Executive Summary

- Companies with sustainable supply chains can enjoy cost savings, improved reputation, and increased market share, which can make them more attractive to investors.

- Supply chains are reported to make up almost 90% of companies’ carbon emissions. Making them more sustainable can be a game changer in helping companies and countries meet their emission targets.

- Markets like Japan and the Emerging Markets have unique characteristics which allow them to benefit not just as supply chain rebalancing destinations but also to benefit from the greening of supply chains globally.

In our whitepaper "New anchors reshaping supply chains: Opportunities for investors", a high percentage of global business leaders viewed supply chain rebalancing as an opportunity to decarbonise their supply chains. Research suggests that supply chains can account for up to 90% of a typical company’s greenhouse gas emissions1 due to their energy-intensive production and transportation activities. Therefore, companies and countries would need to make their supply chains more sustainable in order to meet their net zero targets.

Good business sense

While traditional supply chains focus on speed, costs and reliability, sustainable supply chains also consider environmental and societal goals including climate change, water security, fair labour practices and human rights.

Sustainable supply chains make good business sense. According to the Economist Intelligence Unit, online searches for sustainable goods has risen 71% globally over the past five years. A survey from McKinsey & Co also shows that 66% of all respondents and 75% of millennial respondents consider sustainability when making a purchase. Besides increasing potential revenue, sustainable supply chains also help companies mitigate risks. Climate change can put business continuity at risk given extreme weather disruptions and growing resource scarcities. At the same time, with the rise of climate regulations, non-compliance can result in potential penalties and reputational damage. Unsustainable supply chains therefore can be a material risk for companies.

For example, Spring is a PRI stewardship initiative for nature, convening institutional investors to use their influence to halt and reverse global biodiversity loss by 2030. One of its key focus areas is supply chain management which include oversight of suppliers, establishing due diligence, and escalation and reporting processes throughout the company’s value chain. With the Spring Statement signed by over 1002 asset managers, asset owners, and other PRI signatories, investor expectations in this relatively new field of biodiversity risk management will impact companies and their supply chains.

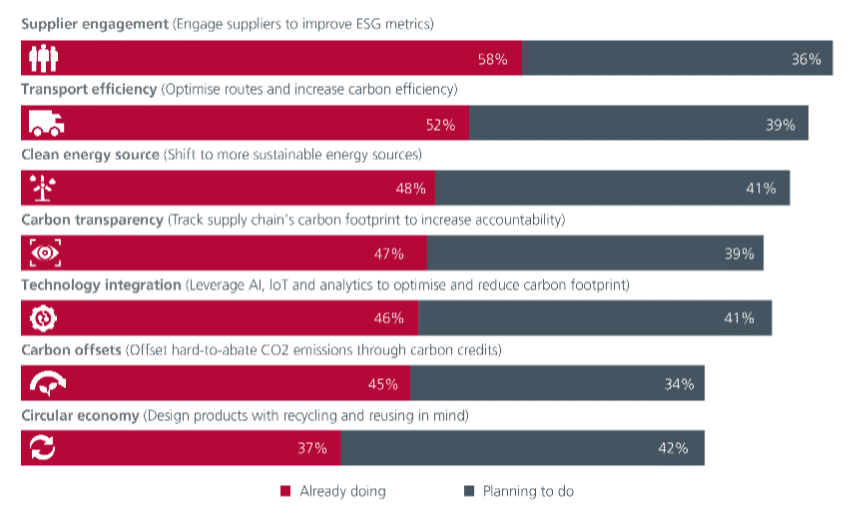

In our whitepaper, we had surveyed 150 business leaders across North America, Europe and Asia. 58% of the global business leaders we surveyed have engaged their suppliers to improve their ESG metrics while 52% have optimised their transportation routes to increase carbon efficiency. Meanwhile, 48% have moved to use cleaner energy sources. Others are also looking to improve the carbon transparency of their supply chains as well as to leverage AI, the Internet of Things and data analytics to optimise and reduce their carbon footprint. Fig. 1.

