Executive Summary

- Behavoural biases tend to become more pronounced when markets are volatile. The disposition effect is a behavioural bias where investors hold onto losing investments for too long and sell winning investments too quickly.

- A stop loss tool can provide an unbiased approach to prompt the sale of losing investments and help protect investment performance. Such a tool can be incorporated into investment teams’ overall risk management framework.

- Our stop loss signal effectively identifies stocks that are likely to continue declining over the 12-month period after the initial trigger. Even if these stocks recover, the benefits of avoiding the decline outweigh the potential gains.

Behavioural biases can lead to irrational decision-making and suboptimal investment performance. With the heightened market gyrations in the recent months, these biases can become more pronounced. We can use data to assess and manage the effect of different behavioural biases and develop tools that can be incorporated into investment teams’ overall risk management frameworks.

Holding losers and selling winners

Among the different biases, the disposition effect stands out. The disposition effect is a behavioural bias where investors tend to hold onto losing investments for too long and sell winning investments too quickly. This can lead to suboptimal investment performance by locking in losses and missing out on potential gains. Imagine yourself as an investor who buys a stock at $100. As the stock price falls to $80, you hesitate to sell, hoping for a recovery. This reluctance to sell is driven by the desire to avoid realising a loss, even though holding onto the stock may lead to further declines. Conversely, if the stock rises to $120, you might sell quickly to lock in gains, missing out on further potential gains.

This occurs because the psychological discomfort of realising a loss can be more painful than the joy of realising a gain. According to the study by Kahneman and Tversky (1979)1 , the pain of losses is felt approximately twice as strongly as the pleasure of equivalent gains. This phenomenon, known as loss aversion, explains why investors may hold onto losing stocks for too long, hoping for a turnaround that may never come.

For fundamental investment teams, the disposition effect is particularly relevant. These investors conduct deep dives on areas such as business model, company management, and competitive position before making an investment decision. A natural attachment and conviction to the decision is likely to develop. This conviction, coupled with the loss aversion effect, can make it challenging to confront a weakening stock position.

By understanding and acknowledging the presence of the disposition effect, fundamental investors can incorporate a data-informed process that supports rational decisions about when to reduce or exit weakening positions. This is where a stop loss tool can support, providing an unbiased approach to prompt the sale of losing investments and help protect investment performance.

Calibrating an effective stop loss signal

Typical stop loss usage involves a one-size-fits-all loss level, for example -20%, which is easy to communicate as a process but impractical. Our approach leverages on one of the core premises in a published research paper2, which is to use volatility as a predictor for stop loss thresholds. This avoids the need to make strong distributional assumptions and, most importantly, accounts for the differences across stocks.

However, we adapted the volatility calibration to use stock returns relative to the market, rather than stock returns themselves. We find that this helps to reduce noise from broad market movements and contextualises the usage for portfolios managed against a performance benchmark.

Our methodology involves two key components: the rolling active volatility calculation and the stop loss signal trigger. We calculate the rolling active volatility using a rolling window of active returns. This helps to determine the fluctuation of a stock’s performance relative to the index . By using a rolling window, we can capture the dynamic nature of market conditions and adjust our volatility estimates accordingly. This is relevant because it allows us to understand how volatile a security’s active returns are, which is crucial for setting appropriate stop loss thresholds.

Measuring volatility of performance deviation to market returns is essential because it helps identify unusual movements specific to the stock, differentiating them from market trends where all other stocks are moving similarly. For instance, if the entire market is experiencing a downturn, a stock's decline may not be seen as unusual. However, if the stock declines significantly more than the broader market, it may indicate that something unusual is happening to that particular stock. Focusing on relative returns volatility helps us to better identify these unusual stock movements and enable us to set more representative stop loss thresholds.

If a stock has high relative returns volatility, it may be more prone to sharp declines. By calculating the rolling active volatility, we can set a stop loss threshold that is sensitive to these fluctuations, prompting timely review of weakening positions. This gives the investment teams an opportunity to review the investment thesis, leading them to either reduce or exit the position, or to add to the position if the stock price shows unwarranted weakness.

