Executive Summary

- Beyond traditional portfolio construction techniques, there are ways we can enhance the portfolio construction process by providing clients with a richer analysis of potential portfolios.

- Complementing traditional portfolio construction techniques with a goals-based approach allows for a more meaningful portfolio design, especially when clients have goals that are intuitive but difficult to articulate.

- Advances in computing power now enable full-scale optimisation, offering greater flexibility and allowing us to move beyond mean-variance optimisation.

Strategic Asset Allocation is often viewed as a key driver of long-term portfolio performance. It serves as the cornerstone of long-term portfolio construction which typically begins with assumptions on the long-term (strategic) joint distribution of future asset returns. These are modelled as a multi-variate normal distribution, parameterised by μ and σ2 – expected return and risk respectively.

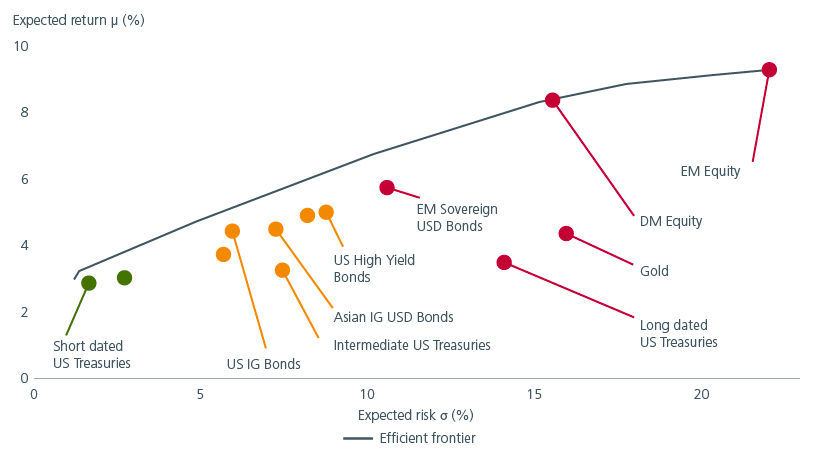

For most clients, expected return and risk serve as inputs in mean-variance optimisation1 to determine portfolio weights. Portfolios constructed through this method are mean-variance efficient; providing the highest expected return for a given level of expected risk. Repeating the optimisation creates an efficient frontier composed of multiple mean-variance efficient portfolios. Fig. 1.

Fig. 1. Portfolio efficient frontier with selected assets highlighted

Source: Eastspring Investments. Thomson Reuters. September 2025. For visual simplicity, we have colour-coded the asset classes here according to their expected volatilities. Assets in green have low expected volatility (<5%), assets in amber have medium expected volatility (between 5% and 10%) and assets in red have high volatility (> 10%).

A goals-based approach to portfolio construction

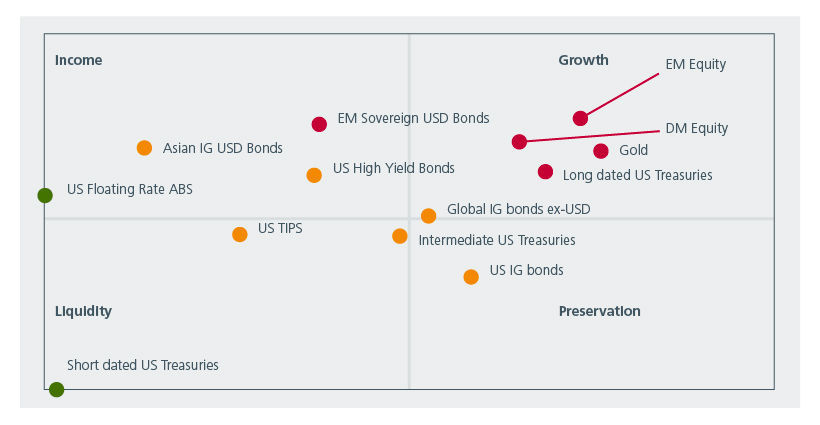

While the earlier approach helps investors to assess the risk-return trade off more effectively, there may be instances where the proposed mean-variant portfolios may not fully incorporate the client’s desired goals. This is especially so when clients may have goals which they recognise intuitively but find it challenging to define explicitly. In these instances, we would employ an additional framework put forward by Golts and Jones2 which offers a goals-based approach to portfolio construction. The framework quantifies an asset’s exposure to four goals – Liquidity, Preservation, Income and Growth – based on the asset’s return skew. See Fig. 2.