Fig. 1. Actions to decarbonise supply chains

Source: Percentages indicate the share of business leaders who have already actioned or planned the respective decarbonisation action. Q: What actions did your company take/plan to take to decarbonise its supply chain.

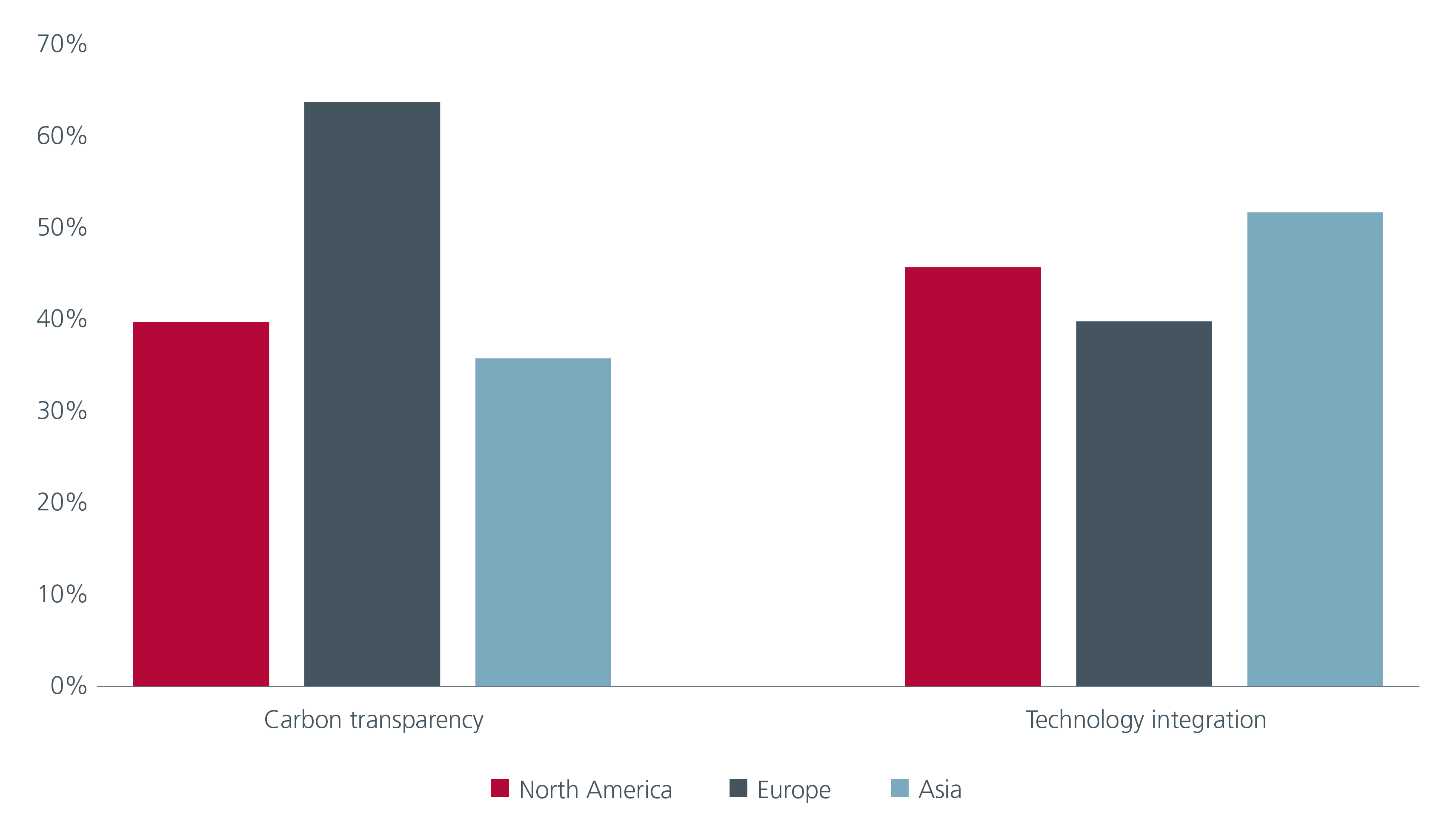

Compared to North America and Asia, a higher percentage of European business leaders in our survey have increased the carbon accountability of their supply chains. Fig. 2. Meanwhile, a higher percentage of Asian companies in our survey are already leveraging AI to improve supply chain sustainability such as in predicting demand and better utilising manufacturing capacities as well as in optimising routes and reducing distances travelled.

