTAs) reflects the important role that trade plays. In 2000, only eight FTAs had been signed in Asia Pacific. By 2023, the region had signed 147 agreements, with another 87 under negotiation4.

While trade has remained important, its composition has changed significantly. The share of manufactured goods in Asia’s exports rose from 77% in 1990 to 86% in 2019, alongside the decline in primary goods exports5. That said, the “world’s factory” is relying less on cheap labour to maintain its edge. Asia has moved up the value chain and diversified its industrial base by embracing technological advancements and innovation. As such, Asia today is home to world-class robotics and industrial goods manufacturers, leading semiconductor chip makers, packagers, and integrated circuit design companies. Many companies have also combined their long-established manufacturing edge with new technologies to become major suppliers in the global renewable energy and EV supply chains. This has in turn created diverse opportunities for investors.

Digital technologies have also enabled new forms of cross-border transactions and e-commerce. By 2022, Asia accounted for 51% of global e-commerce sales6, almost double from 2014. This growth has led to the emergence of more Asian-based platform and e-commerce players in recent years.

Fig. 1. How Asia’s trade has evolved

Source: The Evolution of the Global Trading System: How the Rise of Asia and Next Generation Challenges Will Shape the Future Economy. Asia Society Policy Institute. 2022. *Latest data available is 2019.

Given rising geopolitical uncertainty and national security demands, many western countries have been increasingly motivated to strengthen their domestic industries, especially in key sectors such as renewable energy and semiconductors. This will have important trade implications for Asia going forward. On the back of growing US trade restrictions, China is diversifying its export destinations and increasing market shares in ASEAN and Latin America.

The consumer dividend

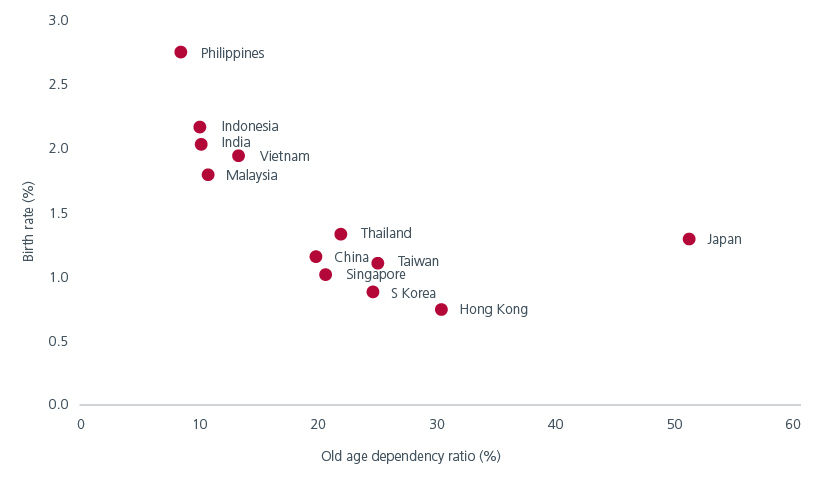

While trade remains important for the region, Asia’s rapidly growing middle class has made domestic consumption an increasingly important growth driver, especially for India and the southeast Asian economies. Demographics play an important role on this front. According to the OECD, a total fertility rate of 2.1 children per woman ensures a broadly stable population, assuming no net migration and unchanged mortality. Philippines, India, Indonesia, and Vietnam fare well against this benchmark. These countries also have the lowest (old) age dependency ratios7 in the region, which puts less stress on the working population and potentially results in a more balanced distribution of resources. Fig. 2.

Fig. 2 ASEAN and India enjoy favourable demographics

Source: Old age dependency ratios (2022) from World Development indicators. Birth rates (2021) from IMF. All data extracted in January 2024.

India became the world’s most populous country in 2023 and is now poised to become the world’s third largest consumer market by 2027. Meanwhile, ASEAN has the world’s third largest population at 661.8 million. Healthy domestic consumption has helped the ASEAN economies be more resilient during export downturns. Their large domestic consumer markets have also attracted global manufacturers to set up production facilities in the region. The share of intra-regional trade in Asia increased from 42% in 1990 to 53% by 20198. This has benefitted the region with increased investments and employment, and creates investment opportunities in the consumer discretionary, real estate and financial sectors.

