Executive Summary

- Companies have optimised their supply chains for decades to benefit from the world’s lowest cost and most scalable manufacturing destination.

- This is changing on the back of higher costs, heightened strategic rivalry between China and other countries as well as rising ESG considerations. Supply chain security and diversification are now at the forefront of most companies’ medium-term investment plans.

- A structural recalibrating of global supply chains away from China is underway, presenting a once-in-a generation opportunity for emerging market countries that have the necessary resources and readiness. We believe that this backdrop presents a structural opportunity that disciplined bottom-up investors can seize.

For decades, companies have optimised their supply chains to benefit from the world’s lowest cost and most scalable manufacturing destination. China’s abundance of low wage workers, strong ecosystem of suppliers, component manufacturers and distributors have made it an efficient and cost-effective location to manufacture products, helping it to become the “factory of the world”.

However, a confluence of factors over the last decade has prompted countries to shift their supply chains away from China, either by reshoring (bringing production back to their home countries), nearshoring (moving production closer to their home countries), or friendshoring (moving production to friendly or allied countries), a process we have termed as the “Great Transition” in this article.

Some of the factors driving the Great Transition include:

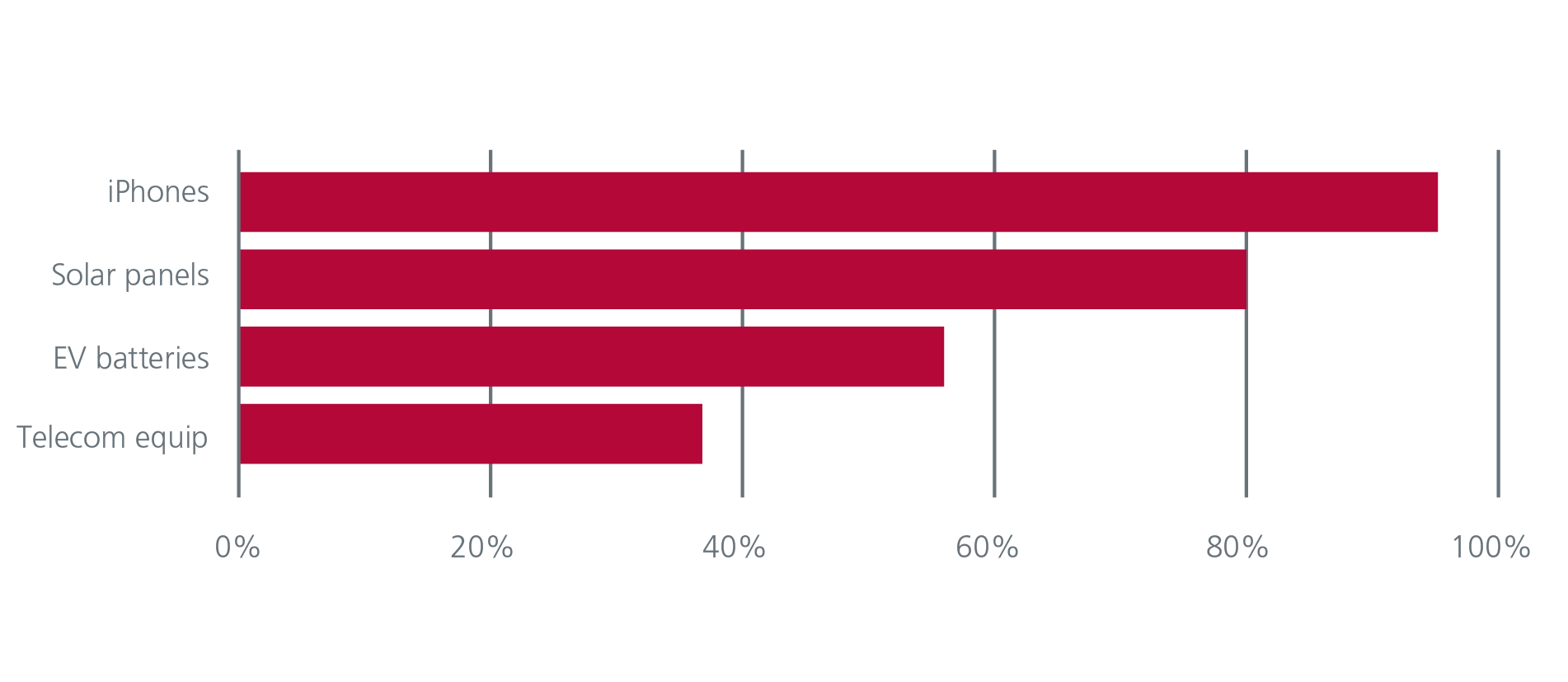

China’s dominance in strategic industries

China’s dominance in strategic industries such as mobile communications, electric battery technology and telecom hardware has risen over the last 5 years. Fig. 1. Meanwhile, the COVID-19 pandemic, heightened strategic rivalry between China and other countries including the US, India, Japan and Australia, as well as the recent developments in Ukraine have intensified the desire for countries to enhance their supply chain resilience and security.

Fig. 1. China’s share in strategic industries

Source: Eastspring, Visual Capitalist, Dell’Oro Group. March 2023.

In February 2021, President Biden initiated a review of American supply chains with the intention to reduce reliance on foreign suppliers, especially for critical products such as semiconductors, pharmaceuticals, rare earth elements, and batteries. The review also sought to identify potential vulnerabilities and opportunities for cooperation with allies. The US has since put in place various policies to foster onshoring and friendshoring. These include the Bipartisan Infrastructure Law (2021) which requires federal agencies to use domestic materials and products for infrastructure projects, and the CHIPS and Science Act (2022) which includes incentives and grants for domestic chip manufacturing and supply chain security. At the same time, the Inflation Reduction Act (2022) reduces the corporate tax rate for companies that produce goods and services in the US and hire Americans.

The US and EU also established the US-EU Trade and Technology Council (TTC) in June 2021 which is viewed as a vehicle for advancing the friendshoring agenda, by harmonising regulatory standards and promoting innovation and competitiveness.

