Executive Summary

- Exchange offers are expanding the investable Asian credit universe, providing investors more ways to access the market.

- Exchange offers enable investors to adapt portfolios more dynamically as markets and issuer fundamentals shift.

- Navigating the complexities of exchange offers are critical for capturing yield and managing risks effectively.

Exchange offers present a compelling opportunity for bond investors who can navigate complexity and uncover relative value across issuers, structures, and maturities—thereby broadening the universe of investable bonds. These offers are being driven by a growing need among bond issuers to manage their liabilities more proactively. Liability management exercises (“LME”) form a critical strategic function that helps bond issuers enhance financial flexibility, optimise capital structure, manage market volatility, and pre-empt formal restructuring.

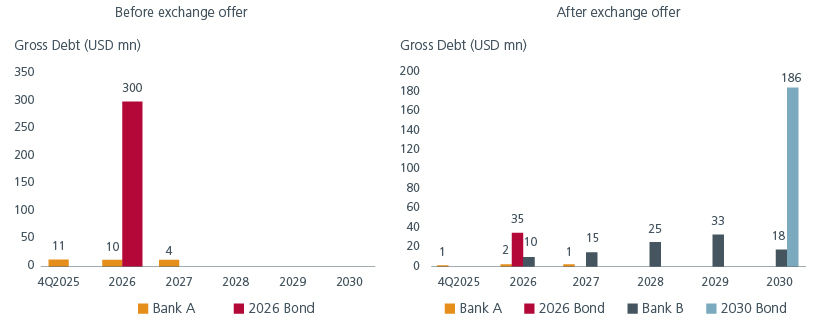

Among the various liability management tools, exchange offers are increasingly common. They involve swapping existing bonds for new ones, often with revised terms such as principal, coupon, maturity, or covenants—allowing issuers to reduce refinancing risks and better align debt obligations with future cash flows. Exchange offers tend to increase when market conditions turn challenging such as slower economic growth pressuring company profits, and tighter financing liquidity making traditional bond issuance less viable.

Fig 1: Hypothetical debt maturity profile of an issuer pre and post a bond exchange offer

Source: Eastspring Investments

Exchange offers are no longer niche—they are becoming a mainstream tool for both investment grade and high yield bond issuers.

Tapping the credit opportunities

While exchange offers have traditionally been a part of the Asian credit markets for bond issuers to manage their liability profiles, over the past two years, there has been a proliferation of various types of exchange offers across various Asian bond issuers, which vary in size and complexity. Over the past 10 years, there have been eleven investment grade, and nine high yield exchange offers.

Across Asia, there has also been pro-active liability management by higher quality Chinese industrial issuers, Indian corporates, and non-bank finance companies (NBFCs), as well as Philippine corporates, in line with constructive capital market conditions as investors reinvest maturing bond proceeds into new bond issues.

In an exchange offer, the promise by the issuer to pay the new debt obligation may have changed substantially from the original payment terms under the existing bond. This affects the evaluation of the issuer’s capacity, character, collateral, and covenants underpinning the repayment of the new debt obligation. Accordingly, a robust credit analysis is critical to identifying idiosyncratic credit opportunities and tail risk management.

Yield-hunting opportunities present themselves in terms of both curve plays (i.e. short-dated bonds versus long-dated bonds) and across USD versus local currency bond markets for Asian issuers on a currency-hedged basis, as credit conditions and currency basis evolve. These trends suggest that bond managers with regional expertise and access to local currency bond markets (e.g., IDR bonds) may be better positioned to capture yield opportunities and manage risk.

Navigating exchange offers demands expertise

While most exchange offers for investment grade bonds are fairly administrative and are consensual processes between the issuer and bond investors, the approach towards exchange offers for high yield bonds is differentiated by requiring a higher degree of active management. This often includes negotiations of key terms before an exchange offer is launched in a consensual process, especially for investors who have significant holdings in the bond and can elect to agree or disagree to the proposed changes by the issuer.