Fig. 2. Actions taken to decarbonise supply chain

Source: Percentages indicate the share of business leaders who have already actioned the respective decarbonisation action. Q: What actions did your company take/plan to take to decarbonise its supply chain.

Challenges and opportunities

There are challenges in decarbonising supply chains. The multi-tiered relationships of most supply chains make it difficult for companies to track the environmental and societal impact of their goods and services, from the start to the end of their life cycles. While most companies can set sustainability targets and standards for their tier 1 supply chain partners, they tend to have significantly less visibility on the operations of their lower tier suppliers or the suppliers of their tier 1 partners.

Carbon emissions can be classified into Scopes 1, 2 and 3. Scope 1 is the most straightforward and generally refers to direct emissions produced by a company. Scope 2 refers to emissions produced by electricity generated or purchased by the company. Scope 3 refers to emissions that are in the company’s value chain and can be split into upstream (suppliers) and downstream (customers). For many sectors, Scope 3 emissions make up most (>50%) of the total emissions but only a very small percentage of companies report Scope 3 emissions.

Countries that have the supporting infrastructure to make supply chains more sustainable will have an edge as companies look to decarbonise their supply chains. Japan, a reshoring beneficiary, has policies in place that help make the country more sustainable. The Green Transformation policy which was approved in February 2023 includes a 10-year roadmap to transition to clean energy via the usage of nuclear power, renewables and carbon-pricing mechanisms. Japan’s cutting-edge technology has also helped it to have a leading inventory of low-carbon technology patents. At the same time, due to the scarcity of resources, Japanese companies have a long history of reducing energy consumption and maximising energy efficiency. Strict laws to control waste have also led Japan to achieve a plastic waste recycling rate of 87%, the highest in the world. These attributes can help supply chains that are in the country be more sustainable.

