Summary

We provide key takeaways from Eastspring’s Asian Expert webinar “Is it time to relook at bonds?”, where Mark Redfearn from PPM America and Clement Chong from Eastspring Investments shared their insights on the US and Asian bond markets.

1. Valuations are attractive

It was not that long ago that the market value of negative yielding debt soared above USD18 trillion1, as global central banks cut interest rates and bought large amounts of bonds in the wake of the COVID-19 pandemic. The amount of negative yielding debt has since dwindled to zero as interest rates rose globally.

Bond yields now in many countries are at multi-year highs, offering investors a once in a decade opportunity to enjoy attractive levels of income and potential capital gains when yields head lower in the coming months and years.

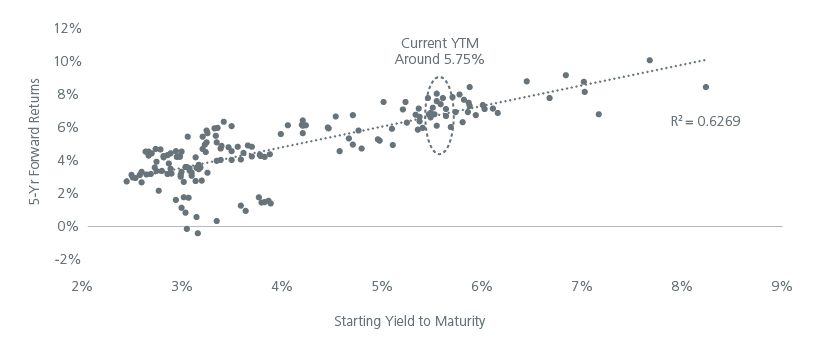

Fig. 1. shows that over the last 13 years, buying US bonds at current levels of around 5.75% has delivered 5-year forward returns of 6% p.a. The figure also shows that historically, there has been very few instances where yields have moved higher from here, suggesting that current yields provide investors with very attractive entry levels.

Fig. 1. Starting yields and forward returns are closely correlated

Source: FactSet, Morningstar. Monthly yields for the Bloomberg US Credit Index from January 2005 through July 2018 and 5-year forward returns from the Jan-05 to Dec-09 period through the Aug-18 to Jul-23 period.

2. Cash rates will fall (eventually)

Cash rates are unlikely to stay high indefinitely. At the Federal Open Market Committee meeting in September, the Federal Reserve (Fed) indicated that it would start cutting interest rates from 2024. In the coming months, as both the US economy and inflation slows further, it would not be surprising for bond markets to move ahead of the Fed and for bond yields to start declining even before the Fed’s first rate cut. As such, investors may want to look beyond the current cash rate levels and instead focus on the upside potential of bonds.

The recent spike in oil prices has raised concerns over the outlook for inflation, and the prospects for rate cuts. Slowing global growth plus the approaching end of the driving season in the US should help to dampen oil demand. In addition, Saudi Arabia is unlikely to extend its production cuts indefinitely and risk losing further market share. All these factors should help to keep a lid on oil prices.

Asia’s inflation has been relatively more contained than the US’, as the region has not experienced the same extent of demand-supply imbalances, especially in the labour market. That said, the recent rise in oil and food prices bears monitoring although historically, Asian central banks have shown the willingness to cushion the impact of high oil prices via subsidies.

The resilience of the US economy to date has given the Fed confidence to keep rates high for longer. However, the full impact of high interest rates has yet to fully filter through the US economy, particularly in home mortgages where many households enjoy 30-year fixed rate terms, as well as in the commercial real estate and corporate debt segments. A faster than expected deterioration of the US economy could prompt the Fed to pivot earlier. Asian central banks are more likely to follow the Fed’s lead.

3. Bonds are diversifiers again

Given current yields, bonds can regain their roles as diversifiers in portfolios again as the income they generate should help buffer portfolios against potential equity market volatility. With the ongoing uncertainty over economic growth, it may be prudent for investors to refocus on income and principal preservation in their portfolios. While equities participate on the upside in earnings expansion, bonds are a low beta strategy. At current yields, bonds potentially offer equity-like returns but with lower volatility.