Fig. 2. Asset classes - goals exposure

Source: Eastspring Investments. Thomson Reuters. September 2025. For visual simplicity, we have colour-coded the asset classes here according to their expected volatilities. Assets in green have low expected volatility (<5%), assets in amber have medium expected volatility (between 5% and 10%) and assets in red have high volatility (> 10%).

Each asset has varying exposure; ranging from 0% to 100%, to the different goals, totalling 100% across the four goals. For example, short-dated US Treasuries are almost fully exposed to the Liquidity goal, while US Floating Rate Asset Backed Securities (“ABS”) have equal exposures to the Income and Liquidity goals. This framework allows us to quickly compare asset characteristics across any investment universe.

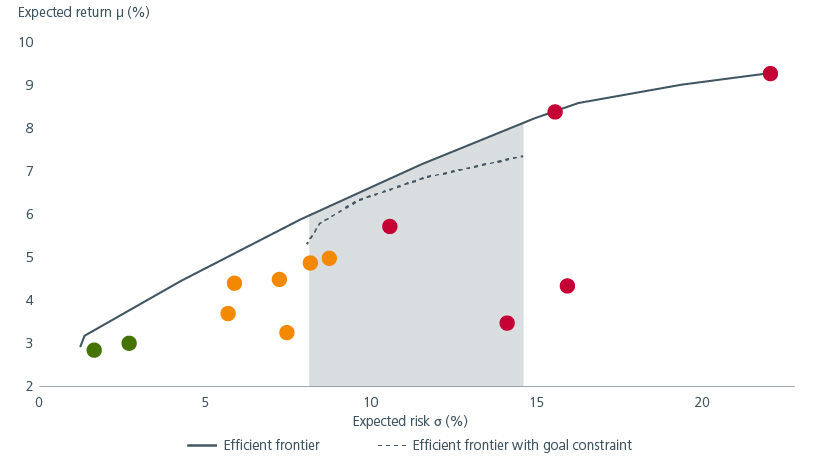

Integrating real world constraints

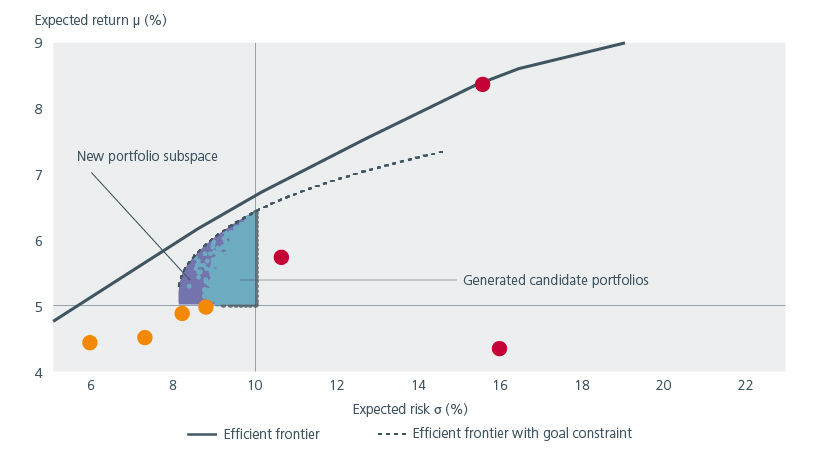

By combining the two approaches, we can integrate asset goal exposures directly into a mean-variance optimisation. In this scenario, we build a constrained efficient frontier for a hypothetical client who requires a minimum exposure of 35% to both the Income and Growth goals. In Fig. 3, the dotted line represents the constrained efficient frontier which occupies a partial subspace of the original efficient frontier as indicated by the shaded grey area. Note that the constrained efficient frontier also sits below the original efficient frontier. These effects are expected, as imposing constraints on the portfolio construction process inherently narrows the range of potential portfolios.

Fig. 3. Efficient frontier with goal constraint

Source: Eastspring Investments. Thomson Reuters. September 2025. For visual simplicity, we have colour-coded the asset classes here according to their expected volatilities. Assets in green have low expected volatility (<5%), assets in amber have medium expected volatility (between 5% and 10%) and assets in red have high volatility (> 10%).

