Executive Summary

- Defensive investing, much like football defence, is crucial for long-term success. Just as defenders anchor a football team, low-volatility strategies provide portfolio stability and resilience amid market uncertainty.

- Market volatility, driven by multiple exogenous shocks, and rising concentration in Asian equity markets highlight the need for diversification. With fewer effective stocks in multiple markets, active management and systematic low-volatility approaches offer a strategic edge.

- History shows that an Asian-focused low-volatility strategy has consistently outperformed the broader market in turbulent and moderately bullish markets, making them a reliable choice for navigating volatile markets.

“Attack wins you games, defence wins you titles” – Sir Alex Ferguson1.

With Premier League clubs currently playing their pre-season fixtures across Asia, the importance of an effective defence can be seen in full play. Whatever a football team’s formation, be it 4-4-2, 4-2-3-1, 3-4-3 or any other setup, every successful strategy includes defenders. Defenders provide stability, shielding against turbulence and unexpected threats and ensuring the team remains effective under pressure. In much the same way, a defensive investment allocation, such as in a systematic low-volatility strategy, acts as the anchor of a portfolio, offering resilience across a wide range of market conditions.

A messy pitch

We have gone past half time, and global equity markets have navigated a turbulent seven months of the year, characterised by alternating risk-on and risk-off sentiment. The period was shaped by tariff uncertainties and subsequent deals/extensions, policy developments such as the "One Big Beautiful Bill Act", geopolitical tensions in the Middle East, and a better-than-expected US corporate earnings season. More recently, signs of cracks in the US labour market and President Trump’s tariff announcements caused the S&P 500 to fall 1.6% on 1 August, the most negative since May 2025.

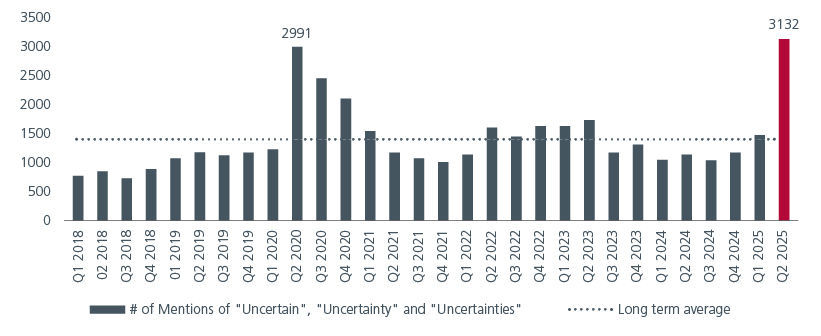

Uncertainty remains a central theme in global markets. Uncertainty persists around policy direction, the outcome of trade tariffs, and the trajectory of economic growth.

While US corporate earnings have been strong, data suggests that this uncertainty is now filtering through to earnings. Since the beginning of April, the terms “uncertain,” “uncertainty,” and “uncertainties” have appeared approximately 3,100 times in corporate earnings calls, conference presentations and related events, according to transcript analysis compiled by Bloomberg. This marks the highest quarterly count in over two decades, surpassing even the peaks seen during the Global Financial Crisis in 2008 and the onset of the Covid-19 pandemic in 2020. Clearly, the level of uncertainty continues to rise.

Fig. 1. No. of mentions of “uncertain”, “uncertainty” and “uncertainties”

Source: Bloomberg. Note: Data through close of trading on 29 May. Includes transcripts of earnings calls, conference presentations and other events.

Against this backdrop, Asian and Emerging Market (EM) equities have outperformed US and developed market equities. With the Dollar Index down 9% year to date, a trend that is historically supportive of EM assets and expected to continue, Asia and EMs’ attractive valuations look compelling. This positions them well to attract capital seeking diversification from US-centric portfolios.