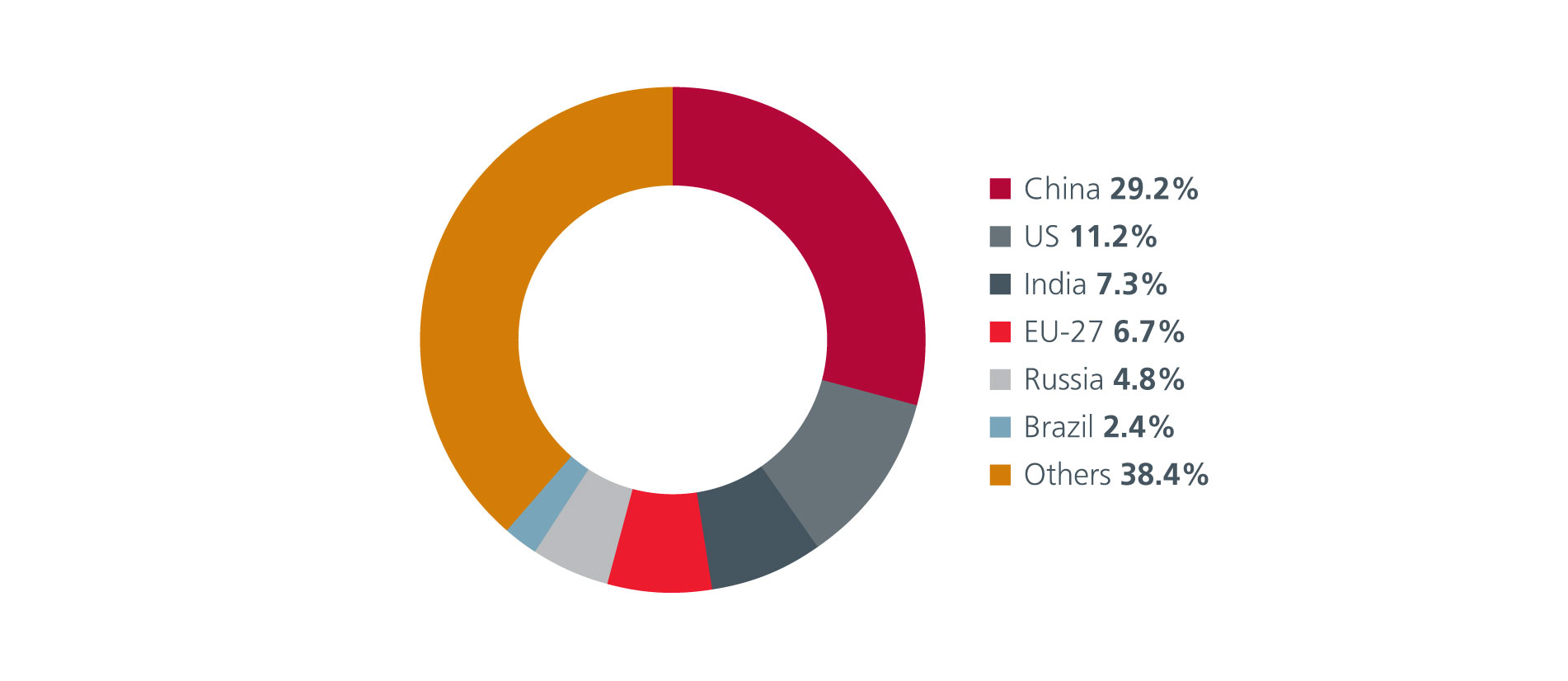

Rising importance of ESG

The increasing prioritisation of Environmental, Social and Governance (ESG) issues for countries, companies and regulators globally has also prompted companies to diversify their supply chains. As the world’s largest emitter of greenhouse gases, China faces growing scrutiny for its heavy dependence on coal as an energy source. Fig. 2. Going forward, more stringent environmental regulations would potentially push operating and investment costs higher for businesses that have their manufacturing hubs in China.

Fig. 2. Share of global greenhouse gas emissions by country (2022)

Source: Statista.