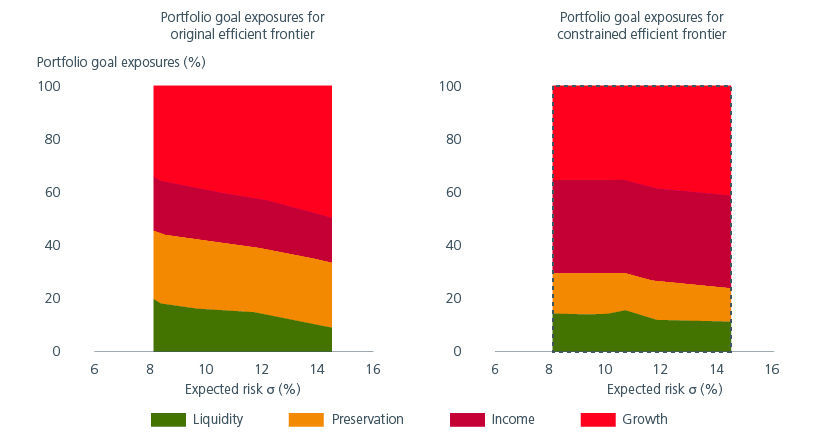

Consequently, the constraints shift the efficient portfolios away from the Growth and Preservation goals towards the Income goal. See Fig. 4. The next step would then be to determine the most suitable portfolio for our hypothetical client.

Fig. 4. Portfolio goal exposures

Source: Eastspring Investments. Thomson Reuters, September 2025.

Alternatives to mean-variance optimisation

Mean-variance optimisation, which was developed in 1952, remains widely used in portfolio construction. Its popularity stems largely from its analytical objective function, which is based on the assumptions that asset returns are normally distributed, and investors have exponential utility functions. However, modern computing power now increasingly allows us to perform full-scale optimisation3, which provides greater flexibility and a move away from such assumptions.

One straightforward approach to full-scale optimisation, which does not rely on advanced algorithms, involves using a brute-force search. In this approach, we first generate candidate portfolios and then filter out those that do not meet client constraints. We then evaluate each remaining portfolio according to the client's requirements. While this approach is computationally intensive and less efficient, it preserves data about sub-optimal portfolios, which can assist us in a more complete analysis of potential client portfolios.

To illustrate, we revisit our hypothetical client. In addition to the earlier goal constraints, the client now also desires the portfolio to deliver an expected return of above 5% p.a. and to maintain risk below 10% p.a.

The horizontal and vertical purple lines in Fig. 5 indicate the client’s new secondary constraints on expected return and risk. The purple area, bounded by these lines and the dotted (constrained) efficient frontier, represents the new subspace of candidate portfolios. The blue points represent different candidate portfolios that meet the client’s requirements for return, risk and goal exposures.

Fig. 5. Efficient frontier with return and risk constraints

Source: Eastspring Investments. Thomson Reuters. September 2025. For visual simplicity, we have colour-coded the asset classes here according to their expected volatilities. Assets in amber have medium expected volatility (between 5% and 10%) and assets in red have high volatility (> 10%).

We subsequently assess the candidate portfolios using additional metrics to evaluate trade-offs against client objectives. This methodology is particularly valuable when client goals are ambiguous or conflicting. In such cases, brute-force optimisation serves as a useful starting point to identify portfolios that are most closely aligned to the client’s requirements.

A limitation, however, of brute-force optimisation is the exponential growth in computational demands as further constraints are introduced or as the universe of potential assets expands. This makes it impractical to generate enough candidate portfolios to exhaustively cover the entire portfolio subspace.

Building better portfolios

While we recognise the strength of traditional portfolio construction techniques, there are ways where we can enhance the portfolio construction and selection process by providing clients with a richer analysis of potential portfolios that are designed to best meet their needs. For example, complementing traditional portfolio construction techniques with a goals-based approach allows for a more meaningful portfolio design, especially when clients may have goals that are intuitive but difficult to articulate. At the same time, advances in computing power now enable full-scale optimisation, offering greater flexibility and allowing us to move beyond mean-variance optimisation. Together these enhancements empower us to build portfolios that are analytically sound and more closely aligned with the nuanced needs of investors.

Sources:

1 Markowitz H., 1952, Portfolio Selection, The Journal of Finance Vol. 7.

2 Golts M. & Jones G. C., 2025, Goal Parity, The Journal of Investing Vol. 34.

3 Adler T. & Kritzman M., 2006, Mean-Variance versus Full-Scale Optimisation: In and Out of Sample, Journal of Asset Management Vol. 7.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.