Executive Summary

- Asian bonds outperformed developed market bonds in 2025, supported by rate cuts, lower risk free rates, tightening credit spreads and a weaker USD.

- Asia’s economic outlook for 2026 remains positive, with modest inflation, supportive monetary conditions and resilient growth prospects.

- Structural trends—such as growing pension systems, rising middle class wealth and Asia’s role in global infrastructure—continue to anchor long term bond market stability.

2026 has kicked off with an ouster of the Venezuelan president, and a US Justice Department criminal investigation into Federal Reserve (Fed) Chair Jerome Powell. While markets have remained relatively calm at the point of writing1, given the strong rally in US equities in 2025, 2026 should be a year where investors relook at portfolios, rebalance and diversify. Asian bonds can potentially provide investors with income, stability, and diversification.

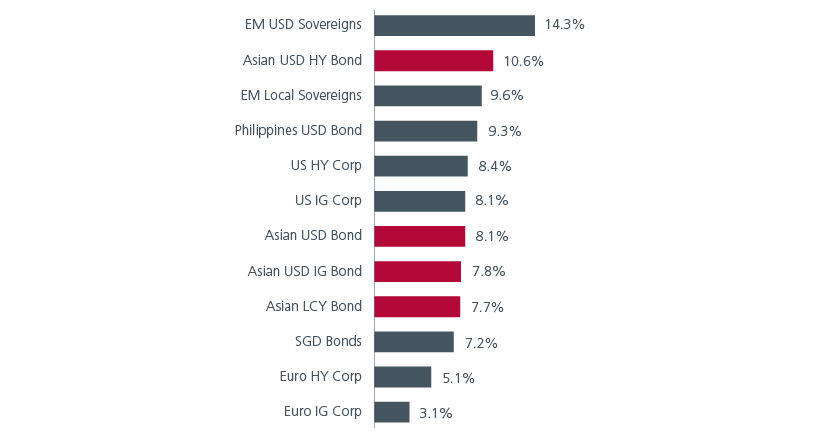

It may surprise some investors that Asian bonds outperformed developed market bonds in 20252 on the back of central bank rate cuts, lower risk-free rates, tightening credit spreads and a weakening US dollar. Meanwhile, concerns over stubborn inflation, persistent fiscal deficits and rising government debt weighed on the performance of many developed market bonds and their currencies.

Fig. 1. Asian bonds outperformed developed market bonds

Source: Bloomberg in USD terms. Eastspring Investments as of 29 December 2025. Please note that there are limitations to the use of such indices as proxies for the past performance in the respective asset classes/sector. The chart above is included for illustrative purposes only and may not be indicative of the future or likely performance of the markets. IG: Investment Grade, HY: High Yield, EM: Emerging Markets, LCY: Local currency.

A positive outlook for 2026

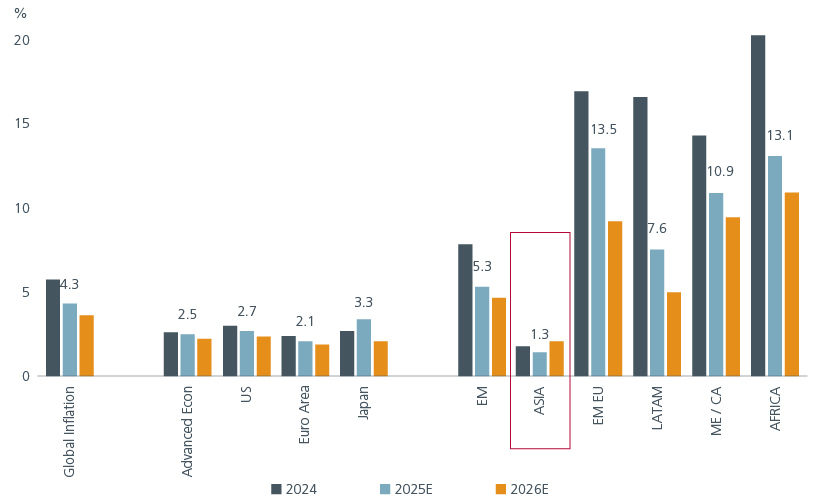

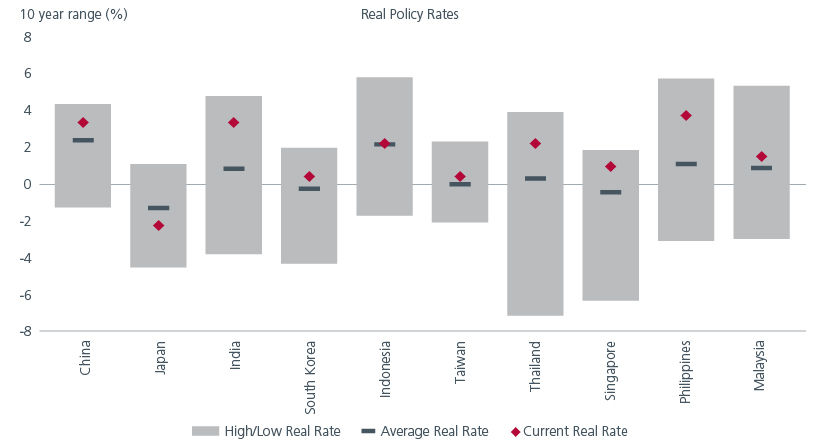

In 2026, Asia is expected to grow faster than developed economies on the back of fiscal and monetary stimulus.3 In Asia, inflation is below both central bank targets and historic averages in all countries except Taiwan. At the same time, real policy rates are above historic norms in most countries. This mix provides room for most Asian central banks to keep rates steady in 2026, which together with relatively attractive carry, should support total returns in the new year.

