Executive Summary

- Indonesia which has the largest nickel reserves in the world is carving a niche in the electric vehicle (EV) supply chain.

- Massive investment flows into nickel and battery materials have positively impacted the country’s trade balance.

- To capitalise the opportunities in electric vehicles, invest directly in Indonesia’s EV supply chain listed companies.

Enhancing supply chain resilience has become a key priority for global businesses following the COVID-19 pandemic. Mitigating supply and sourcing risks, as well as hedging geopolitical and regulatory risks emerge as the top two drivers of supply chain rebalancing for business leaders surveyed in our whitepaper “New anchors reshaping supply chains: Opportunities for investors”. However, despite being primarily driven by risk considerations, business leaders are also rebalancing to position their organisations for future growth.

The ongoing reconfiguration of global supply chains is benefitting South East Asian economies; foreign direct investments (FDIs) into the region have increased substantially with record inflows of USD224bn in 2022, a 5.5% increase over 2021. Consequently, the region’s share of global FDIs has risen from 15% to 17%.1 Growing connectivity and complementarities between Asian economies and unique competitive advantages have led to Asia’s rising importance within global supply chains.

Indonesia which has the largest nickel reserves in the world is carving a niche in the electric vehicle (EV) supply chain by leveraging its critical mineral reserves and incentives to court investments. The country saw record foreign investment inflows of USD22bn in 2022 with the manufacturing sector drawing over half of these inflows.2 Insights from business leaders surveyed in the whitepaper also point to Indonesia benefitting from the supply chain rebalancing in the automotive industry, especially EVs.

Climate and consumers to drive EV growth

The Indonesian government is committed to reducing greenhouse gas (GHG) emissions by 29% by 2030 and achieving net zero emissions by 2060 or sooner. As the transport sector is one of the largest sources of emissions, the electrification of this sector is central to Indonesia meeting its climate goals. Within the transport sector, road transportation contributes over 90% share of emissions.3

Currently EVs have less than 1% penetration in Indonesia. By 2030, total EV penetration is forecast to reach 6% for two-wheelers (2Ws) and 2% for four-wheelers (4Ws).4 As Indonesia is already a major automotive production hub, scaling up production of EVs will not be an issue. In addition, government incentives such as the removal of the luxury tax on EVs in 2024, the waiver of import tax until 2025, and a reduction in the value-added tax on EV sales are aimed at encouraging EV production and sales.

Separately Indonesia is the largest consumer market in South East Asia and its growing middle class purchasing power will underpin vehicle sales. The number of EV models has also been increasing since 2021, thereby increasing the options for consumers. Analysts estimate 4Ws to experience a 10% CAGR between 2024-325 led by GDP/capita growth and significant infrastructure investment in roads.

Meanwhile the Indonesian government has set an ambitious target of 2.2 million EV cars and 13.5 million EV motorcycles on the road by 2030.6 On the emissions’ reduction target, the government has also banned the sale of fossil fuel motorcycles and cars by 2040 and 2050 respectively.7

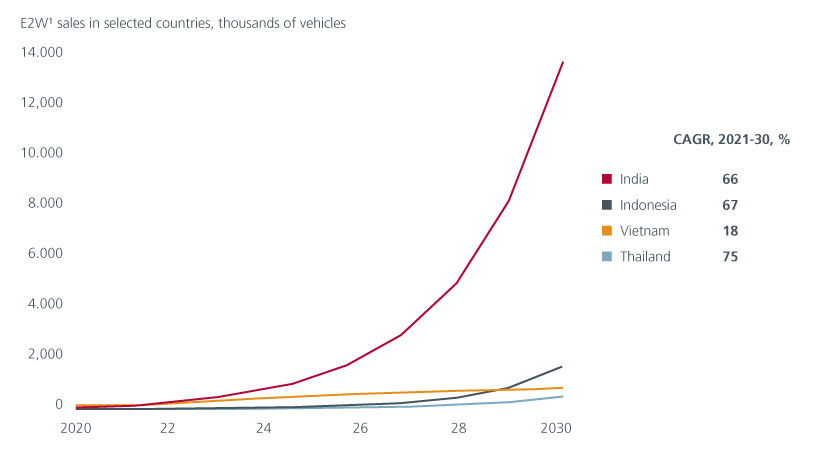

Fig 1: Sales forecast of electric two-wheelers

Source:1 includes e-scooter and e-motorcycles. McKinsey, Asean Automotive Federation, Statista, International Clean Council on Transportation, WRI India

