Executive Summary

- A shift to innovation, tech independence, and stronger domestic demand is redefining China’s growth and investment landscape.

- Key equity themes include healthier competition under anti-involution measures, artificial intelligence and a rebound in consumption.

- Household savings, rate cuts, and possible tariff shifts could bolster China’s equity market which remains cheap versus global markets.

Despite the strong recovery in both onshore and offshore China equities over the past two years, investors have largely remained underweight, unconvinced that the stock market rally is sustainable. On an asset-weighted basis, global active mutual funds underweighted China by 340 basis points (bps) versus their benchmarks at the end of Sep 25 (versus underweight by 320 bps at the end Jun 25). Investor skepticism has kept valuations at discounted levels compared to developed markets.

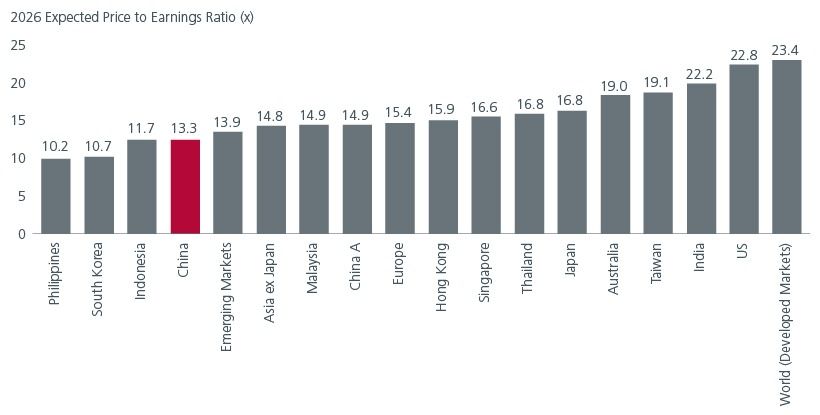

Even after the recent gains, MSCI China trades at 13.3x forward price-to-earnings, marginally above its 10‑year average. When compared to other key global market indexes, the MSCI China Index is trading at over 20% below its recent peak in 2021, while others have reached or exceeded their peak valuation in recent years.

Fig 1: China remains cheap compared to global markets

Source:MSCI, Institutional Brokers' Estimate System (IBES) estimates as of 31 Jan 2026.

It is convenient to argue that China remains “cheap for a reason,” yet this overlooks the shifts that are underway. China’s macro narrative is shifting in a more deliberate way. Rather than relying on broad-based stimulus, policy support will be geared towards higher-value industries and long-term tech self-sufficiency as recommended in China’s most recent 15th Five-Year Plan, 2026-2030.

A reshaping of the opportunity set

The plan emphasises deepening China’s ability to innovate and accelerate breakthroughs in artificial intelligence (AI), semiconductors, advanced computing, biotech, next-generation materials, satellite communications, and clean energy systems. These sectors are at the forefront of China’s mid- to- long-term growth model.

Supply chain security and industrial resilience also feature prominently in this plan. China aims to localise critical technologies, reinforce strategic manufacturing capacity and modernise traditional industries, creating opportunities for domestic champions and realising self-sufficiency in key sectors.

In parallel, the plan recommends bolstering domestic demand by placing greater emphasis on sectors such as healthcare, elderly care and service consumption - segments that have seen structural underinvestment and now offer multi‑year growth potential.

Collectively, these policy priorities are reshaping the landscape of investment opportunities and creating a conducive environment for active stock selectors.

Equity themes to monitor

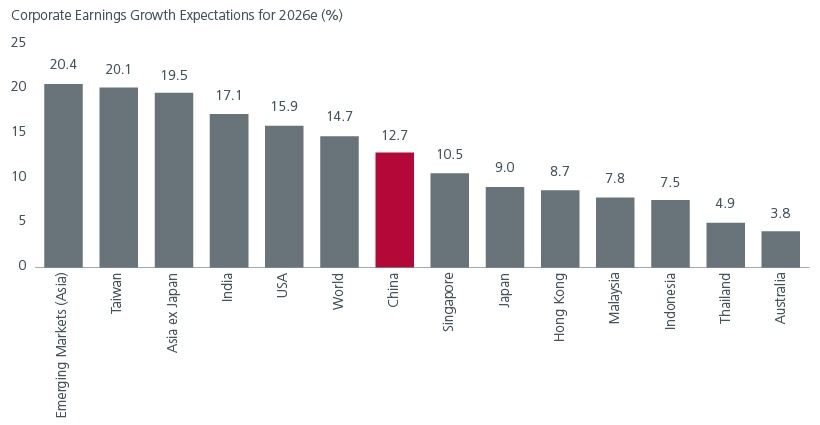

A key theme in our view is the accelerating execution of anti-involution measures after the National People’s Congress in March. This supports a healthier competitive environment and bodes well for earnings growth; consensus estimates for earnings per share are around 13% in 2026 – placing China in the upper tier of Asia Pacific markets.

Fig 2: China’s earnings growth estimate is decent

Source: LSEG Datastream, Institutional Brokers' Estimate System (IBES), MSC as of 31 Dec 2025. Data represents the projected weighted year-on-year growth in earnings-per-share for the respective calendar year.