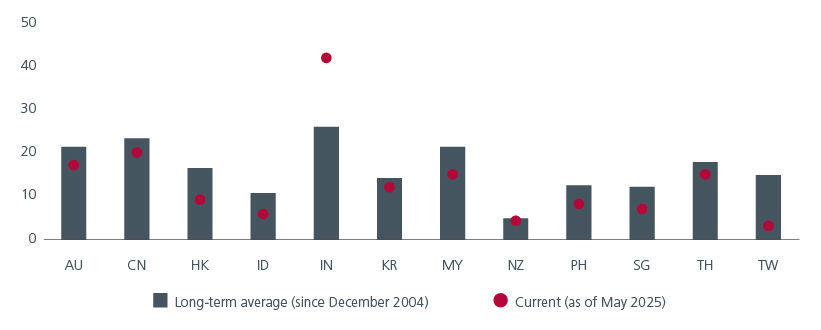

Playing active defence

Amid the volatility, Asian markets are becoming increasingly concentrated, with the effective number of stocks in Asia Pacific ex-Japan now well below their long-term average. The “effective number of stocks” helps us to understand how diversified a market index is. It is calculated as the inverse of the Herfindahl-Hirschman Index (HHI), a commonly used measure of concentration. The higher the HHI, the lower the effective number, the more concentrated the market index. See Fig. 2. Taiwan in particular stands out with just three effective stocks. This growing concentration highlights the pressing need for diversification and reinforces the value of active management in Asia.

Fig. 2. Effective number of stocks

Source: Eastspring Investments and MSCI. As of 30 May 2025.

As such, for investors with existing exposures in Asian equities or looking to increase their allocations, a systematic low-volatility strategy appears well suited given the current market volatility. Rather than chasing short-term fads which could lead to over-concentration in portfolios, a systematic low-volatility strategy is based on a long-term investment thesis which is grounded on the statistical average of sound investment principles, specifically, the low-volatility anomaly. This anomaly, coupled with refinements introduced by practitioners, suggests that stocks with lower price fluctuations, attractive dividend yields, and multi-factor alpha characteristics tend to deliver superior risk-adjusted returns over time.

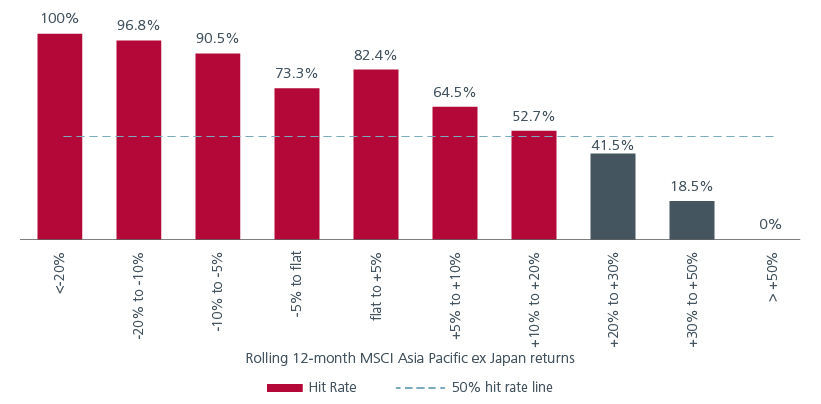

Historical data over more than 24 years supports this – the rolling 12-month returns of an Asian-focused low-volatility strategy, proxied by the MSCI AC Asia Pacific ex-Japan Minimum Volatility Index, have consistently outperformed the broader market during periods of market stress, as well as during periods of modest or steady gains. This performance holds across diverse market scenarios, from declines of -20% to gains of +20%. Notably, the low-volatility style has a greater than 50% probability of outperforming the broader market when the market’s returns range between +10% and +20%, demonstrating the strategy’s robustness even in moderately bullish environments. Fig. 3. illustrates this dynamic clearly.

Fig. 3. Hit rate of low-volatility strategy beating the market

Source: Eastspring Investments, MSCI. As of 31st July 2025. MSCI AC Asia Pacific ex Japan Minimum Volatility Index used as a proxy for low-volatility strategy. Please note that there are limitations to the use of such indices as proxies for the past performance in the respective asset classes/sector. The chart above is included for illustrative purposes only and may not be indicative of the future or likely performance of the markets

Scoring with stability

While year-to-date equity market rallies have been narrow, and skewed towards high-growth, high-volatility stocks, the recent market sell-off in early August and the potential for a period of range-bound trading, highlights the enduring importance of defensive allocations in investor portfolios. Just as defenders in football teams are key in securing victories, low volatility strategies play a vital role in helping portfolios weather market turbulence by mitigating downside and delivering consistent returns over time.

Sources:

1 the legendary former manager of Manchester United.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.