Fig. 2. Inflation remains modest in Asia

Source: Eastspring Investments, as of end September 2025. The information provided herein are subject to change at the discretion of the Investment Manager without prior notice. Past performance is not necessarily indicative of the future or likely performance. Any projection or forecast is not necessarily indicative of the future or likely performance.

Fig. 3. Asia’s real policy rates are higher than historical levels

Source: Eastspring Investments, as of 30 Sep 2025. 10 Yr range from Sep 2015 to Sep 2025. The information provided herein are subject to change at the discretion of the Investment Manager without prior notice. Past performance is not necessarily indicative of the future or likely performance.

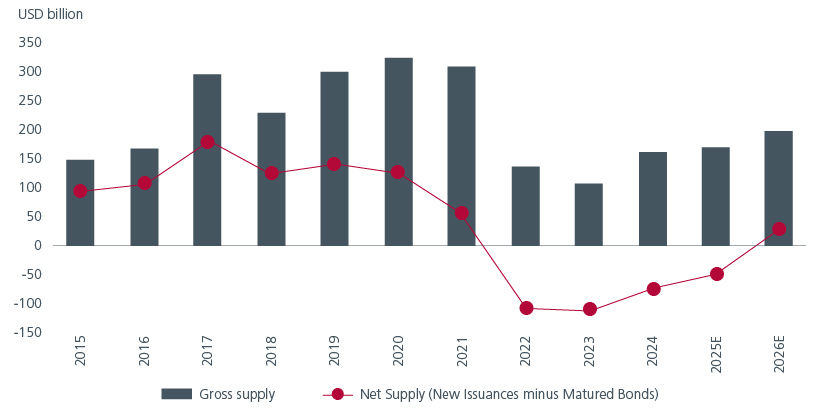

The global Artificial Intelligence (AI) infrastructure build-out is also expected to drive economic growth in the region, as Asia exports semiconductors, power generation equipment, batteries, and builds data centres. Asia’s resilient economic growth in 2026 should support the region’s credit markets, offering investors attractive income and potential capital gains. In addition, although the gross issuance of Asia USD bonds is increasing, it remains below pre-COVID highs. Tighter bond supply amid resilient demand supports Asian bonds’ favourable outlook in 2026.

Fig. 4. Net Asia USD bond supply to remain modest in 2026

Source: JP Morgan report as of December 2025. The use of indices as proxies for the past performance of any asset class/sector is limited and should not be construed as being indicative of the future or likely performance.

With bond yields having fallen in 2025, we believe that there are opportunities to increase bond duration in the new year if yields spike higher. We also look for cross-currency basis opportunities i.e. buying non-USD bonds and hedging them to USD for USD based portfolios. This strategy can enhance yield, increase portfolio diversification and reduce volatility.

Asian credit spreads have tightened over the course of 2025 – similar spreads between comparable Asia, US and European bonds imply that Asia offers comparable yields while allowing investors to diversify globally. That said, shifting market expectations over further easing by the Fed in 2026 may cause spreads to be volatile, presenting opportunities for active investors.

After strengthening against the USD in the first half of 2025, Asian currencies consolidated in the second half, potentially paving the way for renewed appreciation in selected Asian currencies in 2026 - supporting Asia local currency bond returns. While we expect the USD to weaken in 2026 as the Fed cuts rates further and the dollar’s carry advantage erodes, the timing may be affected by shifting expectations around monetary policy, inflation and changes in global risk appetite. As such, an active bond strategy that incorporates dynamic foreign currency management should be more effective in adding alpha.

While potential rate cuts, improving fundamentals and a weaker USD are positives for Asian bonds, there are also potential challenges. We expect some level of tariffs to remain when trade negotiations are finalised in 2026. This will likely result in a shift in supply chains and trade flows, introducing some uncertainty around how various economies and companies would respond. Active credit selection becomes even more critical in such an environment.

Anchored by structural trends

Over the longer term, we expect Asia’s bond market stability to be anchored by structural trends. Asia’s rapidly expanding pension systems create one of the world’s most powerful sources of long-term domestic bond demand. The region’s rapidly expanding middle-class wealth is also expanding the domestic investor base, resulting in deeper and more resilient local currency bond markets. Asia’s role as a global infrastructure hub also drives regular, high-quality sovereign and quasi-sovereign bond issuance, ensuring a consistent supply of investable bonds.

Encouragingly, Emerging Asia’s improved fundamentals have not gone unnoticed. The International Monetary Fund’s (IMF) latest World Economic Outlook report4 says that Emerging Markets have shown improved resilience to global risk off events since the global financial crisis. Monetary policies have become more credible and better managed. Stronger fiscal frameworks have helped to stabilise growth while keeping debt under control.

Asian bonds offer a unique opportunity for investors seeking income, stability, and diversification beyond traditional US or global bond holdings. With Asia’s stronger growth outlook, supportive monetary conditions, and structural demand drivers, the region’s bond markets are well-positioned to deliver attractive total returns in 2026 and beyond. For investors looking to diversify and enhance portfolio returns while tapping into one of the world’s most dynamic regions, Asian bonds present a compelling choice.

Sources:

1 13th January 2026.

2 Source: Bloomberg. Eastspring Investments.

3 World Economic Outlook, Oct 2025

4 https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.