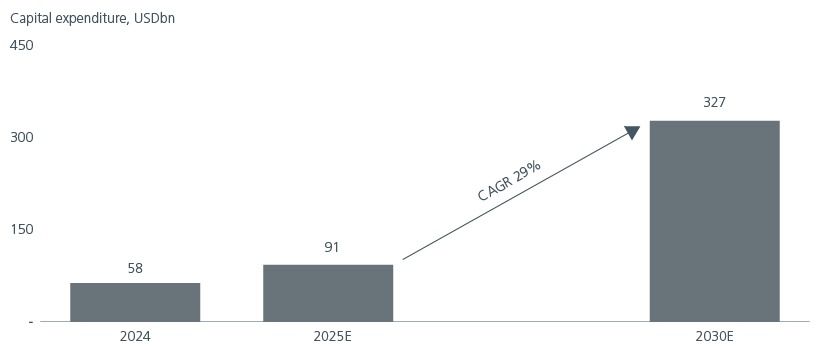

AI remains a dominant multi-year theme, but China’s AI advancement is under-appreciated. With global AI capex set to rise meaningfully in 2026 and beyond, there will be strong demand for China’s upstream hardware suppliers which offer scale, speed and pricing, thus supporting global customers’ need to build computing power and data centres with efficiency. Local AI beneficiaries and early AI monetisation proxies that emerge as winners in the ongoing market consolidation phase should also attract investor interest.

Fig 3: China’s AI capex to reach USD330bn in 2030E

Source: BofA Global Research estimates, Eastspring Investments as of 11 Oct 2025

Financials also feature as another theme. In particular, non-bank financials such as life insurers serve a key role in delivering steady returns to policyholders, especially when there’s a significant amount of household time deposits that are maturing this year.

Yet another theme to monitor is domestic consumption which is expected to experience a K‑shaped recovery, with resilience in the luxury segment. Service‑led consumption, spanning healthcare, leisure, wellness and experience‑based spending, stands out as a key structural growth area.

Catalysts that could change the game

Chinese households’ USD22tn in deposits could be a powerful catalyst for equity markets. With property investments losing appeal and deposit yields declining as deposit rates fall, more of this liquidity is expected to migrate into alternative areas including equities. On monetary policy, the next move from the People’s Bank of China would likely be an interest rate cut starting Q2 2026. Such a move, along with the US Federal Reserve’s additional rate cuts, could mean further share price upside for Chinese stocks.

In addition, with increased new life insurance premiums, there could be more capital flowing into China’s equity market. Chinese policymakers have issued guidance to encourage insurers to take a longer‑term role in the equity market.

Lastly, we believe that some of the negotiated tariffs have swung too far, and if the US begins to face higher inflation, the administration could be forced to unwind some of these trade actions. This in turn could ease pressure on Chinese exporters, support China’s industrial economy, and lift both sentiment and capital flows into China’s equity market. A more constructive global macro backdrop as well as monetary and fiscal easing will be conducive for the equity market in 2026.

Opportunities amid the risks

The China market could stay volatile. We are cognizant that the market’s significant rally in the last two years has increased a near-term risk of a potential correction, possibly driven by near-term overbought sentiment, and high expectations on growth resilience. An increasingly unpredictable geopolitical environment could add further volatility; US–China trade frictions are likely to persist but might have passed the worst times in the run‑up to the November US mid‑term elections. No political party is likely to secure easy wins if the US economy is under pressure from rising inflation and tariff risks.

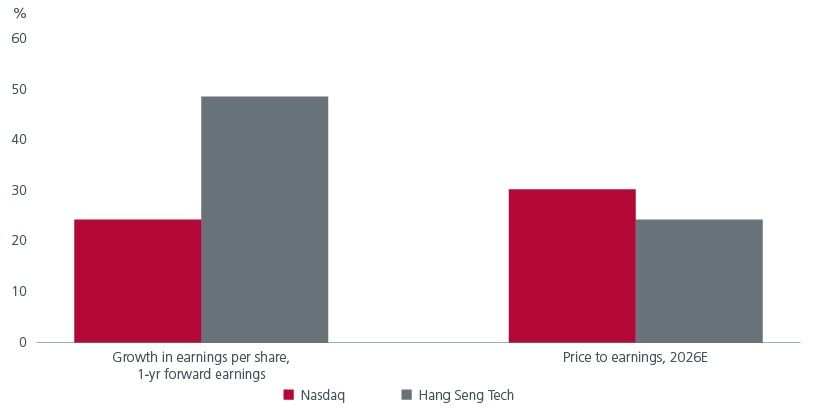

We believe China equity markets could continue to rally in 2026, albeit at a more gradual pace given that valuations are fair while still at a notable discount versus the developed markets. We believe a depreciating US dollar, investors’ low expectations for stimulus policy, and the market’s attractive earnings growth potential are all supportive factors. The rally is also likely to be more sustainable and supported by genuine tech breakthroughs, targeted government backing, consistent buying from domestic investors and increased probability of improving foreign inflows.

Fig 4: Chinese tech stocks cheaper than US peers

Source: Bloomberg, Eastspring Investments as of 9 Jan 2026

We remain focused on fundamentally sound companies with reasonable valuations and credible growth, while avoiding firms burdened with national‑service mandates. We target global and national champions, including those within the tech and advanced manufacturing sectors. Equally, a “barbell” approach of having both defensive and growth compounders in our portfolio allows for nimble positioning.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.