A new pecking order?

The economic prominence of the different countries in the region has also evolved over the years. China’s share of the regional economy increased rapidly from less than 10% of Asia’s GDP in 1990 to more than 50% in 2022, after its entry to the World Trade Organisation. Meanwhile, Japan’s share of the region’s GDP has fallen from 60% in 1990 to 13%9. Fig. 3. Accordingly, 162 Japanese companies were represented in the Fortune 500 companies in 1995. By 2023, 137 Chinese and 41 Japanese companies were featured in the list. That said, the fortunes of these two economies continue to evolve. The weakness in China’s real estate sector and weak consumer sentiment have clouded the country’s near-term economic prospects10. On the other hand, Japan’s economic outlook has brightened on the back of rising inflation and corporate reforms.

Fig. 3. Share of Asia GDP

Source: Nominal GDP. Current prices, billions of USD. IMF. Data extracted in January 2024.

Besides China and Japan, the pecking order of the other Asian economies is also evolving. The increased competition amongst the superpowers and the desire by countries to prioritise national security over economic efficiency have caused global supply chains to rebalance, benefiting India and ASEAN. India is expected to be the region’s second largest growth driver in 202411. India’s Production Linked Incentive scheme has helped the country leapfrog basic manufacturing and focus on more advanced manufacturing. Meanwhile, Indonesia is leveraging its large reserves of nickel and cobalt to develop an integrated electric vehicle (EV) supply chain. It aims to become one of the world’s top three producers of EV batteries by 2027. India and Indonesia have made significant progress since 2013, when they were part of the "Fragile Five", a term coined to describe economies that were heavily reliant on volatile foreign investments to finance their growth.

Investing in a dynamic Asia

Asia is expected to contribute to 60% of global growth12 by 2030. Its growth model will continue to evolve as it did over the last 30 years. Asia’s changing landscape has also produced disruptors across different sectors, presenting investors with greater choice to tap into the region’s growth. Going forward, the drivers of change are expected to be accelerate given the growth of digital technologies, the rising importance of sustainability and the increasing complexities of geopolitics13. More than ever, investors will need experience, agility, and deep local insights to invest in a dynamic Asia.

Look out for our next article in this series which will focus on the insights from 30 years of investing in Asia’s bond markets.

Sources:

1 IMF Datamapper. Data extracted on 5 January 2024. GDP current prices. Asia includes China, Hong Kong, India, Indonesia, Japan, Malaysia, Philippines, South Korea, Singapore, Taiwan and Vietnam.

2 IMF. Data extracted January 2024.

3 The Evolution of the Global Trading System: How the Rise of Asia and Next Generation Challenges Will Shape the Future Economy. Asia Society Policy Institute. 2022.

4 The Evolution of the Global Trading System: How the Rise of Asia and Next Generation Challenges Will Shape the Future Economy. Asia Society Policy Institute. 2022.

5 The Evolution of the Global Trading System: How the Rise of Asia and Next Generation Challenges Will Shape the Future Economy. Asia Society Policy Institute. 2022.

6 Global retail e-commerce revenues. Source: Statista. 2024.

7 World Development indicators. Data extracted in January 2024.

8 IEvolution of the world’s 25 top trading nations. https://unctad.org/topic/trade-analysis/chart-10-may-2021

9 IMF. Nominal GDP (Current prices in USD). Data extracted in January 2024.

10 https://www.worldbank.org/en/news/press-release/2023/12/14/sustained-policy-support-and-deeper-structural-reforms-to-revive-china-s-growth-momentum-world-bank-report

11 Asia outlook 2024. Driving global growth despite risks in China. EIU.

12 https://www.weforum.org/agenda/2019/12/asia-economic-growth/

13 https://www.imf.org/en/News/Articles/2021/09/27/sp092721-the-future-of-finance-and-the-global-economy

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.