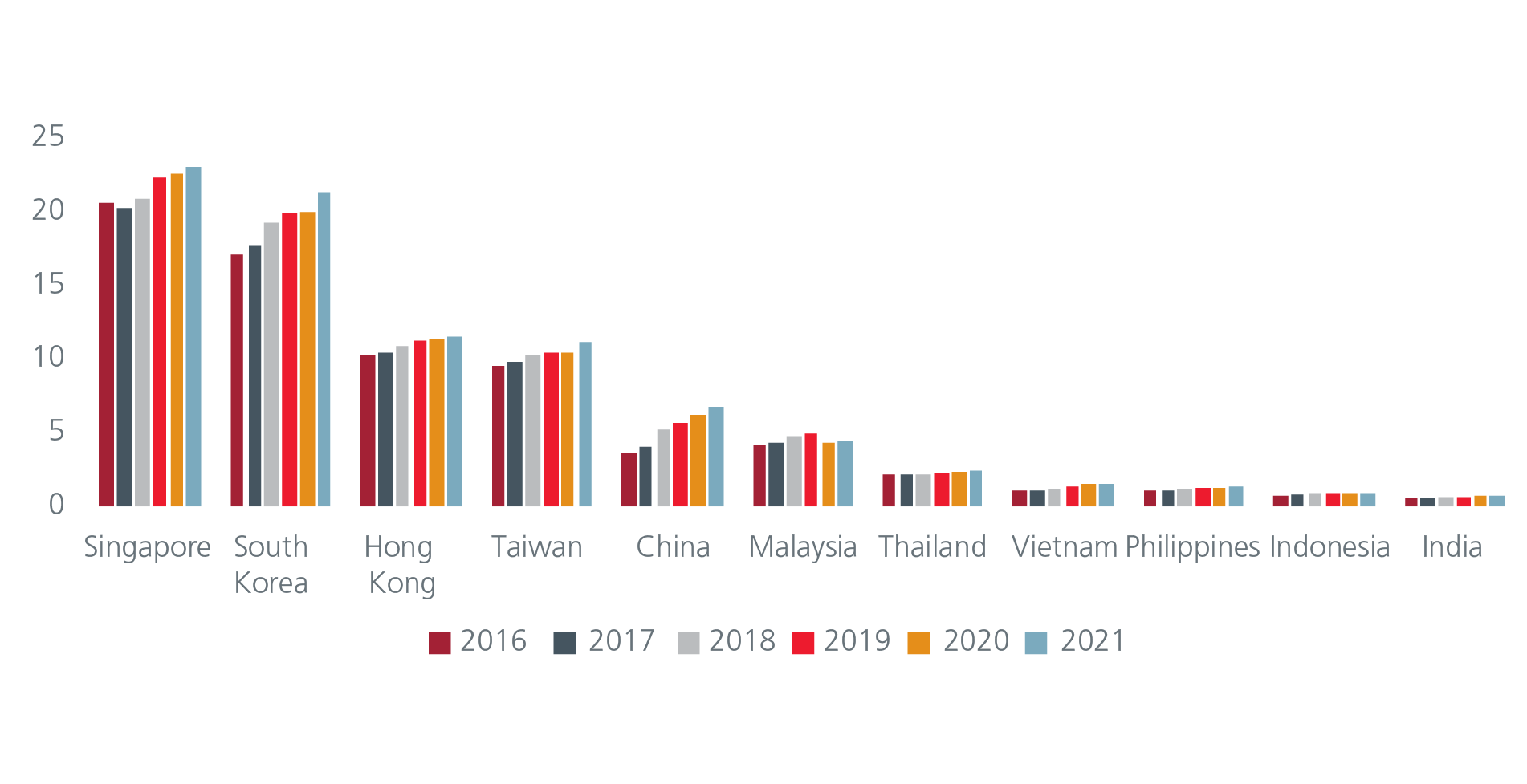

Eroding cost advantages

China’s labour cost advantage over the US has eroded over the years, in line with China’s economic growth and ageing population. When China entered the World Trade Organisation in 2001, the gap between the annual wage of the average American worker versus his Chinese counterpart was 30x. This wage gap has since fallen to 3.5x as of 20211. Meanwhile, the manufacturing wages of China are more than twice of Brazil and Mexico2 and potentially greater than India and selected countries in ASEAN. Fig. 3.

Fig. 3. Manufacturing wages (USD/hour)

Source: Euromonitor, Morgan Stanley Research. Oct 2022.

Is the Great Transition really happening?

The global supply chain transition has impacted corporate sentiment, trade and investments.

A recent survey of US and European companies showed that more than 50% of US and European respondents has near or re-shored operations in the last 12 months3. In another survey, companies cited China’s COVID policy, the desire for greater supply chain resilience and increased costs as the top three reasons for diversifying their supply chains away from China4.

