About Us

We live in, and invest from, the heart of one of the fastest growing regions in the world. With Asia now representing 75% of the Global Emerging Markets universe, understanding this region remains critical to long-term outperformance.

The disciplined application of our philosophy through all stages of our process creates high conviction strategies with attractive dividend yield, valuation and growth characteristics. Our emphasis on company engagement, specifically with regards to dividend yield and capital allocation, differentiates our product among a peer group who typically favor a high growth approach.

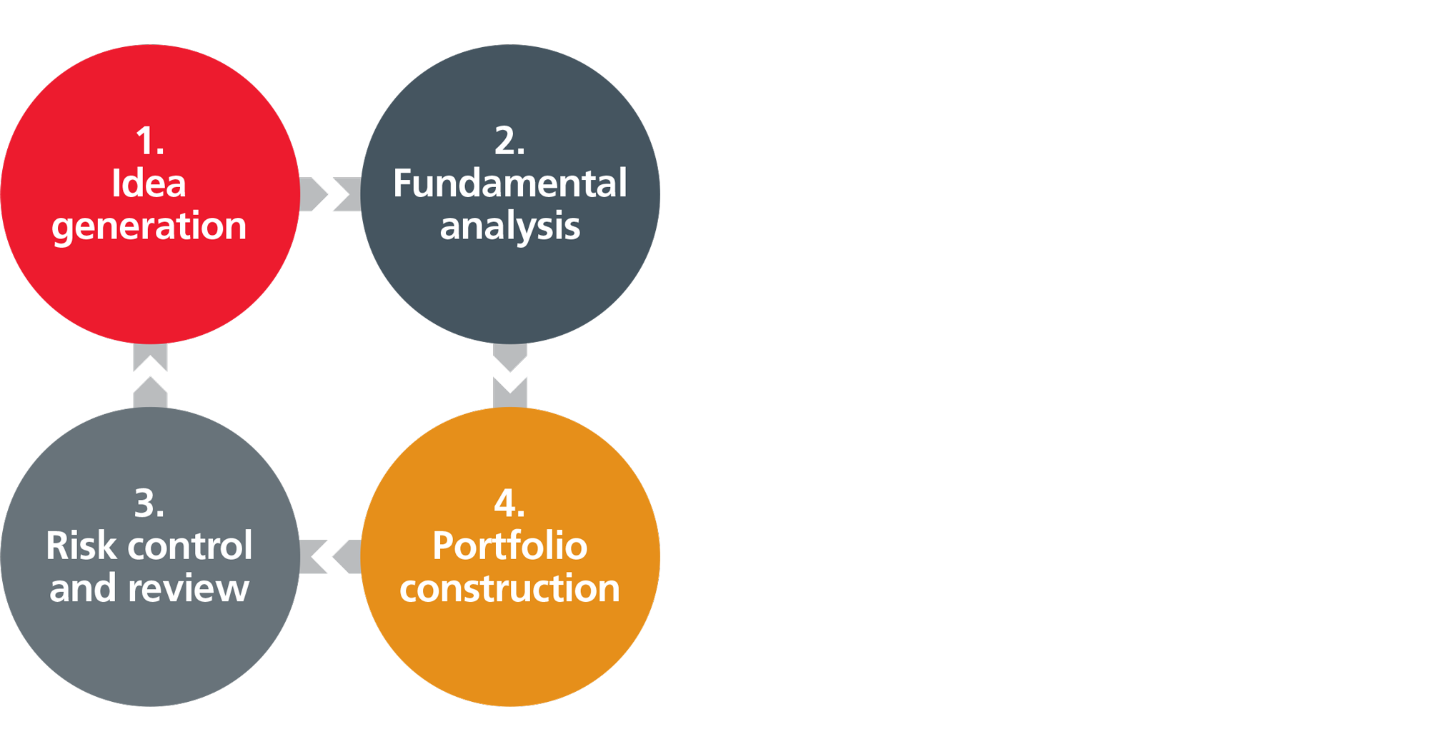

Investment Process

Our investment process consists of four stages: Idea generation; fundamental analysis; portfolio construction; and risk control and review. Proprietary screens are first used to identify attractive stocks on a number of fundamental aspects – include growth, quality, analyst sentiment, and momentum; we cast the net wide to identify the most significant ideas in the universe. We also know that good ideas may come from anywhere, so we leverage industry contacts and chain research to identify potential investment ideas outside of the disciplined screening stage. The Equity Income focus team then conducts extensive fundamental research to validate these initial ideas using a rigorous approach to valuation modelling that focuses on a company’s ability to generate sustainable earnings through the cycle. Stocks that pass through this process with high upside potential and high shared conviction make it to the team’s Conviction List. Stocks from this Conviction List become the core positions in our strategies. Risk control and review is embedded at all stages of the process and conducted by the focus team investors, senior management and our independent risk oversight team.

ESG

The team incorporates ESG issues into its fundamental analysis and decision-making process. The team actively engages with the companies in which they have invested and vote proxies on all resolutions (except when it is not in the best interests of a client). Specifically:

- The team explicitly incorporates relevant ESG issues into every aspect of its activities as fundamental equity investors, both before making investment decisions as well as during the time an investment is held in the portfolios.

- As responsible stewards of Eastspring’s clients’ assets, they maintain a dialogue with the entities invested in (where this is feasible) and actively express their opinions and views.

- The team utilizes third-party ESG data and research vendors in order to assist with the due diligence and ongoing monitoring processes.