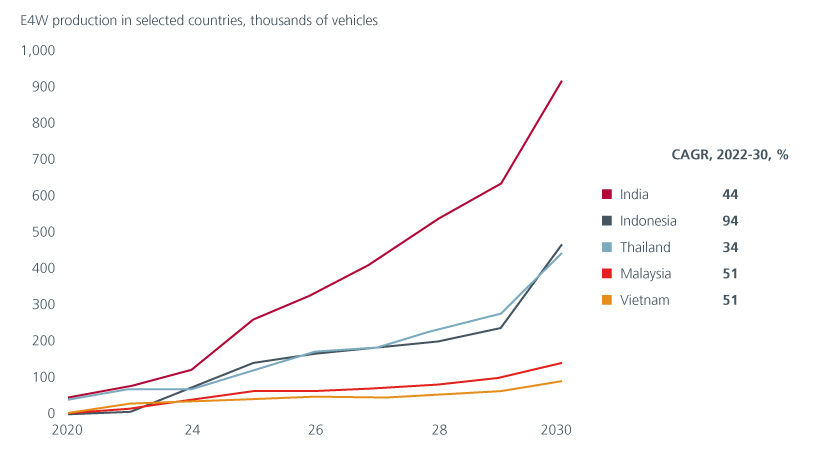

Fig 2: Production forecast of electric four-wheelers

Source: IHS Markit Forecast Model, McKinsey analysis

Niche position in the EV value chain

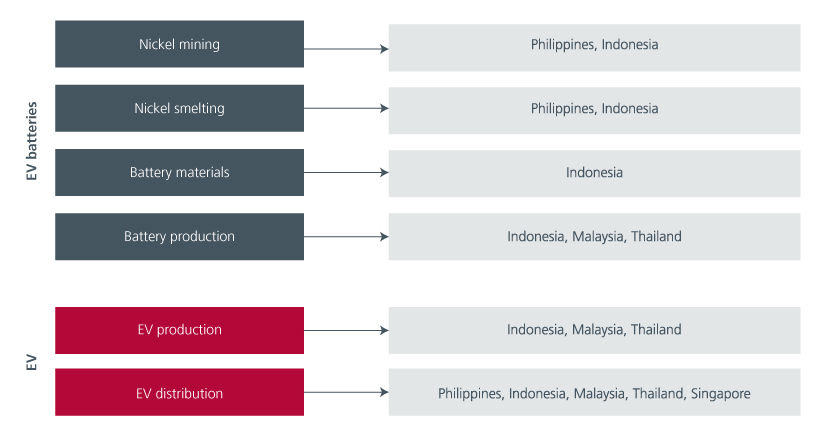

Between 2018-2022, Indonesia was the largest beneficiary of investments flowing into South East Asia’s EV market. This is not surprising as Indonesia is present in all segments of the EV value chain from nickel mining all the way to EV production and distribution.

Fig 3: Asean participation in global EV value chain

Source: CLSA, Asean Electric Vehicles, Feb 2023

Across the value chain, Indonesia has an outsized representation in the upstream segment of the EV sector; its share of global nickel supply is forecast to rise from 46% in 2022 to 60-61% in 2025-30. Meanwhile, the world’s use of nickel in batteries is also expected to grow strongly. As Indonesia transitions to become a key nickel production hub, the government has set a target to become the world’s third largest producer of electric batteries by 2027.8 At the same time, new investors are getting into various areas of the automotive supply chain and their presence attracts suppliers, facilitating a robust domestic supply chain development which benefits the local economy.

Positive knock-on effects on the economy

Massive investment flows into nickel and battery materials have positively impacted the country’s trade balance; in 1Q24, iron and steel exports reached USD7.5bn (2.2% GDP) from less than 0.5% of GDP in 2014. Nickel downstream products have also become one of the country’s top three export products alongside coal and palm oil. Meanwhile Indonesia’s nickel belt is located in Central Sulawesi and North Maluku, and as per FY23 GDP data, both provinces grew by 20.5% and 11.9% year-on-year respectively.

The whitepaper survey findings suggest more than three quarters of global businesses prefer to engage in strategic partnerships, and more than half prefer to rebalance through mergers and acquisitions. Indonesia’s nickel expansion project is seeing joint ventures between Chinese and Indonesian companies. Many listed Indonesian companies are also acquiring nickel smelters and looking for strategic partners to expand their nickel smelting capacity, which will lead to knowledge transfer.