For investment grade and stronger high yield bond issuers in the JP Morgan Asia Credit Index, vanilla exchange offers pose the question of whether relative value is attractive enough for a simple maturity extension via participation in an exchange offer. However, for the lower-rated segment of high yield bond issuers, the ability to discern liquidity options for these high yield issuers and the evaluation of the specific structure of the exchange offer is not only key to managing idiosyncratic credit risks, it can also be a source of returns in determining which bonds have the greatest potential for yield compression as the likelihood of repayment increases.

Understanding the risks behind the opportunity

While exchange offers can broaden the investable universe and unlock relative value, they also demand careful evaluation due to structural risks that may weaken bondholder protections. Some issuers’ tactics include moving valuable assets to entities outside of the bond’s covenant protections (drop-down financings), restructuring debt in ways that disadvantage non-participating holders (up-tiering), and giving new bondholders multiple claims on the same assets (double-dip structures).

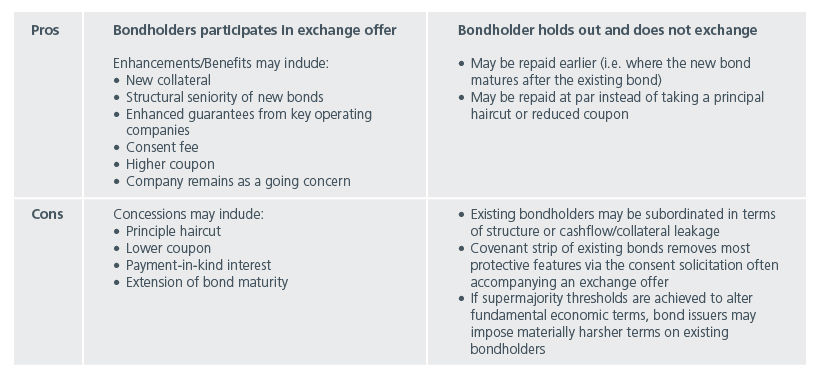

Beyond deal mechanics, investors must also weigh strategic considerations—such as holdout risks, the impact of unsuccessful offers, and the use of exit consents (see Fig. 2). Each scenario can affect credit quality, recovery prospects, and portfolio positioning. Ultimately, not all exchange offers are credit-positive, and bottom-up credit assessment remains essential to identifying which deals offer genuine upside versus hidden risks. In this way, expertise in deal structure and issuer fundamentals becomes a key source of alpha.

Fig 2: Implications of participating in an exchange offer

Source: Eastspring Investments

Why LME execution matters for credit selection

A quick walk down memory lane for the Asian aviation sector illustrates the aforementioned concepts in our credit selection. The outbreak of Covid-19 posed major operational and financial challenges for the aviation sector as air travel came to a halt. We highlight two flag carriers in the region that faced severe financial stress but took different approaches to liability management, resulting in divergent outcomes for investors.

One of them had strong state-linked shareholder support and hence received substantial liquidity infusions through equity, quasi-equity, and standby facilities. This support stabilised its balance sheet, maintained leverage ratios, and allowed the airline to refinance high-cost debt with new, lower-cost bonds as market conditions improved. The airline’s ability to repay debt in full and even ahead of schedule validated our investment thesis and delivered positive returns for investors.

In contrast, the other airline underwent multiple rounds of debt restructuring over the years, including principal haircuts, debt-for-equity swaps, coupon reductions, and tenor extensions. These measures resulted in significant net present value losses for investors. Persistent issues such as aggressive accounting practices and weak corporate governance further undermined confidence. Despite remaining in the JP Morgan Asia Credit Index, the airline is viewed cautiously due to its ongoing negative equity and uncertain repayment prospects.

The contrasting outcomes underscore the importance of rigorous, bottom-up credit assessment and issuer selection in extracting alpha from LMEs. Successful participation depends on selecting issuers with robust fundamentals and credible support, while steering clear of those with weak structures and governance issues.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.