A stop loss signal is triggered when the active return falls below a threshold, which is determined by a carefully calibrated scaling factor multiplied by the rolling active volatility. This approach ensures that the stop loss signal is sensitive to changes in market conditions and the specific behaviour of the security.

Helping our investment teams sell better

To evaluate the effectiveness of our stop loss strategy, we asked ourselves – “What would the stock performance have been if we did not exit at the point of trigger?” We measure the consequences using performance of the stock relative to the broad market, over the period of 1/3/6/12 months after the event.

This helps us evaluate whether the hypothetical stop loss discipline was effective in mitigating the disposition effect.

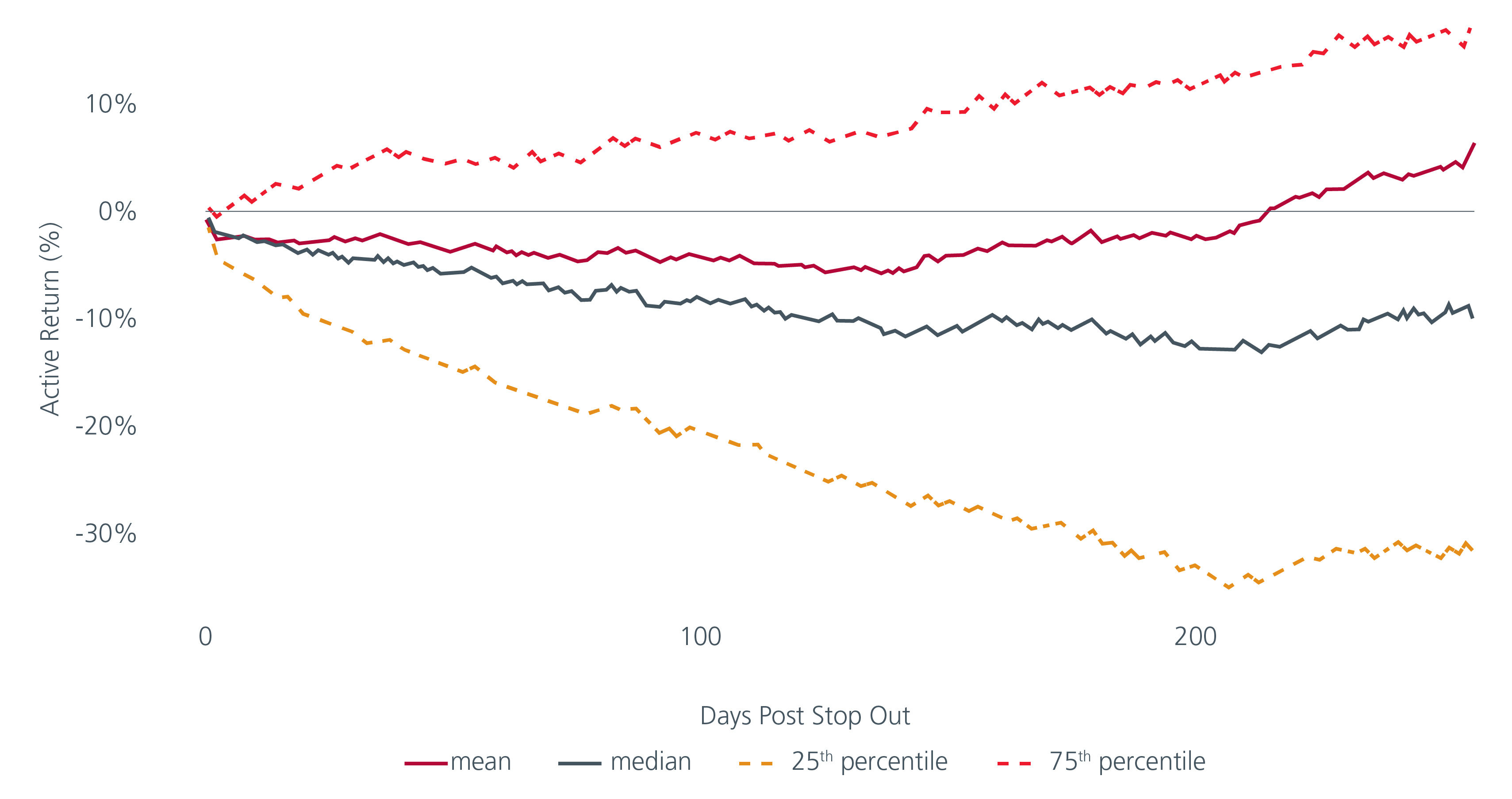

The results are encouraging. We review the hypothetical outcomes at the 12 months mark after the trigger of the signal, a time horizon which is more representative to a fundamental investment style. See Fig. 1.

Fig. 1. MSCI AC Asia Pacific ex Japan post stop out performance

Source: Eastspring Investments, April 2025.

Fig. 1. shows the stocks’ performance after they have triggered the stop loss signal. For every stock, we track its respective performance relative to the broad market, right from the second day after it crosses the stop loss threshold, up to one year later. To evaluate the effectiveness of the signal across all the stocks in the study, we sample representative segments of the observations. The 75th percentile represents ‘stocks that recovered’ while the 25th percentile represents ‘stocks that continued falling’. To understand the entire distribution of outcomes, we also study the Mean and Median, which represents ‘the average stock’.

The ‘stocks that continued falling’ (-32% after one year) consistently declined by more than the ‘stocks that recovered’ (+17% after one year) . This means that even if stocks recovered after the unusual tumble that triggered the stop loss signal, the amount of recovery did not outweigh the benefits of avoiding a decline which might have been larger.

The Median stock (-10%) also underperforms the broad market, with the Mean (+6%) delivering neutral performance against the broad market. This does not include the opportunity cost of not reinvesting the capital into a higher conviction stock, which could mean forgoing higher potential returns. Hence, if we are consistent in using this signal, a stock which has crossed the stop loss threshold is an undesirable candidate in the portfolio as it is unlikely to outperform the broad market even up to 12 months after.

