Executive Summary

- Active engagement is a key alpha driver, enabling informed decisions and measurable progress across the investment cycle.

- Engagement and proxy voting are central to active ownership, helping companies align with long-term sustainability goals.

- Studies confirm that successful shareholder engagement can boost returns and enhance long-term performance.

In our Why it pays to be dirty article, we highlighted that by choosing not to ignore “dirty” industries, investors enjoy an expanded investment universe and increased alpha opportunities. From a viewpoint of climate transition, this also allows investors to deliver impact from investing in companies from “brown” sectors that are taking concrete steps to adapt their businesses to a climate changed world. This is particularly relevant for those investing in Asia and the Emerging Markets (EMs) where brown industries form a significant part of the economy.

As such, investing and facilitating the transition of assets from “brown to green” will be both essential and create more real-life impact than investing in already existing green investments. One of the key components of facilitating the transition is via active engagement, especially on companies in high conviction active portfolios.

Asset managers who actively engage with companies for better sustainable practices and encourage improvements drive change that can lead to enhanced long-term financial performance and value creation. We consider engagement and proxy voting as key elements of our active ownership initiatives.

Milestone-based engagements are essential

For us as active managers, company engagement serves multiple purposes. First, it helps us with informed decision making and improved risk assessment during the due diligence phase. Second, it measures progress, promotes sustainable practices and ensures transition alignment of the companies we invest in. Third, it presents a real alpha opportunity in and of itself.

Only by engaging are we able to influence policies at the corporate level and hold firms accountable for their actions. This is something passive investors are unable to do. Through constructive dialogue, we safeguard shareholder rights and interests. In our experience, management teams value this feedback loop, as it enables us to share insights and lessons learned from other portfolio companies and their respective transition journeys.

Our engagement process incorporates a range of milestones and spans the full investment cycle, aiming to assess and improve climate transition and business performance while keeping social factors in focus. We evaluate each company’s strategy and progress across business lines, focusing on both climate adaptation and mitigation for a holistic transition.

The improvement plan addresses gaps identified through research and discussions with the firm, peers, and industry experts. Engagements are integral to our fundamental analysis, as climate transition readiness is a key alpha driver

Engaging with companies that score well on the Eastspring-Prudential Climate Framework often sparks meaningful dialogue around long-term value creation for shareholders. These firms are receptive to linking early-stage climate initiatives with near-term revenue drivers, shifting the focus from broad targets to tangible pathways for implementation and growth. We believe that long-term outcome-based engagements will allow us to collectively move the needle on progress especially in EMs where it is needed the most.

Reinforcing engagements via proxy voting

Engagement and proxy voting are core to active ownership, guiding companies to align their transition with long-term sustainability goals. An active engagement policy helps prioritise and align resources effectively. In addition, it results in firms maximising transition outcomes while not causing harm to social ones. This is essential in advancing a just transition in Asia and EMs.

Aligning our engagement with how we vote results in an approach that encourages companies to:

- Adopt holistic climate transition strategies aligned with long-term capital planning

- Track and disclose social impact, such as workforce training and employee turnover

- Engage in climate risk discussions, including scenario analysis and carbon pricing

- Commit to best-practice targets such as Net Zero and/or align with their country’s Nationally Determined Contribution (NDC) targets

By way of example, in the case of an energy company in Asia, we voted “for” a board report despite a proxy advisor’s “against” recommendation. While the proxy advisor required specific emission reduction goals, the company had intentions promoting other aspects of the transition such as green energy generation targets. Our analysis also found that the company’s transition plan met national leadership benchmarks, including strong governance, interim targets, and alignment with global standards. Given its progress and market context, we supported the firm’s efforts.

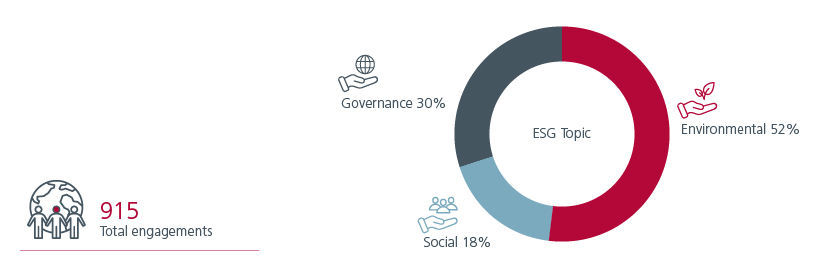

Fig 1: Total engagements in 2024

Source: Eastspring Investments

Boosting alpha with impactful engagement

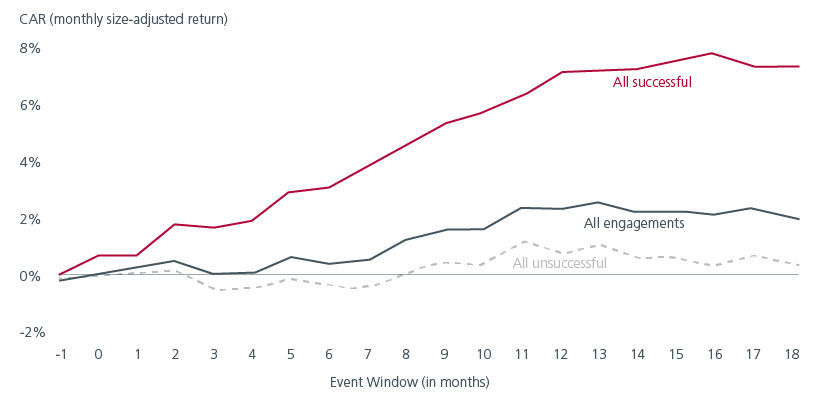

We believe that active engagement leads to superior portfolio outcomes and is an alpha contributor over the investment cycle. Several academic studies point to positive excess returns through engagement, thereby confirming our belief.

To highlight one example: joint research1 by academics from the University of Cambridge, Temple University and Boston College comprising 613 listed firms over 10 years revealed that engagements generated a +2.3% excess cumulative abnormal return over the year following the initial engagement. For firms where the engagement turned out to be successful, the positive effect was +7.1%.

We were not surprised to see that those companies also experienced improved accounting performance and increased institutional ownership. For an engagement with a corporate to make sense as an active investor, it is crucial that the typical investment holding periods matches or exceeds the expected engagement timelines. Here the study highlighted the time from initial engagement to success was on average 1.5 years, aligning well with our typical multi-year holding period for portfolio companies.

Other research too point to similar conclusions. A study2 looking at the impact of shareholder engagement and downside risk in 2023 highlights that there are key risk reduction benefits. For us, managing risk is just as important as generating returns. Prudent portfolio management is likely to result in better risk-adjusted-returns over time, besides safeguarding against negative reputational exposures.

Fig 2: Engagement and the impact on alpha generation

Source: Active Ownership research paper, August 2015 by Dimson, Karakas and Li.

Collective efforts enhance shareholder value

Separately, another research paper analysing a Principles for Responsible Investment (PRI) dataset of over 900 listed firms concluded that “coordinated engagements are value-enhancing for shareholders”. The authors showcase that returns are enhanced if coordinated engagements with other shareholders have a clear lead investor and improvement metrics are explicitly defined.

In this regard, we are part of several collaborative platforms such as UNPRI, AIGCC and Climate Action 100+ and we have been the lead or co-lead engager for various portfolio holdings. Such collaboration gives us greater leverage and a more effective platform for influencing corporate behaviour.

Sources:

1 Active Ownership” research paper, August 2015 by Dimson, Karakas and Li

2 “ESG Shareholder Engagement and Downside Risk” research paper, September 2023

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.