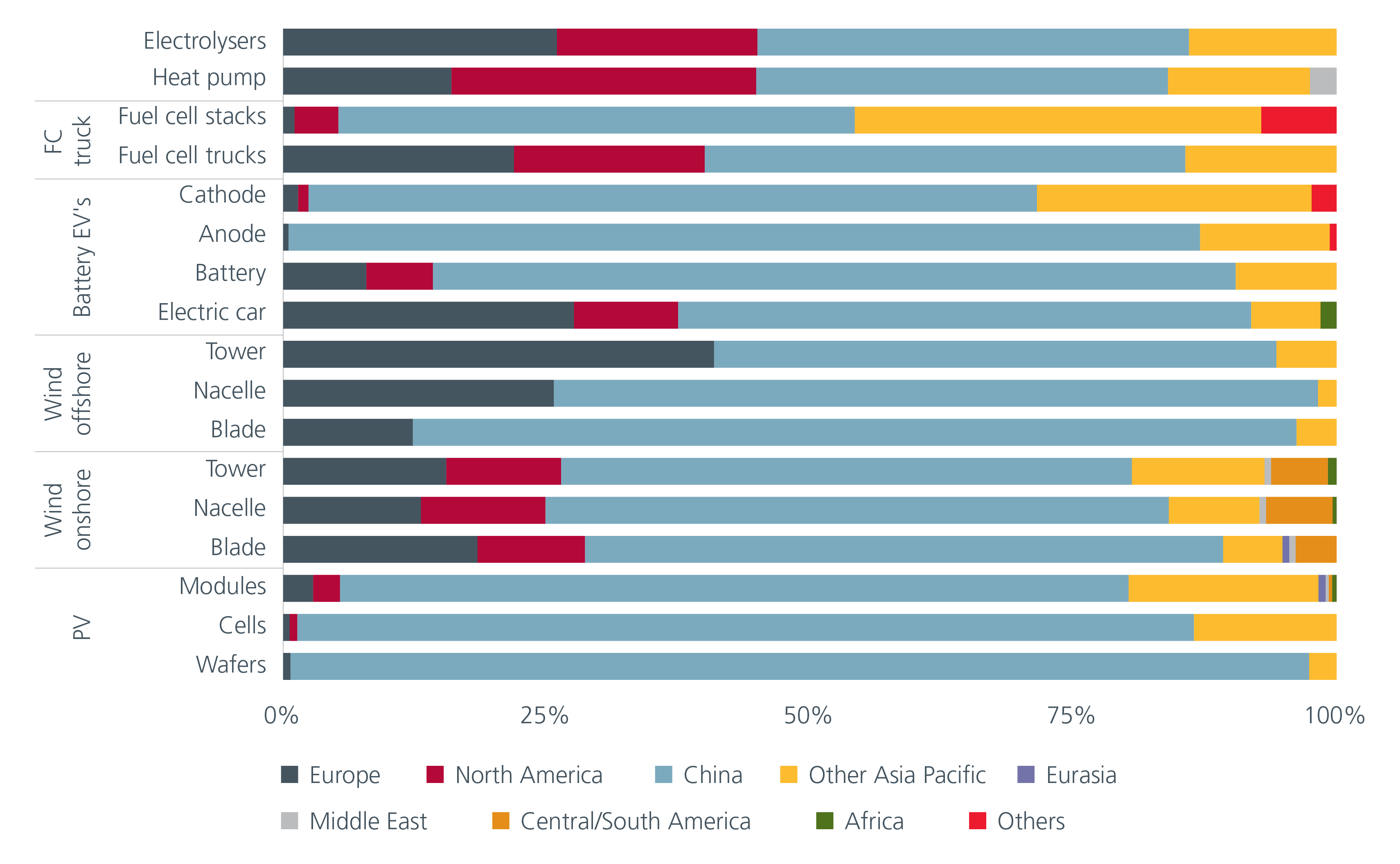

The growing demand for green infrastructure and renewable energy as companies build out sustainable supply chains is also expected to benefit the Emerging Markets (EMs) given their significant commodity reserves. For example, the IEA expects the demand for lithium, which is used in rechargeable batteries, to rise by 40 times over the next 10 - 20 years. Today although Australia is the world’s leading lithium producer, most the world’s underdeveloped lithium reserves are in Bolivia, Argentina, and Chile. Meanwhile, Asia Pacific and China dominates the production of net-zero technologies. Fig. 3. China for example produces almost all the world’s equipment for making solar panels, and almost every component that goes into solar panels, from wafers to special glass.

Fig. 3. Regional shares of anufacturing capacity for selected mass manufacturerd clean energy technologies and components (2021)

Source: EA analysis based on InfoLink (2022); BNEF (2022), BNEF (2021b); Benchmark Mineral Intelligence (2022); GRV (2022); UN (2022a); Wood Mackenzie (2022)

Investment implications

Investors should consider supply chain sustainability when evaluating companies. These firms are likely to benefit from cost savings, improved reputation, and increased market share which should positively impact their ESG ratings, as well as long-term performance. Companies that can provide greater transparency on their emission data as well as those committed to emission reductions should be more attractive to investors. At Eastspring, we believe that active engagement with high Scope 3 emitters can help to encourage companies to provide better reporting and to set strategies and targets for Scope 3 emissions reductions.

At the same time, markets like Japan and the Emerging Markets have unique characteristics which allow them to benefit not just as supply chain rebalancing destinations but also to benefit from the greening of supply chains globally.

Sources:

1 “Transparency to transformation: a chain reaction. CDP 2020 Global Supply Chain Report”, February 2021

2 As of 27 March 2024. https://www.unpri.org/investment-tools/stewardship/spring

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.