Summary

Tariff delays and exemptions helped the US economy outperform expectations in the first half of the year, but rising tariff collections and upcoming trade deals—with significantly higher reciprocal rates—could pressure US consumption, a key growth driver. Asian growth too faces headwinds in H2 as US import frontloading fades, but China and India are relatively resilient. The Fed may cut rates by year-end, while most Asian central banks are set to ease amid low inflation. The USD is expected to weaken as US growth slows and rate cuts loom, supporting modest appreciation in most Asian currencies. Meanwhile lingering tariff uncertainty and easing trade tensions create space for tactical risk-taking.

This is an extract of our Q3 2025 Market Outlook. Click here to download the full report which includes a special feature “The tariff landscape is rapidly becoming messy”.

Macro: Tariff-related strains expected to manifest in H2, heightening global growth risks

US growth outperformed in H1 due to tariff delays but is expected to slow to 1.6% year-on-year by year-end and remain sub-trend in 2026. Rising tariffs and trade deal uncertainty may pressure US consumption and global growth, though extreme downside risks are easing. Asia’s export boost from US frontloading is fading, but China and India are relatively resilient. China’s Q3 growth may moderate, with stimulus supporting a Q4 rebound; India’s growth is gradually improving, aided by rate cuts and low inflation.

US inflation is rebounding as tariffs begin to impact prices, prompting companies to pass on costs. In contrast, Asia ex-Japan faces disinflationary pressures from weak growth, low oil prices, and strong harvests, though easing policies may reduce this by year-end. China’s policy shift on manufacturing adds uncertainty but is unlikely to offset property-driven disinflation.

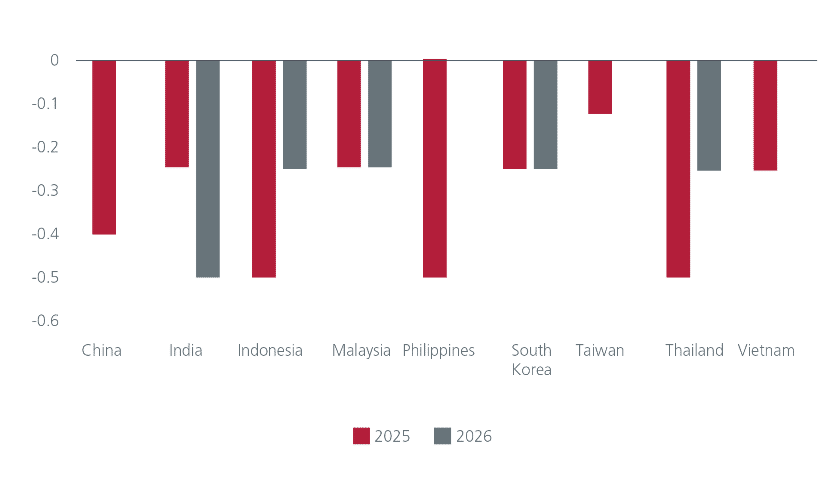

The Fed may cut rates by 25–50bps by year-end if unemployment rises, though timing depends on inflation data. Most Asian central banks are expected to ease. The USD is likely to weaken 3–5% over the next 6–9 months, supporting modest appreciation in most Asian currencies, though gains may be tempered by regional rate cuts.

Asia forecast policy rate change, %

Source: Eastspring, 24 July 2025

Asset Allocation: Tariff uncertainty persists, but de-escalating trade tensions afford runway for tactical risk positioning

Following President Trump’s “Liberation Day” announcement on April 2—which initially triggered sharp declines in equities and widening credit spreads—market sentiment has since recovered, supported by factors such as the 90-day tariff truce and a general easing in trade tensions.

Eastspring’s Multi-Asset Portfolio Solutions (MAPS) team now views the economic impact of tariffs as less severe than previously assessed. As a result, the team has reduced cash allocations and adopted a more constructive tactical stance across risk assets, particularly in equities and credit. Key indicators such as global PMIs and corporate earnings revisions continue to support a near-term positive outlook.

Given ongoing trade policy uncertainty beyond the extended August 1 deadline, the team is implementing barbell strategies using equity options to balance upside participation with downside protection.