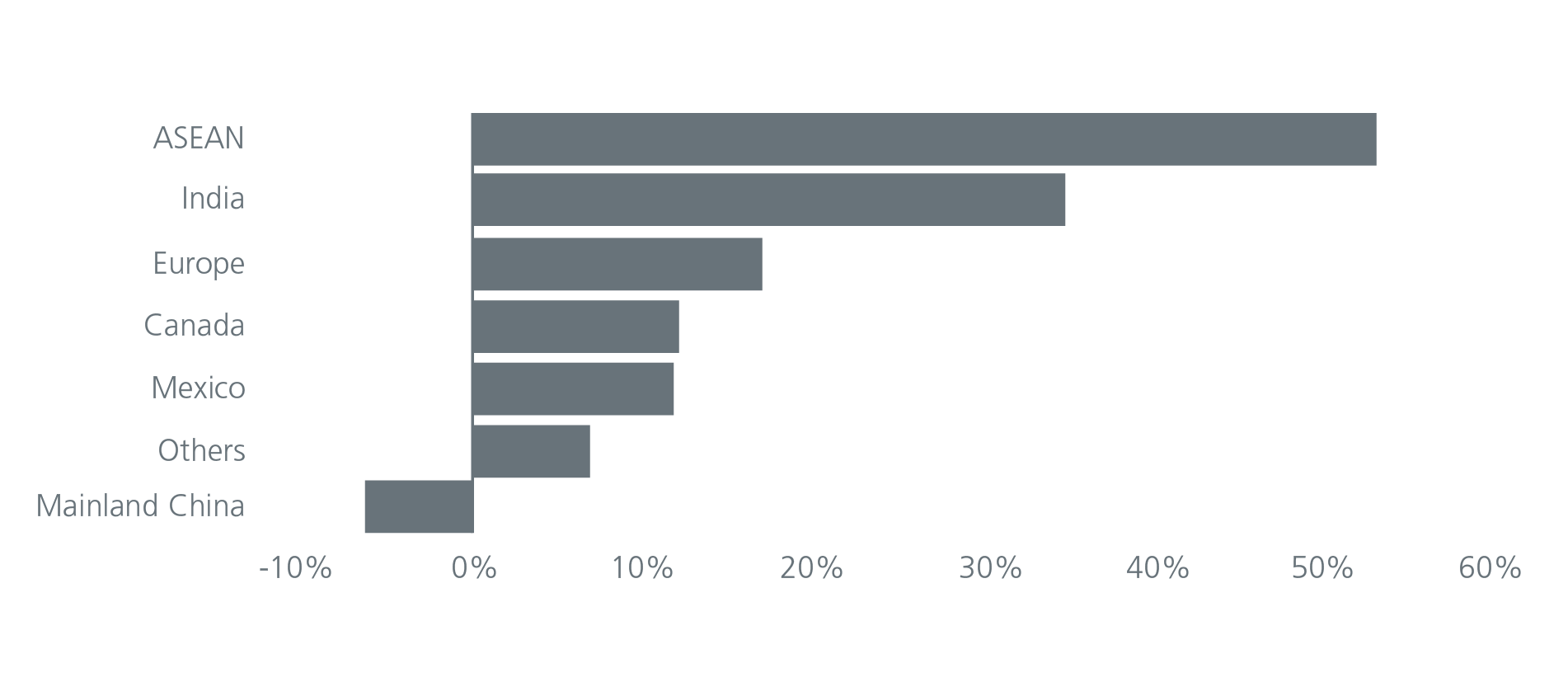

Meanwhile, there is evidence that companies have started to move some of their manufacturing facilities to ASEAN and India. Since the start of the US-China trade war, the value of US imports has contracted for China but expanded for ASEAN and India, as well as the other major exporting countries. Fig. 4. The US’ and EU’s restrictions on the exports of advanced semiconductor chips and production equipment to China are likely to have hurt the exports from China’s high-end electronics and automobile manufacturing industries.

Fig. 4. % Change in value of US imports by source country (2018 – 2021)

Source: US Census Bureau, HSBC. Oct 2022.

