Executive Summary

- The Indian consumer market is positioned to become the world’s third largest by 2027, presenting significant opportunities for investors who can tap into this potential.

- Growing affluence and high levels of mobile penetration are driving consumption growth and changing consumer behaviour.

- India’s rapid pace of urbanisation and the emergence of peri-urban spaces are also creating unique opportunities for consumer companies, and therefore investors.

India became the world’s most populous country in April 2023. With a population of above 1.428 billion, and a working-age cohort that is expected to exceed 1 billion by the next decade, consumer spending in India is forecasted to surpass USD4 trillion by 2030. This will push India’s consumer market, currently the world’s 5th largest, up the ranks to become the third largest by 20271. This creates significant opportunities for investors that can tap into India’s growing consumption potential.

There are several factors driving India’s consumption spending:

Growing and more discerning

India’s strong economic growth is transforming household spending. India’s annual GDP averaged 6.21% from 2006 – 2023, among the world’s highest. For FY2024, the World Bank forecasts that India’s economy will grow by 6.4%. By 2027, around 25.8% of Indian households will have an annual disposable income of USD10,000. On the back of such strong economic growth, the spending by Indian households is growing rapidly. In 2021, India’s household spending per capita grew 7.1% versus 5.2% for ASEAN and is forecasted to grow by an average of 7.8% p.a. going forward2.

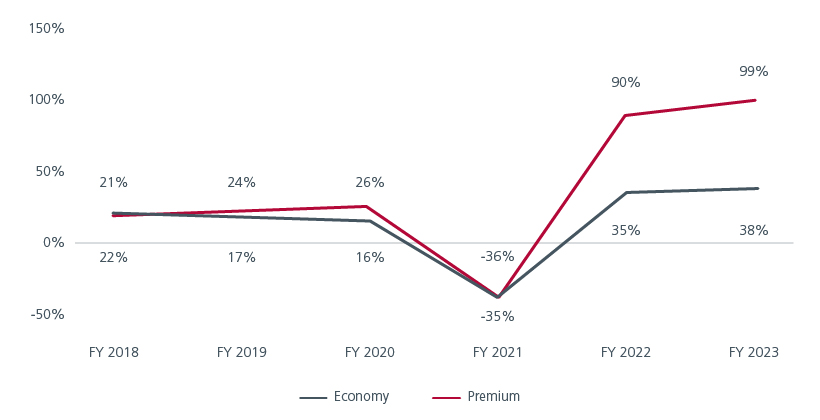

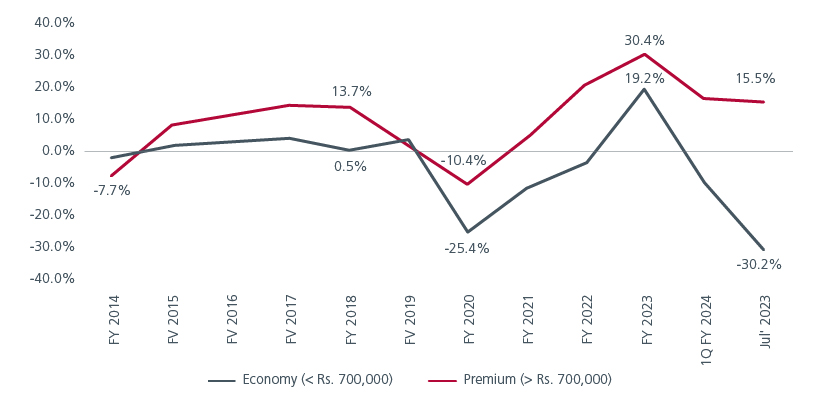

As a result of India’s growing affluence, the new Indian consumer is different from the consumers of the past. They tend to seek more quality, variety, and convenience in their purchases, and are also open to more experiential offerings. They are also more aware of social and environmental issues that align with their values. As a result, brands are offering higher-end products and services to consumers, a trend known as premiumisation. Premiumisation can be seen across multiple categories including fashion, vehicles as well as food and beverages. Fig. 1 and 2. Research suggests that there is strong demand for premium offerings within fashion, packaged foods, cosmetics, eating out and lifestyle accessories from the smaller towns. This has led retailers to expand rapidly in the tier 2 and 3 cities3.

Fig. 1. Apparrels net sales (% yoy)

Fig. 2. FY23 liquor sales (% yoy)

Source: : LHS: Companies, Avendus Spark Research, Note: Vmart and Premium is Trent. RHS: United Spirits; Economy: McDowells No 1 Premium: Antiquity, Signature, Black Dog, VAT 69, The Singleton.

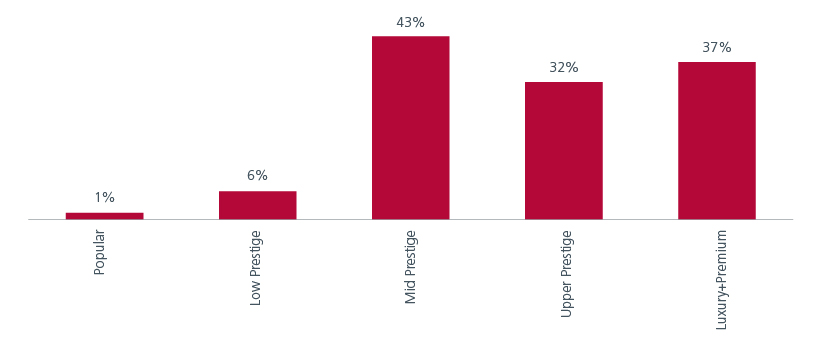

Deloitte's 2023 Global Automotive Consumer Study too reported a clear shift in buying pattern among Indian consumers. Fig. 3. Consumers are now prioritising experience over cost, with 55% of those surveyed willing to accept a longer delivery time in order to enjoy a better experience and get their preferred choice of vehicle.

