Executive Summary

- There have been some bright spots in China’s recent economic indicators. The worst for the economy appears to be behind us, although the road ahead remains bumpy.

- China’s attractive valuations and low exposures among investors make it a compelling long-term investment, especially when compared against expensive markets which had outperformed in the last 12 months.

- A sustainable market rally in China would require implementation details of the government’s equipment upgrade and consumer trade-in programme, as well as further fiscal and monetary easing. Signs that policy makers are moving ahead of the curve would also be a key catalyst.

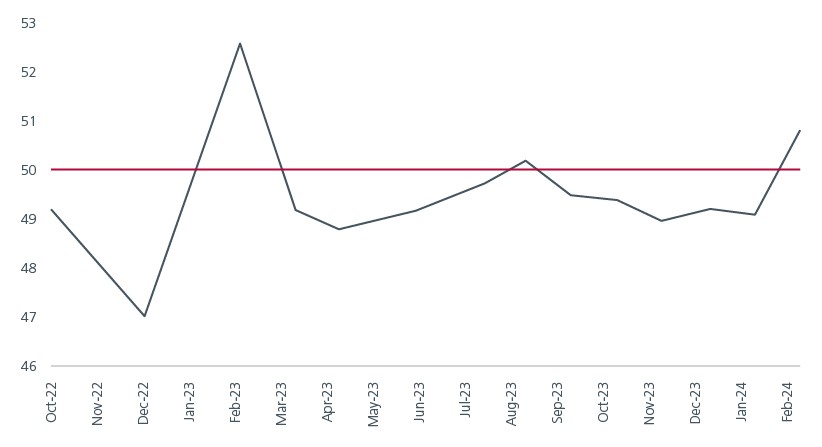

At the point of writing, the China A-share market (CSI 300 Index) is up year to date on the back of bottom fishing by investors and state-ordered buying1. The gains have come against a backdrop of (modestly) improving economic fundamentals. Power generation grew 8.3% yoy in January to February while industrial production increased 7% from the year before, beating consensus expectations of a 5.2% gain. Exports during the first two months of the year were 7% higher than the year before, versus expectations of a 1.9% increase. February’s consumer price inflation also inched up +0.7%yoy after four months of deflation. More recently, the NBS manufacturing PMI beat market consensus by rising to 50.8 in March from 49.1 in the previous month, supported by gains in new orders and production. This was the highest reading in 12 months and reflects an improvement in both external and domestic demand. Fig. 1. Have China’s economy and market turned the corner?

Fig. 1. China’s manufacturing PMI

Source: Bloomberg. As of April 2024.

Exports and consumption are key

We believe that the worst for the Chinese economy is behind us, although the road ahead remains bumpy. Infrastructure spending is expected to moderate this year as the central government focuses on containing the local governments’ already elevated debt-servicing burdens. The PBOC’s largest one-time cut to the 5-year Lending Prime Rate in February was an important signal that the government wishes to stabilise the property sector. The government’s urban renewal projects can help to further stabilise the property sector but not cause a strong rebound. Nevertheless, the property sector should continue to exert less of a drag on the broader economy going forward.

Exports and consumption will be key to helping China achieve its 5% GDP growth target for 2024. Amid geopolitical and trade tensions, China has been diversifying its export destinations from the US and Europe to developing countries. Product upgrades, product mix improvements and increasing competitiveness have created significant export opportunities for Chinese auto, battery, construction, solar and grid equipment. In line with the key goal of developing “new quality productive forces” as highlighted in the 2024 Government Work Report, the government has indicated that it will encourage large equipment upgrades and trade-ins of consumer goods. This will help to boost consumption.

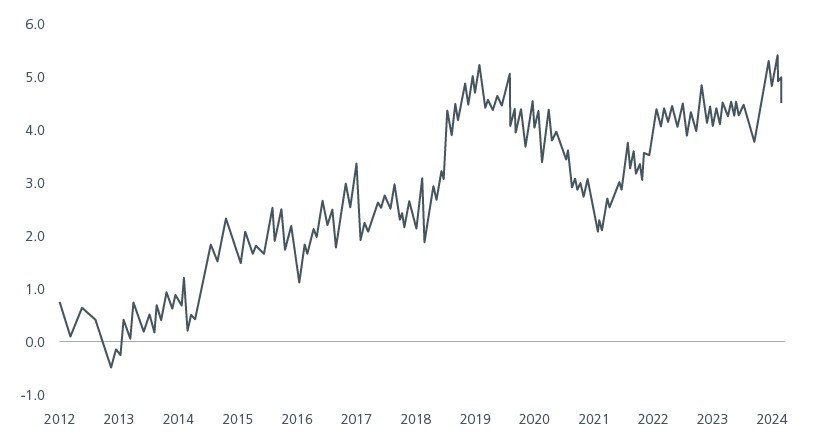

Compared to China’s economic and market downturn in 2015/16, we note that the picture on the company front appears to be more encouraging. Overseas revenues account for 15% of total revenues, up from 12.5% in 2015. Leverage as measured by net debt to EBITDA (Earnings before interest, taxes, depreciation and amortisation) ex property has fallen significantly and free cash flow generation is close to its historical high since 2012. Fig. 2. This has enabled companies to lift their capital returns to shareholders with the dividend payout ratio now at 33% vs 29% in 2015/2016.

Fig. 2. Trailing free cash flow yield

Source: Factset, UBS, Note: MSCI China is used as universe.

Keeping the faith

The CSI 300 Index is currently trading around a 12-month forward price to earnings ratio of 10.3x, close to its 10-year historical average2 following the recent rally. Meanwhile, most professional investors3 currently have an underweight position in the market although we note that global investors have turned net buyers of onshore shares via a link with Hong Kong for a second consecutive month in March.

While China’s growth is not as strong as before, it does not mean that the market is devoid of opportunities. The capital goods, consumer durables, energy, banks, and utility sectors have delivered high single-digit to mid double-digit returns year to date4. For now, we are adopting a barbell investment strategy. On the one hand, we like companies that have low valuations, stable dividend yields and stable fundamentals. This is balanced against exposure to companies that are gaining market share from global peers or well positioned to benefit from the future technology boom in promising growth sectors.

China’s attractive valuations and low exposures among investors make it a compelling long term investment, especially when compared against expensive markets which had outperformed in the last 12 months. In our view, a sustainable market rally would require implementation details of the equipment upgrade and consumer trade-in programme, as well as further fiscal and monetary easing (ie cuts to interest rates and the reserve requirement ratio). Signs that policy makers are moving ahead of the curve would also be an important catalyst for the market.

Sources:

1 Bloomberg. YTD returns for CSI 300 in RMB terms as of 2 April 2024.

2 FactSet, I/B/E/S, CSI. As of 22 March 2024.

3 BofA Global Fund Manager Survey. March 2024.

4 Bloomberg, FactSet, MSCI, CSI. Bottom-up calculation based on current constituents and weights. As of 22 March in RMB terms.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.