Over the 3-month tactical horizon, the team favours Emerging Markets and Asia equities over US, citing more attractive valuations and macro conditions. In credit, US high yield remains compelling with a 7% yield, while EM bonds offer potential upside from USD depreciation. US Treasuries are also held constructively, serving both as a yield opportunity and a hedge against a potential US growth slowdown.

Investment Implications

Our Japan equity team believes the trade deal reduces the uncertainty of potential economic impact of tariffs on the economy, and the agreed tariff rate has turned out to be more favourable than what market participants estimated. As for impact on key sectors:

Autos: Given the favourable tariff rate, it is possible for the automakers to gain from competitive positioning if Europe and other nations end up facing higher tariff rates.

Domestic sectors: With Japan increasing US rice imports by 75%, this can potentially lower rice prices and alleviate some of the price pressure. In turn, this may allow more room for wage growth to boost consumer sentiment and domestic consumption.

Factory automation and investment-sensitive segments may be better positioned to benefit from companies reviving their capital expenditures that were placed on hold because of tariff uncertainty, but more time is needed to assess actual impact.

In the wake of the US trade deals with Vietnam, Indonesia, Philippines and now Japan, our Multi-Asset Portfolio Solutions team expects more countries to arrive at deals, or at least some framework of sorts. Global trade tensions have likely peaked since Trump unveiled his trade agenda on April 2nd ‘Liberation Day’. To the extent there continues to be progress in global trade discussions (alongside improved geopolitical developments), the team believes that extreme left-tail growth risk scenarios are now less likely. As such, in the absence of new shocks or negative catalysts (i.e., oil or trade shocks), risk assets can potentially continue to perform well over the near-term, tactical horizon.

The information and views expressed herein do not constitute an offer or solicitation to deal in shares of any securities or financial instruments and it is not intended for distribution or use by anyone or entity located in any jurisdiction where such distribution would be unlawful or prohibited. The information does not constitute investment advice or an offer to provide investment advisory or investment management service or the solicitation of an offer to provide investment advisory or investment management services in any jurisdiction in which an offer or solicitation would be unlawful under the securities laws of that jurisdiction.

Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the strategies managed by Eastspring Investments. An investment is subject to investment risks, including the possible loss of the principal amount invested. Where an investment is denominated in another currency, exchange rates may have an adverse effect on the value price or income of that investment. Furthermore, exposure to a single country market, specific portfolio composition or management techniques may potentially increase volatility.

Any securities mentioned are included for illustration purposes only. It should not be considered a recommendation to purchase or sell such securities. There is no assurance that any security discussed herein will remain in the portfolio at the time you receive this document or that security sold has not been repurchased.

The information provided herein is believed to be reliable at time of publication and based on matters as they exist as of the date of preparation of this report and not as of any future date. Eastspring Investments undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. Eastspring Investments personnel may develop views and opinions that are not stated in the materials or that are contrary to the views and opinions stated in the materials at any time and from time to time as the result of a negative factor that comes to its attention in respect to an investment or for any other reason or for no reason. Eastspring Investments shall not and shall have no duty to notify you of any such views and opinions. This document is solely for information and does not have any regard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receive this document.

Eastspring Investments Inc. (Eastspring US) primary activity is to provide certain marketing, sales servicing, and client support in the US on behalf of Eastspring Investment (Singapore) Limited (“Eastspring Singapore”). Eastspring Singapore is an affiliated investment management entity that is domiciled and registered under, among other regulatory bodies, the Monetary Authority of Singapore (MAS). Eastspring Singapore and Eastspring US are both registered with the US Securities and Exchange Commission as a registered investment adviser. Registration as an adviser does not imply a level of skill or training. Eastspring US seeks to identify and introduce to Eastspring Singapore potential institutional client prospects. Such prospects, once introduced, would contract directly with Eastspring Singapore for any investment management or advisory services. Additional information about Eastspring Singapore and Eastspring US is also is available on the SEC’s website at www.adviserinfo.sec. gov.

Certain information contained herein constitutes "forward-looking statements", which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof, other variations thereof or comparable terminology. Such information is based on expectations, estimates and projections (and assumptions underlying such information) and cannot be relied upon as a guarantee of future performance. Due to various risks and uncertainties, actual events or results, or the actual performance of any fund may differ materially from those reflected or contemplated in such forward-looking statements.

Eastspring Investments companies (excluding JV companies) are ultimately wholly-owned / indirect subsidiaries / associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.