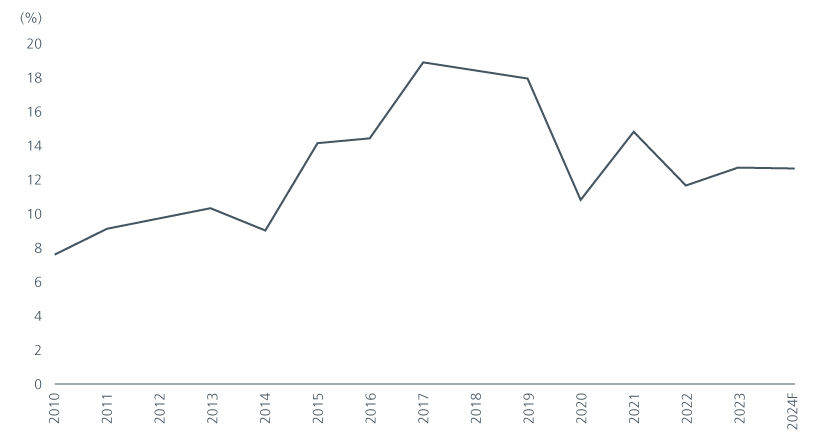

Nonetheless to build an integrated end-to-end EV value chain, good physical infrastructure has to be in place to ensure a seamless integration across supply chains. To date there has been satisfactory progress on this front. During President Jokowi’s regime, the number of toll roads, power plants, airports and seaports increased by 235%, 53.2%, 21%, and 90%, respectively. Infrastructure spending as a percentage of the government budget reached its peak in 2017 at ~18%. It is currently around 12%, higher than during the previous administration.

Fig 4: Government spending on infrastructure

Source: CLSA, Government statistics

Continuous efforts in building infrastructure and giving incentives to businesses are bearing fruit. In recent years, the Indonesian government has signed partnership deals worth more than USD15 bn9 with international vehicle and battery manufacturers such as Ford, Porsche, Hyundai, CATL, LG etc. for nickel mining and refining to battery and EV manufacturing in the country.

Investment implications

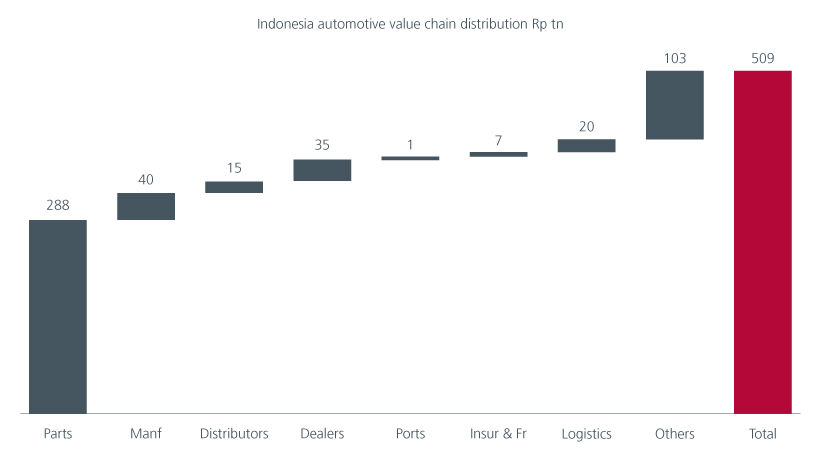

To capitalise on the EV theme, invest directly in Indonesia’s 2Ws and 4Ws EV supply chain listed companies. Indonesia has many highly competitive producers of battery materials in the upstream and midstream supply chain. Downstream, there are many established companies involved in 2-wheelers manufacturing and sales, 4-wheelers sales and dealerships, EV battery pack and electronic sensor manufacturing, as well as in EV solutions and infrastructure.

Auto parts makers, EV manufacturers and dealers will be the main winners. These three capture 75% of the value chain. Auto parts makers will benefit from Indonesia’s minimum local content requirements for EVs; EV players can get the incentives of free import duty and luxury tax if the minimum local content reaches 60% by 2027 and 80% by 2030. Given that many of these downstream companies are still at initial stages of development, the growth potential is significant as EV adoption in Indonesia accelerates.

Fig 5: Indonesia’s automotive value chain distribution – 2023

Source: Gaikindo, Verdhana research

Sources:

1 ASEAN Investment Report 2023

2 ASEAN Investment Report 2023

3 https://fulcrum.sg/indonesias-ev-transformation-a-work-in-progress/

4 https://www.mckinsey.com/id/our-insights/indonesias-green-powerhouse-promise-ten-big-bets-that-could-pay-off

5 CAGR – Compounded average growth rate. PT Verdhana Sekuritas Indonesia – Indonesia Autos, Mar 2024

6 https://www.weforum.org/agenda/2023/02/moving-indonesia-the-multi-stakeholder-network-building-indonesia-s-ev-production-market

7 https://www.mckinsey.com/featured-insights/future-of-asia/capturing-growth-in-asias-emerging-ev-ecosystem

8 https://www.aseanbriefing.com/news/indonesia-issues-new-tax-incentives-to-spur-ev-production-and-sales

9 https://theicct.org/indonesia-mef-may2023/

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.