As mentioned earlier, the impact of higher interest rates is still making its way through the US economy and is likely to affect corporate margins and earnings eventually. Over in Asia, China is still growing but at a much lower rate than what investors are used to or anticipated. Slow growth in China and the developed economies has weighed on the outlooks of the export-dependent economies in Asia, although countries with large domestic populations such as India, Indonesia and the Philippines have been more resilient.

Investors should nevertheless retain a thoughtful approach towards their bond allocations as the recent sharp selloffs in the bond markets in October 2022 and March 20232 show that market depth and liquidity are lower than perceived.

Where are the opportunities?

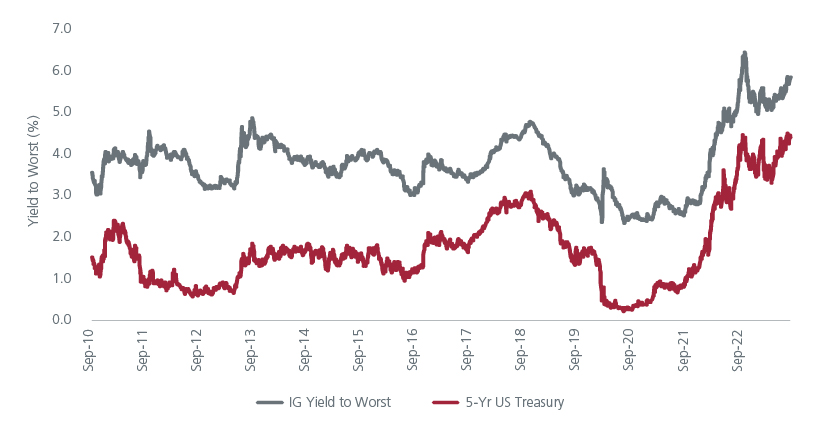

In both the US and Asia, Investment Grade credits are expected to better weather the higher costs of funding given their stronger credit profiles. The duration of US Investment Grade is roughly twice that of its High Yield counterpart3. This suggests that US Investment Grade bonds on average are likely to enjoy greater capital appreciation than US high yield bonds when bond yields fall in the coming years. Over in Asia, the yield to worst for Investment Grade credits is at its highest since 2008. See Fig. 2. This presents the potential for capital appreciation when the Fed starts to pivot.

Historically, IPOs have also appealed to the retail investor for its alpha generation potential. Our analysis shows that IPOs historically demonstrate positive excess returns over the market. Analysis around the “first day IPO pop” shows consistent positive first-day excess returns going back 15 years. Fig. 5. We see a similar phenomenon when looking at longer-term excess returns from participating in IPOs for the same markets. One thing to take note is that retail investors usually cannot directly participate in IPOs in markets outside of their home country. One way around this is to invest in mutual funds that have access to equity capital market events across geographies.

Fig. 2. Asian Investment Grade credit market is in a sweet spot

Source: JP Morgan, Bloomberg, September 2023. JACI Investment Grade Index.

Within US Investment Grade credits, single A-rated bonds are favoured over BBB-rated bonds. In addition, there is a preference for highly regulated sectors such as utilities, energy and large national champion banks which tend to be better capitalised. Meanwhile, the USD is expected to remain supported by interest rate differentials.

In Asia, there is a preference for local government bonds especially from countries that have stronger fiscal and current account positions, better inflation dynamics and the flexibility to cut rates at some point. Since Asian currencies may be weighed down in the near term by a weak RMB, it may be appropriate to assess valuations on a currency hedged basis. The valuations of Singapore dollar (SGD) corporate bonds and Malaysian government bonds look compelling on a currency hedged basis. Besides attractive yields, SGD corporate bonds also offer greater stability.

PPM America is a US-based asset manager and is the investment sub-manager for Eastspring’s US bond strategies. Please click on this link to watch a replay of the webinar.

Sources:

1 Bloomberg. 2020

2 US regional banking crisis.

3 The indices used for this measurement are the Bloomberg US Corporate Index and the ICE BofA US High Yield Index, which have effective durations of 6.92 and 3.60 respectively as of 31 August.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.