Another helpful metric we used for assessing the effectiveness of the signal was the Hit-Rate, which measures how often the stop loss signal correctly identifies stocks that will underperform the index. This metric informs us on “how often are you likely to be correct?”. According to this, our stop loss signal has an average Hit-Rate of 65%; out of every 100 instances, 65 stocks will go on to underperform the broad market.

These findings indicate that the stop loss signal is helpful in identifying stocks that are likely to continue declining. Incorporating this signal into the investment process can enhance risk management as well as tactically protect alpha in the long run. Even if the decision is to continue holding the position, it would have been informed by both data as well as a healthy debate.

By prompting a timely review of these stocks, the stop loss signal is an unbiased tool which helps investors mitigate the disposition effect and can potentially free up capital in the portfolio for deployment in other more promising stocks.

Protecting portfolio alpha

Our stop loss signal aims to help our investment teams not hold onto losing investments for too long or sell winning investments too quickly. We calibrate our signals so that they are sensitive to changes in market conditions and the specific behaviour of the security.

Through testing, we see that our stop loss signal can identify stocks that are likely to continue declining, or even when they recover, the amount of outperformance did not outweigh the benefits of avoiding a decline. With a respectable Hit-Rate of 65%, our investment teams are encouraged to incorporate such an overlay in their portfolio and risk management process.

The stop loss signal is an unbiased tool that can inculcate discipline in reviewing underperforming stocks, thereby helping to mitigate the investment teams’ behavioural biases and protect the alpha in their portfolios.

Sources:

1 Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263-291.

2 Adam Y.C. Lei,a,* Huihua Lib (2009). The value of stop loss strategies.

Financial Services Review 18, 23–51.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.