Fig. 3. Car sales (% yoy)

Source: Kotak institutional research. October 2023.

Connected and diverse

As of January 2023, there are 692 million internet users in India. This number is expected to reach more than a billion by 2030, greater than the populations of Europe and North America combined. However, not all of India’s internet users are buying online despite the rapid growth of e-commerce sales.

There are an estimated 289 million of online buyers in India in 2021 and this number is forecasted to rise to 400-450 million by 2027. The rising availability of affordable smartphones, greater access to information and online payment systems, as well as online promotions and personalised advertisements are helping to fuel online purchases. Greater variety from an expanding online seller base and a more efficient logistics network are also enhancing the online buying experience. According to a report by Accenture, e-commerce spending in India is expected to grow by nearly sixfold from USD38 billion in 2021 to USD200 billion by 2030.

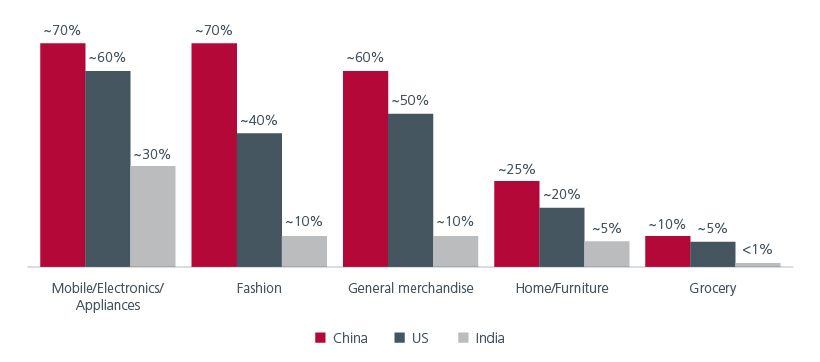

The market penetration of e-retail is expected to double from 5% in 2022 to 9%-10% over the next 5 years. Compared to China and the US, there is significant headroom for e-retail penetration in India to rise across multiple product categories. Fig. 4.

Fig. 4. E-retail penetration by category (2021)

Source: Penetration represents e-retail as a percent of total retail. Forrester. Market participant interviews. Bain analysis.

The profile of India’s online buyers has also evolved over the last decade. During the early adoption phase, India’s online shoppers were previously middle-aged, and from the higher income groups and tier one cities. They now include Gen Z shoppers, as well as those from tier two cities and beyond. The shopper base has also expanded to include the lower-middle income group and has matured, with a rising percentage of daily active users.

Urbanising and transforming

Urbanisation is a major driver of consumer spending in India, as it transforms the size, composition, and dynamics of the consumer market, creating opportunities and challenges for businesses and therefore investors. According to the World Bank, India's urban population as a percentage of the total population increased from 28% in 2001 to 35% in 2020 and is projected to reach 40% by 2030⁴.

Urbanisation has several impacts on consumer spending in India, including increasing income and purchasing power. Urban areas tend to offer higher wages, more employment opportunities, and better access to education and health care than rural areas. This tends to lead to higher income levels and purchasing power for urban consumers, who can afford to spend more on discretionary items, such as consumer durables, entertainment, travel, and personal care.

Urbanisation also changes consumer preferences and behaviour by exposing consumers to new products, services, brands, and lifestyles. Urban consumers tend to be more aspirational, quality-conscious, convenience-seeking, and digitally savvy than rural consumers. They also have more diverse and sophisticated tastes and demands, such as for health and wellness, sustainability, personalisation, and social responsibility. These factors drive demand for new and innovative offerings across various product categories and sectors.

Urbanisation also creates new market segments and channels for consumer spending in India. For example, the emergence of peri-urban spaces, which are transitional areas between rural and urban habitats and have developed around cities due to rapid urbanisation and urban expansion, offers a unique opportunity for businesses to tap into a large and underserved consumer base that has both rural and urban characteristics.

Tapping into India’s consumer growth potential

Consumption is an important driver of India GDP with Personal Final Consumption Expenditure accounting for 59.7% of India’s nominal GDP in June 20234. Besides a large population, other structural factors such as premiumisation, digitalisation and urbanisation are driving India’s consumption growth. With the Indian consumer market positioned to become the world’s third largest by 2027, investors can tap into this significant growth by investing in businesses that can understand and meet the changing needs of the Indian consumer.

We would like to thank ICICI Prudential Asset Management Company (IPRU) for contributing their insights to this article. IPRU is a joint venture between our parent Prudential plc and ICICI Bank. This partnership has been in place since 1998 and brings together two leading asset managers with expertise in Asia and India respectively.

Sources:

1 BMI Research.

2 BMI Research.

3 Report by consulting firm Redseer, in collaboration with Plural by Pine Labs. al payments firm. June 2023.

4 CEIC data. June 2023.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.