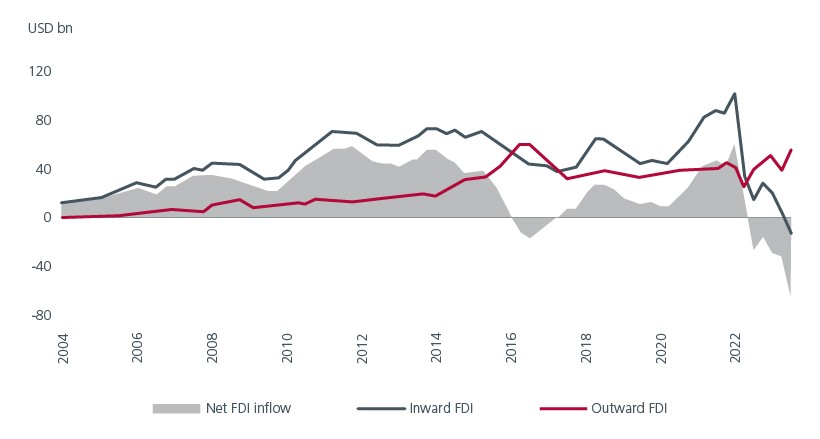

Inward Foreign Direct Investments (FDI) into China has also been declining sharply since the second quarter of 2022, turning the direct investment balance under the Balance of Payments (BoP) into a deficit for some time. More recently, China's inbound FDI flows fell into negative territory in the third quarter of 2023 for the first time since the series began. Fig. 5. As the BoP measure captures the repatriation of working capital as well as earnings of the MNCs in China, the lower interest rates in China as well as weaker industrial profits also have a part to play in the lower FDI readings. That said, geopolitical tensions as well as weak business confidence have clearly reduced China’s appeal as an investment destination.

Fig. 5. China’s inbound vs outbound FDI (BoP data)

Source: BofA Global Research, CEIC. December 2023. Data prior to 2022 are shown as 4qtr moving average.

Who benefits from the Great Transition?

