A disciplined and bottom-up fundamental investment approach with a relative valuation anchor, which seeks to deliver superior returns over a full market cycle.

Our edge

- Our philosophy is central to our edge. Our awareness of behavioural influences on our judgment has led us to conceive a process that produces repeatable returns over a time horizon acceptable to our clients. The durability of our policy and process over market cycles is underpinned by the hard-wired nature of behavioural influences on decision making.

- We only target stocks that have a significant difference between price and valuation. We screen a wide investment universe of over 2,000 companies applying consistent anchors around valuation. We are equipped to rapidly identify valuation outliers which may become investment candidates.

- Expertise and significant experience in managing small, mid and large cap Japanese equity portfolios allow us to meet the needs of clients with different risk appetites.

Team

- Our deliberately small but highly experienced team has significant buy-in to the investment process. We operate under a culture of challenge and debate that is intended to maximise a creative team dynamic, which we believe is the optimal structure that enables us to focus on the best investment ideas.

- All investment outcomes are owned by the team and this serves to reinforce the strength and quality of debate.

Investment Philosophy

- Prices frequently move more than justified due to shifts in investor risk perception and expectations

- Behavioural biases influence both investor expectations and risk appetites

- True underlying value is not always reflected in price

- Opportunities exist – emotional detachment, rigorous analysis and discipline over a longer-term horizon allow us to exploit these opportunities

- Our price focused process with a relative valuation anchor aims to deliver superior long-term returns

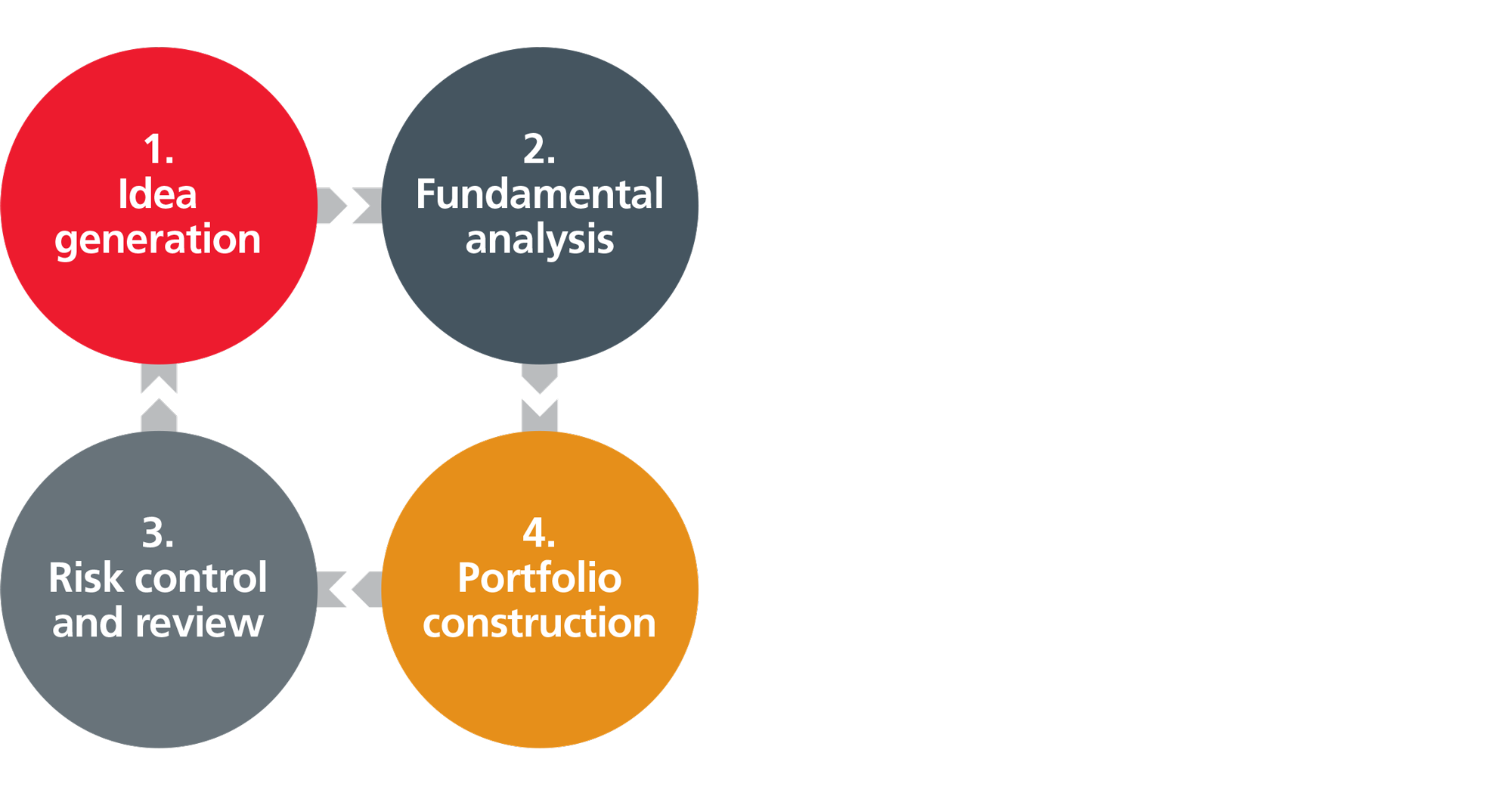

Investment Process

- Idea Generation - Systematically look for mis-priced assets. Focus on extremes. Identify maximum impact opportunities.

- Fundamental Analysis - The most important part of the investment process. Confirmation that value exists. Deepen understanding and test conviction.

- Portfolio Construction - Establish and monitor the risk and reward relationship. Link research output to portfolio construction and review.

- Risk Control and Review - Ongoing feedback supports sell-discipline. Ensure integrity of investment process.

ESG

The team incorporates ESG issues into its fundamental analysis and decision-making process (in cases where these factors could have a material impact on a company’s valuation and financial performance). This process relies on a proprietary fundamental research process to assess all material factors. The team engages with the companies they have invested in and vote their proxies on all resolutions (except when it is not in the best interests of a client). Specifically:

- The team explicitly incorporates relevant ESG issues into every aspect of their activities as fundamental equity investors, both before making investment decisions as well as during the time an investment is held in the portfolios

- As responsible stewards of Eastspring’s clients’ assets, they maintain a dialogue with the entities invested in (where this is feasible)

- The team utilises third-party ESG data and research vendors in order to assist with the due diligence and ongoing monitoring processes.

Related articles

JAPAN

Japan: Are the stars aligned?

Japan equities are seeing the highest inflows in 20 years. ...

- Aug 23

- |

- Ivailo Dikov

JAPAN

Six questions on Japan

The Japan team explains why a global cyclical market like Japan ...

- Feb 23