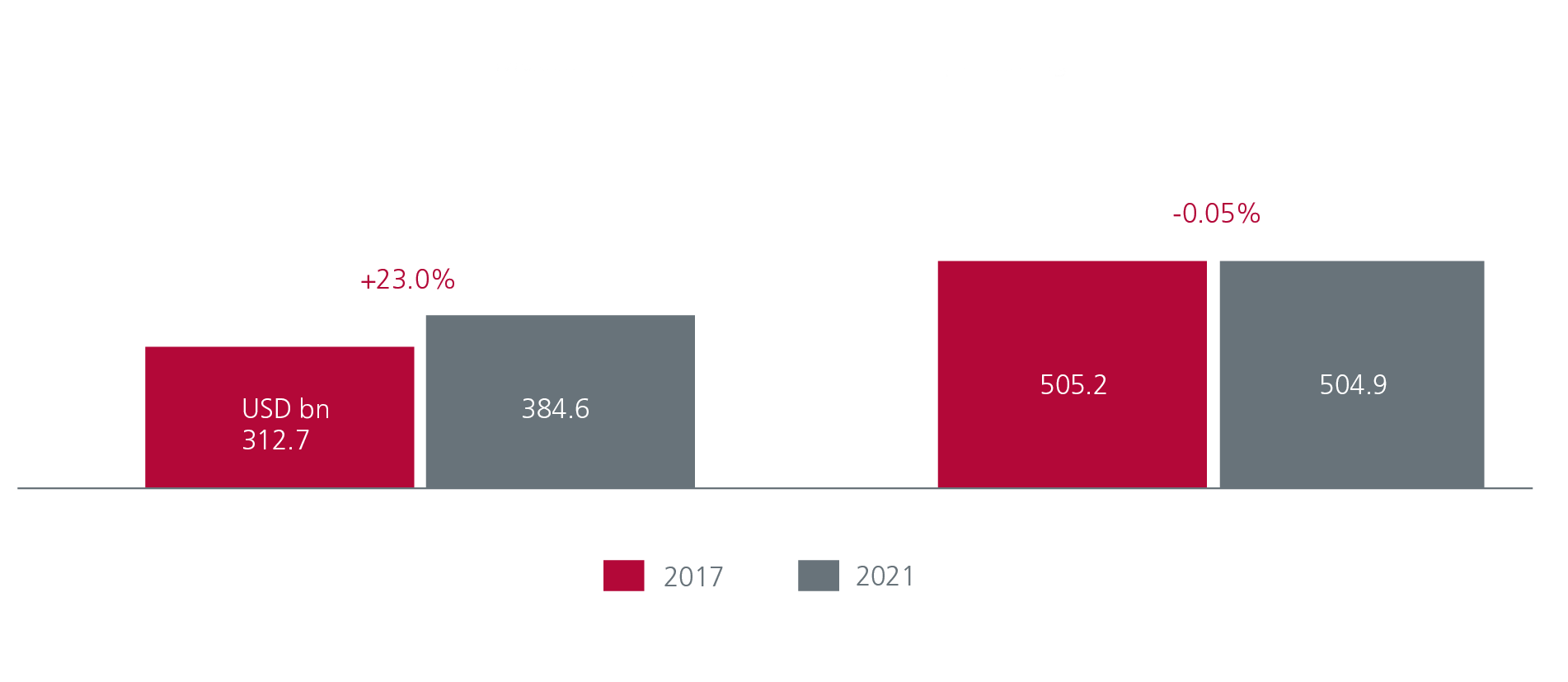

China will still be a dominant and influential player in global supply chains given its large and skilled workforce, excellent infrastructure, and huge domestic market. The shift away from China is therefore likely to be gradual and partial. That said, the transition will still yield outsized opportunities for many economies and companies across the Global Emerging Markets. The largest beneficiaries of this transition are likely to be in ASEAN, Latin America, India and EMEA, countries with cheap labour, decent manufacturing bases and producers of key commodities. The combined manufacturing value add of these countries is less than half that of China. See Fig. 6. As such, a small shift away from China adds a significant amount of manufacturing value add to these countries.

Fig. 6. 2021 manufacturing value add (USD bn)

Source: World Bank. Asean-5 includes Indonesia, Thailand, Malaysia, Philippines, and Vietnam. Latam-6 includes Mexico, Brazil, Colombia, Peru, Chile, and Argentina. EMEA-7 includes Poland, Czechia, Hungary, Turkey, South Africa, Nigeria and Egypt.

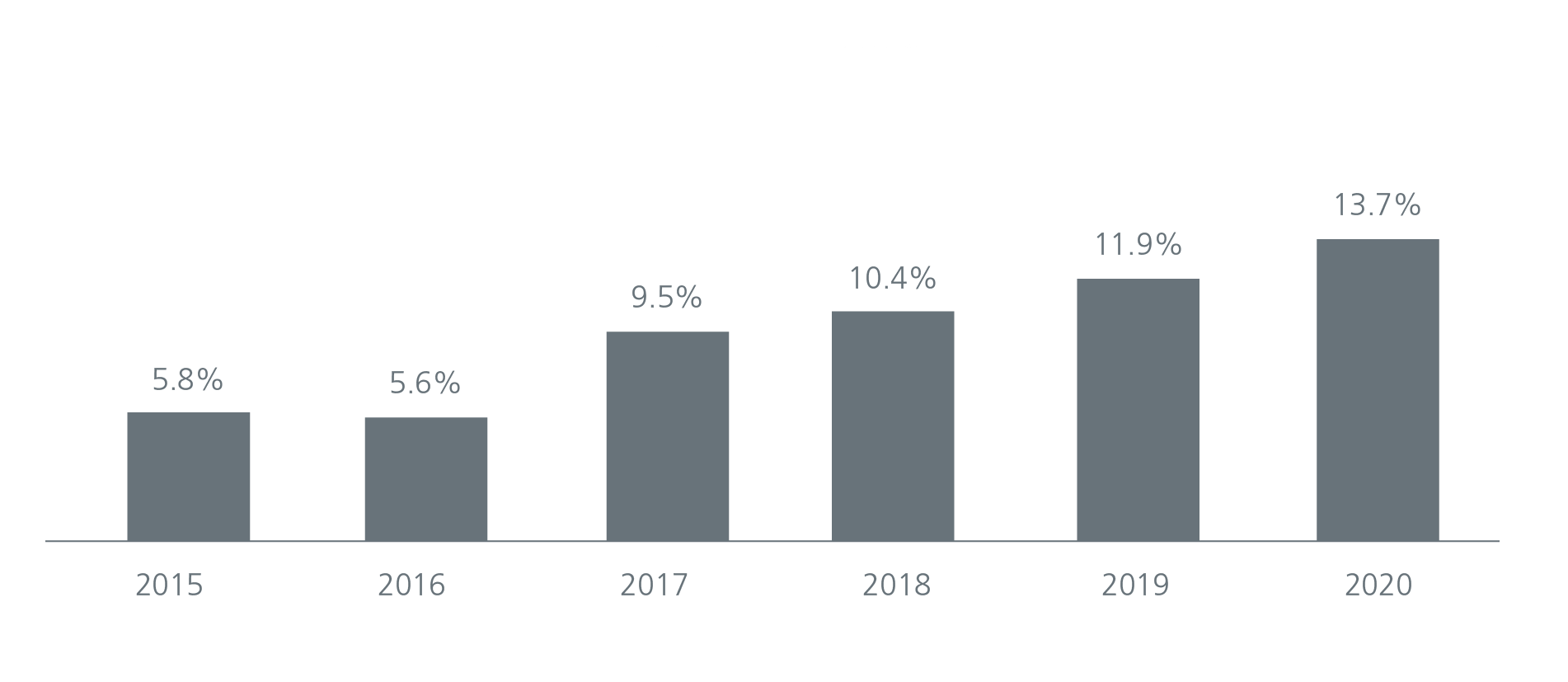

ASEAN has started to account for a growing share of global FDI and exports (Fig 7) and it already boasts of a well-established supply chain for the electric vehicle (EV) industry. The economic vitality of ASEAN has also strengthened notably with robust growth in technology investments, especially in semiconductor start-ups. ASEAN’s appeal as a manufacturing hub is further enhanced by its attractive consumer market, thanks to favourable demographics.

Fig. 7. ASEAN’s growing share of global FDI

Source: ASEAN Secretariat, ASEAN FDI database. Sept 2021.

In Latin America, Mexico is the ‘Nearshoring’ leader given its geographical proximity to the US, robust manufacturing capability, ample labour pool and important natural resources (energy, copper, lithium). FDI into Mexico has been robust since 2013 and ramped up in 2022 reflective of a strong ‘Nearshoring’ trend. Furthermore, Mexico benefits from free trade agreements with the US. Mexican exports to the US have been rising since the start of the US-China trade war and more recently, Mexico overtook China to become the biggest exporter to the US in the first half of 2023. Fig.8. The rest of Latin America is rich in lithium and copper which are key materials for EV and renewable energy, making the region an attractive destination for foreign investments.

Fig. 8. Mexico’s exports to the US rising

Source: USITC. Nov 2022.

India has one of the best demographic profiles in the world which in turn provides a source of abundant labour and growing consumption base. The Indian government is also supporting the manufacturing sector with a series of measures such as corporate tax rate cuts, production linked incentives (‘Make in India’) and its National Infrastructure Pipeline. The Indian manufacturing sector is likely to continue to see strong growth in exports and inflows of foreign investments, such as the recent expansion plans by iPhone maker Hon Hai.

EMEA (Emerging Europe, Middle East and Africa) has similar attractive demographics and manufacturing bases. The CE3 countries (Poland, Hungary and Czechia) and Turkey have very competitive manufacturing bases and will benefit from ‘Nearshoring’ trends of companies from advanced European economies as well as multinational companies. Africa has the fastest growing and youngest population in the world and is adding half of the world’s population between 2020 and 2030. It is also expected to have a combined consumer and business spending of USD6.7 trillion by 2030 and USD16 trillion by 2050.

How to invest in the Great Transition

Higher costs, geopolitical concerns and the desire for increased supply chain resilience and security are causing global companies to diversify and seek alternative manufacturing facilities nearer home or within like-minded allies. Apple’s pivot to India, Tesla’s major factory in Mexico and Samsung’s investments in Vietnam are evidence that this supply chain transition is underway. This presents a once-in-a-generation opportunity for Emerging Market countries that have the necessary resources and readiness. For investors, we believe that much of the opportunities reside in small to mid-capitalisation stocks, which would be best uncovered via a disciplined, fundamentally-driven stock-picking investment approach.

Sources:

1 Beijing National Bureau of Statistics.

2 Moody’s Analytics. September 2023.

3 EY Industrial Supply Chain Survey, 2022.

4 CEIC, US China Business Council, June 2022 survey.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.